How to Raise Funds for Your Startup: A Step-by-Step Guide

Learn how to raise funds for your startup, explore funding options, pitch strategies, and tips to attract investors and secure capital successfully.

Aug 29, 2025

Starting a business is challenging enough without the added pressure of securing capital. Yet for most entrepreneurs, fundraising becomes an unavoidable reality, the difference between watching your vision collect dust and turning it into a thriving enterprise. The startup funding landscape has never been more diverse, with options ranging from traditional venture capital to innovative crowdfunding platforms and AI-powered investor discovery tools.

The key to successful fundraising isn't just having a great idea, it's understanding the funding ecosystem thoroughly, preparing systematically for every scenario, and executing your outreach strategically. Whether you're seeking $10,000 to validate your concept or $1 million to scale your operations significantly, this guide will help you navigate the funding maze with confidence and clarity.

Define Your Funding Needs and Goals

Before approaching any investor, you need crystal-clear answers about how much money you need and exactly how you'll use it. This foundational step determines your entire funding strategy.

Calculate Your True Funding Requirements:

Build detailed financial projections covering product development, marketing, salaries, office space, and legal fees

Create three scenarios: conservative, base case, and optimistic, base your ask on the middle scenario

Plan for 12-18 months of runway, the standard most investors expect before your next raise

Account for the fundraising process itself, which typically takes 3-6 months of focused effort

Set Milestone-Driven Goals:

Investors want to see how their capital drives specific, measurable progress:

Product Development: Completing beta versions, launching MVPs, or adding key features

Market Traction: Customer acquisition targets, revenue milestones, or geographic expansion

Team Building: Hiring key personnel, building departments, or acquiring critical expertise

Operational Scaling: Establishing manufacturing, building distribution, or implementing systems

Each milestone should directly contribute to increasing your company's value and positioning you for future growth rounds.

Understand Your Funding Options

The startup funding ecosystem offers numerous pathways to capital, each with distinct advantages and trade-offs.

Bootstrapping and Self-Funding

Best for service-based businesses or founders prioritizing control over rapid growth. You retain full ownership and operational flexibility but accept slower scaling and personal financial risk. This approach works well for companies with early revenue potential.

Friends and Family ($10K-$250K)

These rounds provide faster access to capital with more flexible terms. However, maintain professionalism with proper legal documentation and regular communication. Establish clear expectations from the beginning to protect both your relationships and your business.

Angel Investors ($1K-$2M)

High-net-worth individuals, often former entrepreneurs, who provide capital plus invaluable expertise and networks. Find them through AngelList, local entrepreneur events, or advisor introductions. Angels typically move faster than institutional investors, valuable for startups needing rapid capital deployment.

Venture Capital ($100K-$15M+)

VCs manage institutional funds targeting high-growth startups. They offer substantial capital, professional expertise, extensive networks, and follow-on funding capability. However, they require significant ownership stakes and board participation.

Research VCs using Crunchbase to find firms matching your stage, industry, and geographic region. For real-time data on actively deploying investors, SheetVenture's intelligence platform tracks 30,000+ VCs and angels who've written checks in the last 18 months, eliminating the "ghost investor" problem plaguing outdated databases.

Crowdfunding

Platforms like Kickstarter (reward-based) or Republic (equity-based) offer market validation, customer building, and marketing exposure without traditional investor requirements. Consider public campaign pressure and fulfillment obligations before choosing this path.

Alternative Sources

Government grants (SBIR/STTR) provide valuable non-dilutive funding for technology and research-focused startups

Startup competitions offer cash prizes plus valuable exposure, networking opportunities, and mentorship

Revenue-based financing provides growth capital without giving up any equity ownership

Strategic corporate investors bring partnership opportunities, potential customer relationships, and distribution channels alongside funding

Create a Solid Business Plan

A comprehensive business plan demonstrates your understanding of the market, competitive landscape, and path to profitability.

Essential Components:

Executive Summary (2-3 pages): Your mission, value proposition, market size, competitive advantages, revenue model, and funding requirements. Many investors make initial decisions based solely on this section, so invest significant effort here.

Market Analysis: Include market size data, growth trends, customer segments, and competitive landscape. Use both top-down (total addressable market) and bottom-up analysis based on your specific acquisition strategy.

Competitive Analysis: Present honest assessment of direct competitors, indirect alternatives, and potential future entrants. Explain your differentiation strategy rather than claiming no competition exists.

Financial Projections: Create three-year forecasts including revenue, expenses, cash flow, and profitability timeline. Clearly explain your unit economics, customer acquisition costs, and pricing strategy.

Build a Compelling Pitch Deck

Your pitch deck is often your first impression with investors. Keep it concise—10-15 slides for presentations, up to 20 for email versions.

