Crowdfunding and VC: The Hybrid Approach That Works for Startups

Explore how combining crowdfunding and VC funding creates a powerful hybrid strategy—boost capital, validate your idea, and attract investors effectively.

Aug 29, 2025

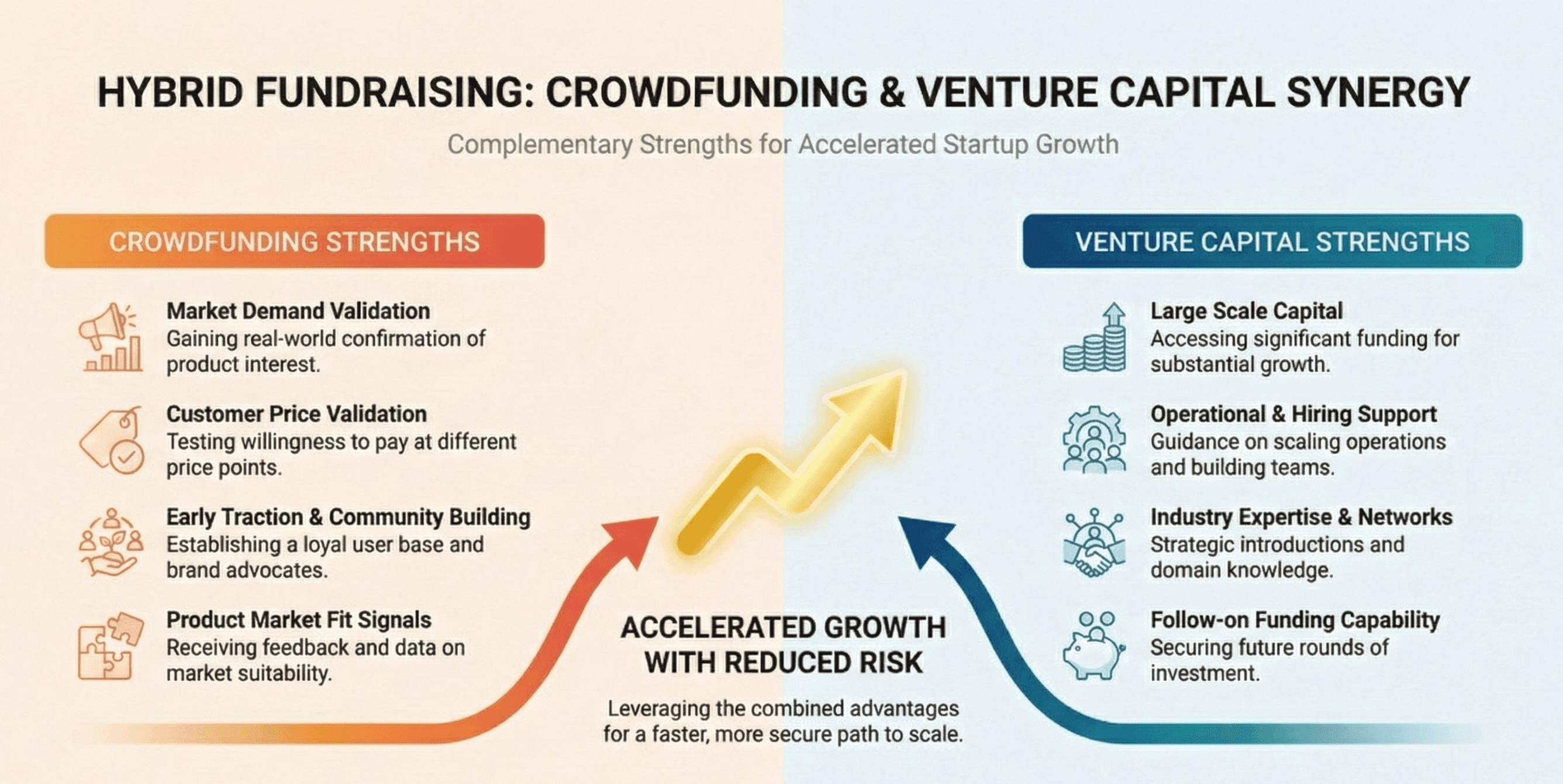

The traditional fundraising playbook is being rewritten. While most founders still view crowdfunding and venture capital as separate, competing strategies, a growing number of successful startups are proving that combining both approaches creates powerful synergies that neither can achieve alone.

This hybrid model isn't just a fallback plan for companies that can't secure VC funding. It's becoming a deliberate, strategic approach that leverages the unique strengths of each funding method while mitigating their individual weaknesses. From hardware startups using Kickstarter to validate demand before Series A rounds to SaaS companies building customer bases through equity crowdfunding before approaching institutional investors, the most innovative founders are discovering that 1+1 can equal 3 in fundraising.

The Evolution of Startup Funding

The startup funding landscape has transformed dramatically over the past decade. Traditional venture capital, once the only viable path to significant growth capital, now competes with dozens of alternative funding mechanisms.

