Live Ecosystem Insights

Live Ecosystem Insights

Live Ecosystem Insights

See the full private-market ecosystem in real time — startups, investors, funding rounds, sectors, and capital flows — all connected in one live map.

See the full private-market ecosystem in real time — startups, investors, funding rounds, sectors, and capital flows — all connected in one live map.

See the full private-market ecosystem in real time — startups, investors, funding rounds, sectors, and capital flows — all connected in one live map.

The Live Startup & Capital Ecosystem Mapped In Real Time

The Live Startup & Capital Ecosystem Mapped In Real Time

The Live Startup & Capital Ecosystem Mapped In Real Time

Trusted by founders, funds, and institutions worldwide

Trusted by founders, funds, and institutions worldwide

Trusted by founders, funds, and institutions worldwide

To make smarter moves, you need to know where capital is moving.

Track live deals, investor activity, and global market signals — all in real time.

Track live deals, investor activity, and global market signals — all in real time.

Access live VC & PE list of investor data, track new deals, and never waste time on stale databases again.

Access live VC & PE list of investor data, track new deals, and never waste time on stale databases again.

AI Intelligence that works like a second brain. Guiding you to smarter, faster fundraising decisions.

AI Intelligence that works like a second brain. Guiding you to smarter, faster fundraising decisions.

Navigate the Global Investor, Startup & Market Landscape in Real-Time.

Navigate the Global Investor, Startup & Market Landscape in Real-Time.

Navigate the Global Investor, Startup & Market Landscape in Real-Time.

Understand the full startup & capital ecosystem — in real time.

Ecosystem Map

See how startups, investors, funding rounds, and markets connect — all in one real-time view of the private ecosystem.

Map startups, investors, and funds

Map startups, investors, and funds

Map startups, investors, and funds

Explore funding rounds and relationships

Explore funding rounds and relationships

Explore funding rounds and relationships

Understand ecosystem structure instantly

Understand ecosystem structure instantly

Understand ecosystem structure instantly

Sector Insights

Explore ecosystems by sector, geography, and stage to understand where capital and competition are concentrating.

Analyze sectors and sub-sectors

Analyze sectors and sub-sectors

Analyze sectors and sub-sectors

Compare regions and markets

Compare regions and markets

Compare regions and markets

Spot crowded vs underfunded spaces

Spot crowded vs underfunded spaces

Spot crowded vs underfunded spaces

Capital Flows

Follow how money actually moves across stages, sectors, and regions — powered by live deal activity worldwide.