Essential Elements:

Problem & Solution: Clearly articulate the pain point and why existing solutions are inadequate

Market Opportunity: Demonstrate size and growth potential with credible data sources

Product Demo: Show your product through screenshots, prototypes, or live demonstrations

Business Model: Explain how you make money and why customers will pay

Traction: Present customer metrics, revenue data, partnerships, or other validation

Competition: Position yourself within the landscape while highlighting unique advantages

Team: Showcase relevant experience and execution capability

Financials: Include realistic growth projections and path to profitability

The Ask: Specify exact funding amount and milestone-based use of funds

Best Practices:

Use professional, consistent design, avoid cluttered slides or excessive text

Tell a cohesive story flowing logically from problem to solution to funding

Practice until you can deliver confidently without reading slides

Prepare both presentation and detailed email versions for different contexts

Research and Target Investors

Strategic investor targeting beats mass outreach every time. Quality research dramatically improves your response rates and meeting quality.

Investor Research Framework:

Investment Criteria Alignment: Focus on investors who fund your stage, industry, and region

Portfolio Analysis: Study their companies to understand patterns and involvement levels

Recent Activity: Research current focus areas and deployment status

Partner Backgrounds: Identify individual expertise aligning with your business

Building Your Target List:

Traditional databases often contain outdated information filled with inactive investors. Founders waste months chasing VCs who stopped deploying years ago. For real-time intelligence, SheetVenture's investor sheets use AI to score investors by startup fit—including stage, sector, and founder profile, letting you export hyper-targeted lists directly to your workflow.

Create comprehensive lists of 50-100+ investors organized by priority:

Tier 1: Perfect matches warranting immediate outreach

Tier 2: Good fits with minor constraints

Tier 3: Possible matches requiring more relationship building

Identify warm introduction pathways through your network, advisors, and portfolio companies. Research optimal timing based on fund deployment cycles and recent activity.

Master Your Outreach and Pitching

Effective investor outreach requires personalized communication demonstrating knowledge of their investment focus and explaining why your opportunity aligns with their interests.

Crafting Effective Messages:

Reference specific portfolio additions or published thoughts relating to your business

Clearly communicate your unique value proposition and why you deserve attention

Include relevant traction metrics, customer testimonials, or third-party validation

Make a specific ask, typically an introductory meeting, not immediate investment

Warm Introduction Strategies:

Warm introductions significantly outperform cold outreach for fundraising success. Systematically leverage your network to identify introduction pathways. Ask advisors, customers, partners, and fellow entrepreneurs for connections. Make requests easy by providing suggested email language and explaining why the introduction benefits both parties.

Meeting Preparation and Follow-Up:

Research all attendees thoroughly before every meeting

Anticipate challenging questions and prepare confident answers

Practice your pitch with advisors until delivery feels natural

Follow up promptly with requested materials and clear next steps

Maintain consistent communication through regular progress updates

Navigate Due Diligence and Negotiations

Once investors express serious interest, your preparation and transparency determine success.

Due Diligence Preparation:

Organize comprehensive data rooms with financials, legal documents, contracts, and IP information

Prepare detailed answers for common questions about market, competition, team, and technology

Gather references from customers, partners, advisors, and previous employers

Proactively address potential concerns before investors discover issues

Understanding Term Sheets:

Key terms every founder must understand:

Pre-money and post-money valuation calculations

Liquidation preferences affecting exit scenarios

Board composition and voting rights

Anti-dilution provisions protecting investors

Work with attorneys experienced in startup financing to review and negotiate terms effectively.

Negotiation Best Practices:

Approach negotiations as partnership discussions, not adversarial contests

Prioritize terms that matter most to your business; show flexibility on others

Consider total value beyond capital, expertise, networks, and ongoing support

Maintain professional relationships, as these investors may become long-term partners

Close Your Funding Round

The final stages require coordinating documentation, managing expectations, and maintaining momentum.

Legal Documentation:

Work with qualified startup-focused legal counsel

Coordinate signature collection and funds transfer efficiently

Update your cap table accurately reflecting new ownership

Ensure securities compliance in your jurisdiction

Post-Funding Actions:

Communicate success to employees, customers, partners, and advisors

Plan strategic announcements building brand awareness and credibility

Implement investor relations processes including regular updates

Focus immediately on executing against promised milestones

Common Fundraising Mistakes to Avoid

Preparation Mistakes:

Starting too early without sufficient traction or market validation

Requesting valuations misaligned with market standards or your stage

Poor investor targeting, using real-time data instead of outdated databases dramatically improves accuracy

Execution Errors:

Inadequate preparation for tough investor questions

Inconsistent messaging creating confusion across different meetings

Poor follow-up letting interested prospects slip away

Administrative Problems:

Messy cap tables or missing legal documents derailing deals

Incomplete due diligence information creating trust issues

Ignoring term sheet implications affecting future control

Your Fundraising Action Plan

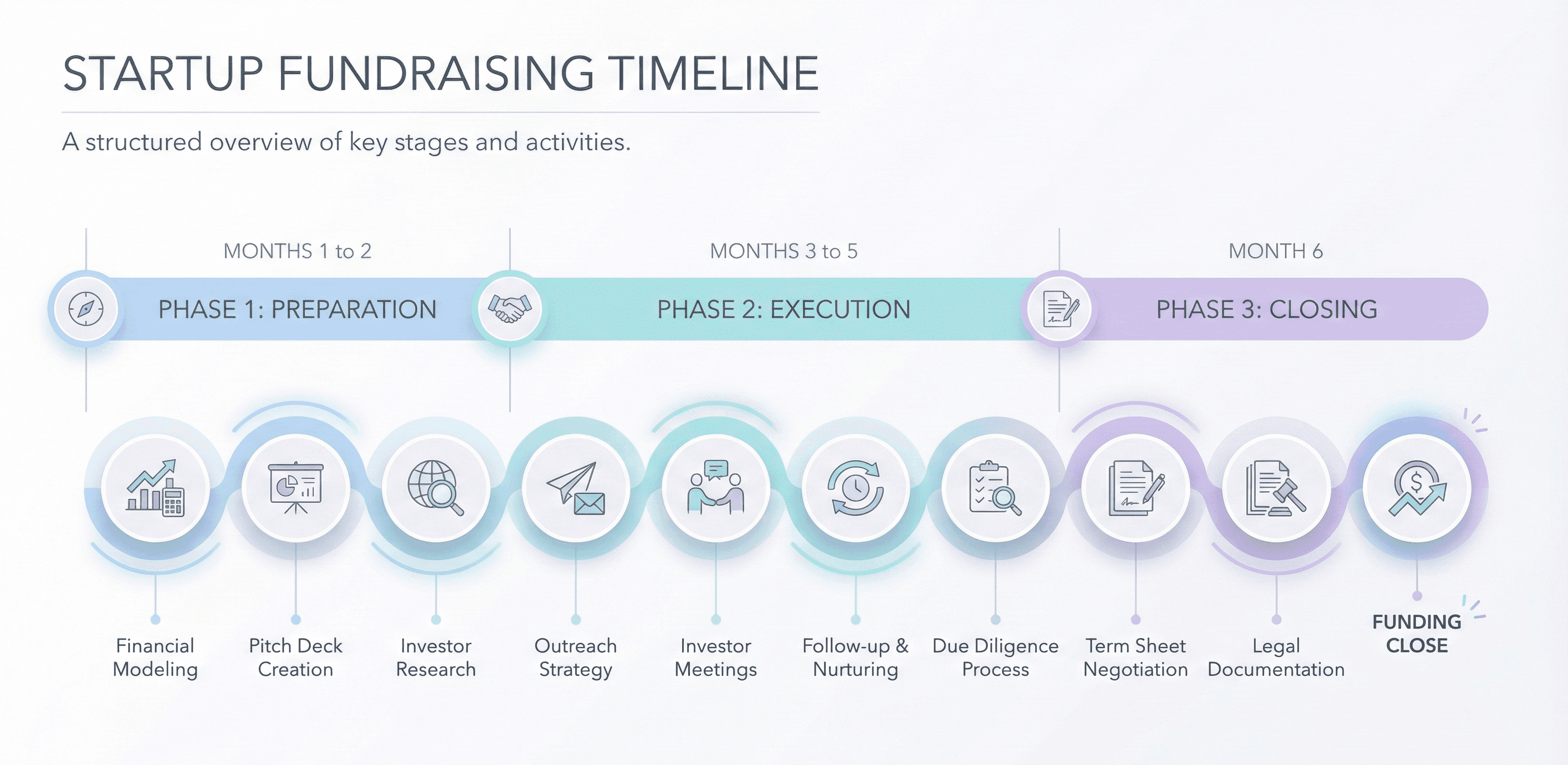

Phase 1: Preparation (Months 1-2)

Weeks 1-2: Complete financial modeling and define funding requirements

Weeks 3-4: Develop business plan and create pitch deck

Weeks 5-6: Research investors and build prioritized target lists

Weeks 7-8: Prepare due diligence materials and practice presentations

Phase 2: Execution (Months 3-5)

Month 3: Begin systematic outreach to Tier 1 investors through warm introductions

Month 4: Conduct investor meetings and refine presentations based on feedback

Month 5: Progress serious prospects through due diligence while maintaining pipeline

Phase 3: Closing (Month 6)

Weeks 1-2: Negotiate term sheets and select optimal partnership

Weeks 3-4: Complete legal documentation and coordinate funding close

Weeks 5-6: Announce success and implement investor relations processes

Your Path Forward

Successful fundraising requires systematic preparation, strategic execution, and persistent effort over several months rather than weeks. Companies that raise capital most efficiently treat fundraising as a strategic campaign rather than a desperate, scattered search for any willing investors.

Remember that fundraising is ultimately about finding the right partners who genuinely believe in your vision and can contribute meaningfully beyond just capital. Focus on building meaningful relationships with investors who truly align with your values, deeply understand your market, and can provide strategic value throughout your entire growth journey.

Most importantly, don't let the fundraising process consume all your time and energy. Continue building your product, serving your customers, and demonstrating consistent progress throughout the entire process. Companies that successfully raise capital consistently show strong momentum regardless of external timeline pressures from investors.

Start by honestly assessing your current readiness for fundraising. If you need more traction, team development, or market validation, invest time in strengthening these areas before beginning your campaign. The preparation time invested upfront pays enormous dividends through higher success rates and better investor partnerships.

Your fundraising journey begins with defining exactly what you need and why. Take that important step today, and begin building the foundation for turning your startup vision into funded reality.