Why Traditional Models Are Shifting:

VC Accessibility Challenges: Only about 0.05% of startups successfully raise VC funding, leaving millions of entrepreneurs seeking alternative paths

Market Validation Demands: VCs increasingly require proof of market demand before investing, creating a chicken-and-egg problem

Consumer Direct Relationships: Crowdfunding platforms enable direct customer relationships that provide market intelligence beyond capital raising

Geographic Limitations: VC funding remains concentrated in major tech hubs, while crowdfunding democratizes access regardless of location

The hybrid approach addresses these challenges by using crowdfunding to build the traction and validation that makes VC funding more accessible.

Understanding Crowdfunding Fundamentals

Crowdfunding encompasses multiple models, each serving different business types and funding objectives.

Reward-Based Crowdfunding

Platforms like Kickstarter and Indiegogo enable pre-selling products to consumers who back projects in exchange for early access or special pricing.

No equity dilution or debt obligations

Product validation through pre-orders

Marketing and brand building opportunities

Typically raises $10K to $500K+

Ideal for: Consumer hardware, creative projects, physical products with broad appeal, and innovations requiring market validation.

Equity Crowdfunding

Platforms like Republic and StartEngine allow retail investors to purchase equity stakes in startups.

Small equity stakes sold to many investors

Regulatory compliance requirements

Broader investor base beyond accredited investors

Typical raises of $100K to $5M

Ideal for: Consumer-facing brands, community-driven businesses, and startups building toward institutional rounds.

The VC Advantage Breakdown

Venture capital provides distinct advantages that complement crowdfunding's strengths while addressing its limitations.

Strategic Value Beyond Capital:

Industry Expertise: Partner experience provides strategic guidance for scaling businesses effectively

Professional Networks: Access to customers, partners, talent, and future investors

Operational Support: Platform services including recruiting assistance, legal support, and business development

Follow-On Funding: Reserved capital for future rounds and relationships with other VCs

Scale and Speed Advantages:

Large capital amounts ($1M to $50M+) enable aggressive growth strategies

Institutional investors can deploy significant capital quickly once decisions are made

VC funding enables rapid movement when market windows open

Large infusions support rapid team building and talent acquisition

For founders seeking to identify the right VCs for their hybrid strategy, SheetVenture's investor intelligence tracks 30,000+ actively deploying investors, helping you target VCs who've previously backed companies with crowdfunding success.

How Crowdfunding and VC Complement Each Other

The hybrid approach works because each funding method directly addresses the other's primary weaknesses while amplifying combined strengths.

Crowdfunding Validates VC Investment Thesis:

Demand Proof: Pre-order numbers demonstrate genuine market need rather than hypothetical demand

Price Validation: Campaigns test price points and reveal customer willingness to pay

Product-Market Fit Indicators: Customer feedback provides insights into alignment

Marketing Channel Validation: Success indicates effective customer acquisition strategies

VC Funding Enables Crowdfunding Success Scaling:

Fulfillment Capability: Capital enables inventory, manufacturing, and logistics infrastructure

Marketing Amplification: Additional capital expands efforts building on campaign momentum

Team Building: Funding supports hiring key personnel to execute on promises

Technology Development: Capital for software, platforms, and technical infrastructure

Risk Mitigation Through Diversification:

Multiple funding sources reduce dependence on any single investor type, provide timeline flexibility, create negotiation leverage, and offer protection against market downturns.

Successful Hybrid Campaign Case Studies

Real-world examples demonstrate how leading startups have executed successful hybrid strategies.

Oculus VR: From Kickstarter to $2B Acquisition

Kickstarter Success: Raised $2.4M, far exceeding their $250K goal, proving massive VR gaming demand

VC Follow-On: Used crowdfunding success to secure $16M Series A (Spark Capital) and $75M Series B (Andreessen Horowitz)

Strategic Value: VC funding enabled product refinement and partnerships leading to Facebook's $2B acquisition

Key Lesson: Crowdfunding proved demand while VC provided resources for technical execution

Pebble: Hardware Innovation Through Hybrid Funding

Multiple Rounds: Raised over $40M across Kickstarter campaigns, proving sustained consumer demand

VC Integration: Secured $15M Series A plus additional VC funding for manufacturing and software

Market Building: Used crowdfunding to build developer community before smartwatch markets emerged

Brewdog: Equity Crowdfunding Plus Traditional Investment

Equity for Punks: Raised over £73M through equity crowdfunding, creating passionate customer-investors

Strategic Investment: Later secured traditional PE investment for international expansion

Community Value: Investor-customers became brand ambassadors driving organic growth

Strategic Implementation Framework

Successful hybrid campaigns require systematic planning that carefully optimizes the sequencing and integration of different funding sources.