Track funding rounds as they happen

Track funding rounds as they happen

Track funding rounds as they happen

Identify rising and cooling markets

Identify rising and cooling markets

Identify rising and cooling markets

Understand VC vs PE behavior

Understand VC vs PE behavior

Understand VC vs PE behavior

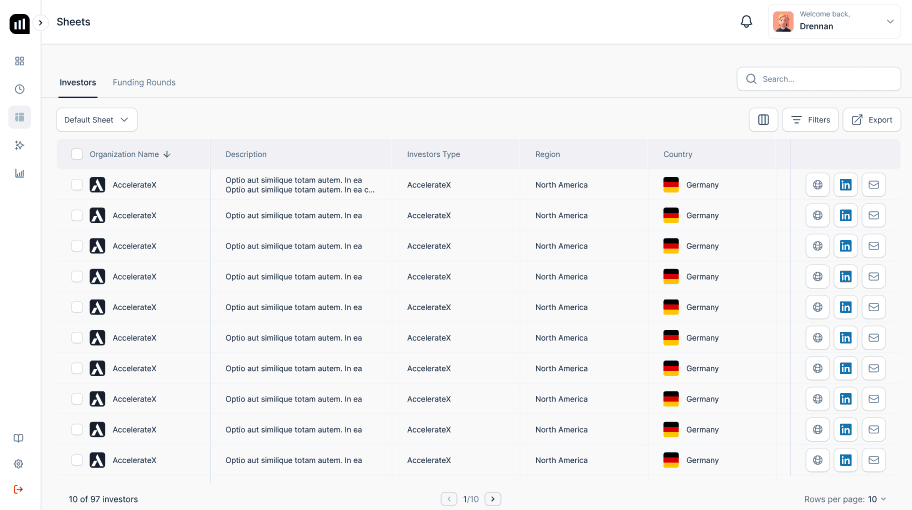

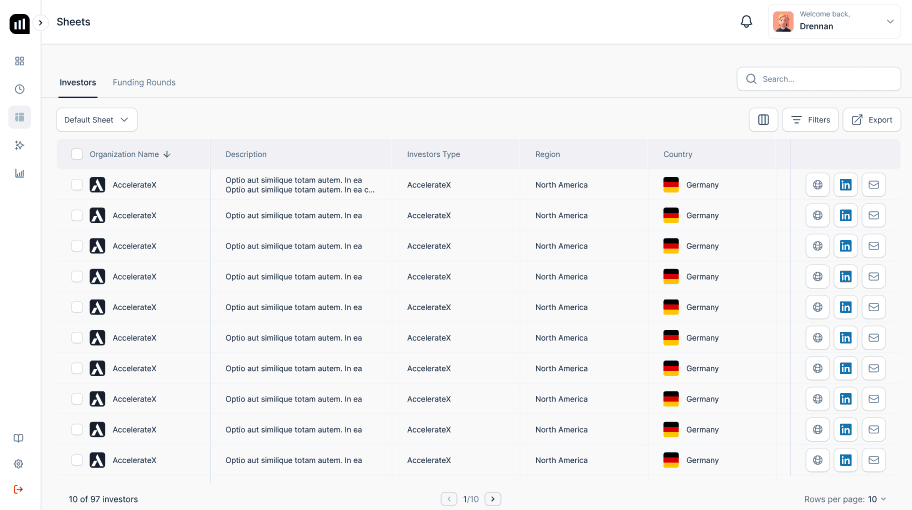

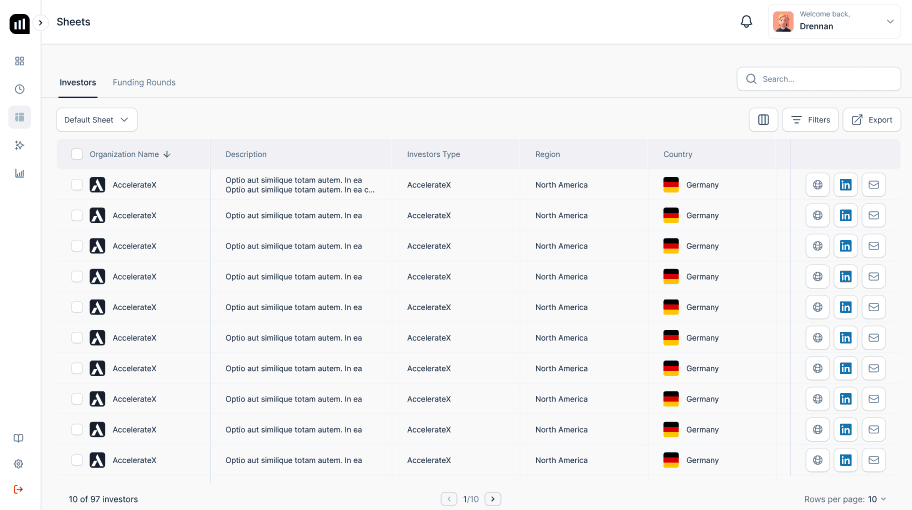

Venture Capital and Private Equity Database.

Access active investors worldwide with coverage across venture capital, private equity, and emerging industries.

Venture Capital and Private Equity Database.

Access active investors worldwide with coverage across venture capital, private equity, and emerging industries.

Discover active investors database with venture capital, private equity, and other funding options.

Discover active investors database with venture capital, private equity, and other funding options.

Discover active investors database with venture capital, private equity, and other funding options.

FAQs

Frequently Asked Questions

How do I know which investors are actually active?

How do I know which investors are actually active?

How do I know which investors are actually active?

Can I filter investors to match my startup?

Can I filter investors to match my startup?

Can I filter investors to match my startup?

How do I prioritize who matters most?

How do I prioritize who matters most?

How do I prioritize who matters most?

Where is capital flowing right now?

Where is capital flowing right now?

Where is capital flowing right now?

Can AI Chat guide my fundraising strategy?

Can AI Chat guide my fundraising strategy?

Can AI Chat guide my fundraising strategy?

How is it different from Crunchbase or other investor lists?

How is it different from Crunchbase or other investor lists?

How is it different from Crunchbase or other investor lists?

Built for Founders and Investors

AI-powered insights for founders raising capital and investors seeking high-quality deals.

Find active investors, validate your market, and raise with confidence. Powered by AI and real-time deal data.

Access 30,000+ active investors updated daily

Filter by stage, sector, geography.

Close rounds faster with AI-driven targeting

Built for Founders and Investors

AI-powered insights for founders raising capital and investors seeking high-quality deals.

Find active investors, validate your market, and raise with confidence. Powered by AI and real-time deal data.

Access 30,000+ active investors updated daily

Filter by stage, sector, geography.

Close rounds faster with AI-driven targeting

Built for Founders and Investors

AI-powered insights for founders raising capital and investors seeking high-quality deals.

Find active investors, validate your market, and raise with confidence. Powered by AI and real-time deal data.

Access 30,000+ active investors updated daily

Filter by stage, sector, geography.

Close rounds faster with AI-driven targeting