Phase 1: Crowdfunding Foundation

Start with crowdfunding to build market validation and customer relationships:

Platform Selection: Choose platforms aligning with your product type and target audience

Campaign Preparation: Develop compelling materials including videos and product demonstrations

Community Building: Build email lists and social followings before launch

Fulfillment Planning: Create realistic timelines and logistics plans

Phase 2: VC Preparation and Outreach

Use crowdfunding success as the foundation for institutional fundraising:

Metrics Documentation: Compile detailed analytics including conversion rates and demographics

Traction Narrative: Develop compelling stories about market validation based on results

Investor Targeting: Research VCs who've invested in companies with similar crowdfunding backgrounds

Due Diligence Preparation: Organize financial data and operational metrics

For efficient investor research, SheetVenture's filterable sheets let you identify VCs by stage, sector, and recent activity, eliminating months of manual research.

Phase 3: Integration and Scaling

Combine resources from both funding sources for maximum impact:

Capital Deployment Strategy: Allocate VC funding toward activities crowdfunding cannot support

Community Leveraging: Use crowdfunding communities for feedback and organic marketing

Follow-On Planning: Plan future strategies including additional rounds

Exit Strategy Alignment: Ensure both investor types' expectations align

Overcoming Common Hybrid Challenges

While hybrid approaches offer significant advantages, they also create unique challenges requiring careful management.

Managing Multiple Investor Types:

Develop separate communication approaches for backers versus VC investors

Clearly communicate timeline expectations and risks to both groups

Work with attorneys understanding both crowdfunding regulations and VC documentation

Establish efficient systems for meeting different reporting obligations

Timing and Sequencing Optimization:

Plan timing to avoid competition between different fundraising activities

Structure activities to maintain consistent momentum

Monitor market conditions for both crowdfunding and VC sectors

Ensure sufficient team bandwidth for multiple complex processes

Valuation and Terms Coordination:

Ensure crowdfunding valuations don't create unrealistic expectations for VC rounds

Structure crowdfunding terms that don't conflict with standard VC provisions

Plan equity allocation carefully to preserve founder ownership

Design corporate structures accommodating both investor types

Technology and Platform Considerations

Choosing the right platforms supports successful hybrid execution.

Crowdfunding Platform Selection:

Kickstarter: Best for creative projects and consumer products, over $6B pledged to successful projects

Indiegogo: More flexible, accepting ongoing campaigns and various project types

Republic: Leading equity platform for startups seeking retail investor participation

StartEngine: Strong marketing support and investor community building tools

Integration Technology:

CRM systems tracking both customers and investors across platforms

Financial management handling multiple investor types and reporting requirements

Communication platforms managing diverse stakeholder groups

Analytics combining data from all sources for comprehensive tracking

Building Your Hybrid Strategy

Transform theoretical understanding into practical implementation through systematic and thorough planning.

Assessment and Planning Phase:

Evaluate whether your business model aligns with successful hybrid approaches

Inventory current resources including team capabilities and network connections

Create realistic timelines accounting for managing multiple processes

Identify potential challenges and develop mitigation strategies

Execution Roadmap:

Months 1-3 (Preparation):

Develop crowdfunding campaign materials

Build pre-launch community and email list

Research and connect with potential VC targets

Establish legal and financial infrastructure

Months 4-6 (Launch):

Execute crowdfunding campaign

Begin VC outreach and relationship building

Document and analyze campaign performance

Prepare VC materials based on crowdfunding results

Months 7-12 (Integration):

Complete VC fundraising process

Fulfill crowdfunding obligations

Scale operations with combined resources

Plan future funding strategies

Success Metrics:

Crowdfunding Performance: Funding amount, backer count, conversion rates, engagement

VC Interest Indicators: Meeting requests, due diligence progression, term sheets

Integration Success: Customer retention, delivery performance, operational scaling

Long-Term Value: Revenue growth, market share, progress toward exits

Your Path Forward

The crowdfunding-VC hybrid approach represents a fundamental shift in how smart founders approach fundraising. Rather than viewing different funding sources as competing alternatives, successful entrepreneurs discover how to combine their unique strengths for superior outcomes.

This strategy isn't right for every business, but for startups with consumer appeal, provable market demand, and scalable business models, the hybrid approach offers compelling advantages. Crowdfunding provides market validation, customer relationships, and initial capital while VC funding delivers resources needed to scale validated opportunities rapidly.

The key to success lies in strategic planning that sequences funding sources effectively, manages multiple investor relationships, and leverages each type's unique strengths. Companies mastering this approach often find themselves with stronger market positions, more diverse funding options, and better long-term growth trajectories than those relying on single funding sources.

As the funding landscape continues evolving, hybrid approaches will likely become even more common and sophisticated. The founders who learn to navigate these integrated strategies now will have significant advantages in an increasingly competitive startup environment.

Start by honestly assessing whether your business model and stage align with successful hybrid examples, then begin building the community and validation foundation that makes both crowdfunding success and VC interest more likely. The time invested in understanding and implementing hybrid strategies can pay enormous dividends through more successful fundraising outcomes.