How Do Investment Committees Weigh Founder Quality vs Market Size?

Investment committees filter founder quality and market size in sequence. Learn six frameworks that drive how VCs make final decisions.

Investment committees don't rank founder quality above market size or market size above founder quality, they apply both as sequential filters where each must clear a minimum threshold before the other gets weighted.

Market size sets the mathematical ceiling on return potential. Founder quality determines whether that ceiling ever gets touched. Miss either threshold and the deal dies before the comparison begins.

The Six Frameworks Committees Use to Resolve the Tension

1. The Sequential Filter, Not a Tradeoff

Committees eliminate before they compare:

What this looks like: Market size runs first as a structural test, if the ceiling can't return fund capital at realistic ownership, the deal ends. Founder quality then determines execution confidence within a market that already passed.

What investors ask: "Does this market work for our fund model, and if yes, can this team actually capture it?"

Red flag: Founders who frame the pitch as "we're a great team, trust us on the market" before proving the market clears the return threshold.

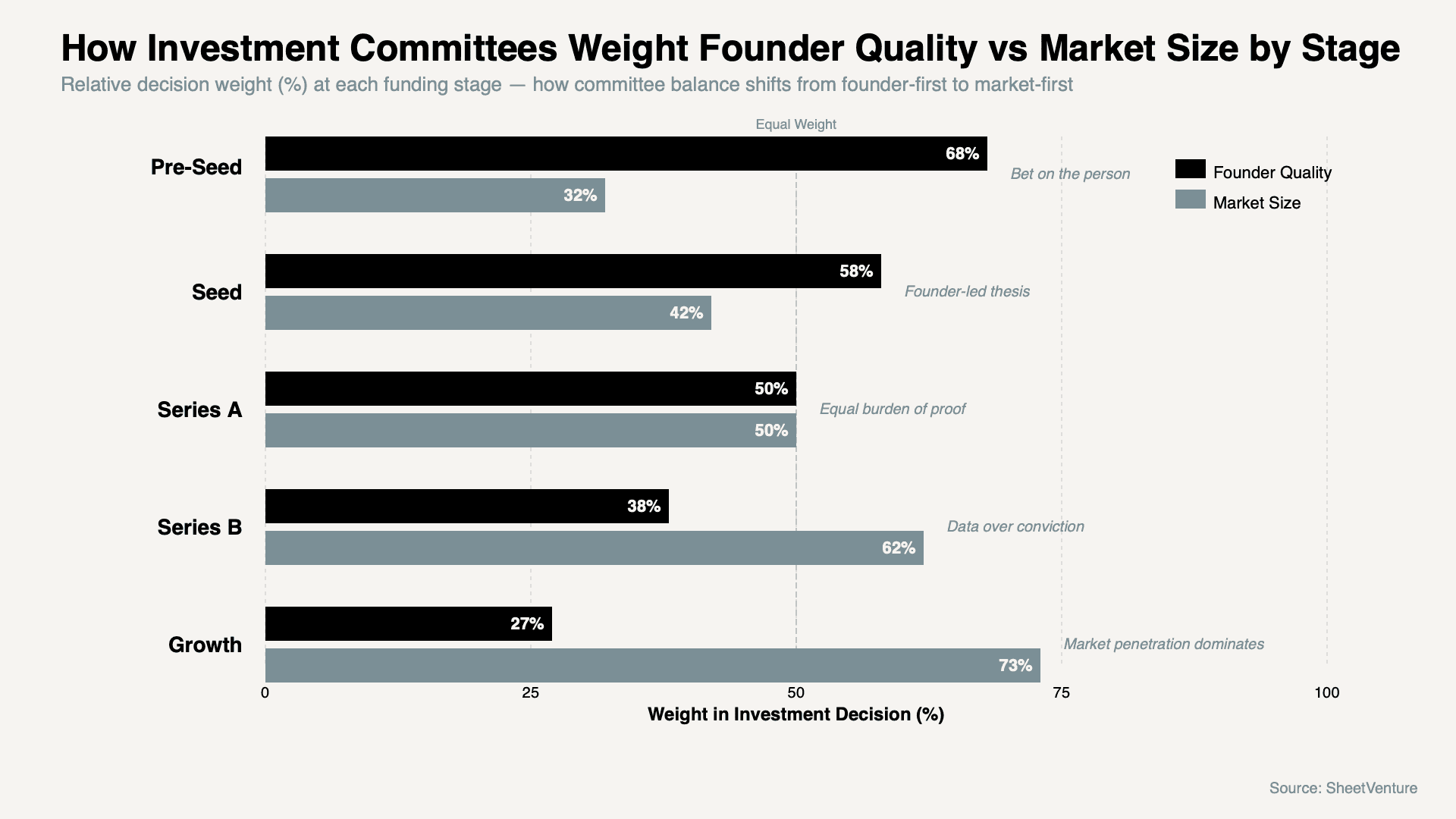

2. Stage Determines Which Carries More Weight

Earlier rounds forgive market ambiguity; later rounds don't:

What this looks like: Pre-seed committees accept directional market logic if the founder signal is exceptional. Series A committees demand evidence of market size, not just narrative. Series B committees want penetration data, founder quality is assumed or already disqualified.

What investors ask: "At this stage, are we underwriting the person or the proof?"

Red flag: Presenting a pre-seed founder story to a growth-stage committee expecting market traction data.

Learn when to raise venture capital and how stage timing shifts what committees prioritize in your evaluation.

3. Exceptional Founders Earn a Market Discount

Strong teams reduce the risk penalty committees apply to uncertain markets:

What this looks like: Every committee discounts market size claims, the only question is by how much. A founder with a demonstrated track record earns a 20-30% smaller discount. A first-time founder gets aggressively discounted even in large markets.

What investors ask: "How much do we trust this team's ability to reach the market they're describing?"

Red flag: First-time founders presenting optimistic TAM without acknowledging the assumptions or execution risk baked into the number.

4. Market Size Can Override Founder Quality in One Direction Only

A large enough market can survive a founder upgrade, a small market cannot:

What this looks like: If the market is genuinely massive, committees consider backing the team with plans to add strong operators. The reverse is not true, an exceptional founder cannot manufacture a market large enough to return fund capital. Market size floors are structural; founder quality is more manageable.

What investors ask: "If we're wrong about this team, does the market still produce a return with the right operators in place?"

Red flag: Assuming a compelling founder narrative compensates for a market that structurally caps below what the fund needs.

5. The Portfolio Construction Constraint

Fund math sometimes overrides deal-level conviction entirely:

What this looks like: A committee that loves a founder may still pass because the market ceiling doesn't fit the fund's ownership model at target check size. Founder quality is evaluated within market constraints, not independent of them.

What investors ask: "Does this deal produce the return we need in a base case, even if market assumptions get cut by 40%?"

Red flag: Founders who don't understand their investor's fund size and ownership requirements before pitching market size projections.

6. The Category Expansion Test

Committees back founders who can grow the market, not just serve it:

What this looks like: A $400M market today with a founder who has a credible path to expanding the category gets weighted differently than a static $400M ceiling. Committees ask whether founder quality changes the market size calculation itself.

What investors ask: "Can this founder expand the category, or are they permanently capped by current market boundaries?"

Red flag: Founder with no evidence of finding adjacent opportunities or expanding scope in prior experience.

Understand market attractiveness and why bottom-up market sizing matters more than top-down TAM claims.

Founder Quality vs Market Size: Weight by Stage

Funding Stage | Founder Quality Weight | Market Size Weight | Primary Committee Question |

|---|---|---|---|

Pre-Seed | 65-70% | 30-35% | "Do we believe in who?" |

Seed | 55-0% | 40-45% | "Does the thesis hold?" |

Series A | 50% | 50% | "Can both be proven now?" |

Series B | 35-40% | 60-65% | "What does the data show?" |

Growth | 25-30% | 70-75% | "Is the market real at scale?" |

The pattern: Founder weight dominates earliest and declines as execution data replaces conviction. Market weight grows as fund math demands proof over promise.

Founder Quality vs Market Size Weight by Funding Stage

Questions Committees Ask to Resolve the Tension

Expect these in partner meetings:

"If the market stays smaller than projected, does this team expand it or extract value anyway?"

"If we're wrong about the team, does the market still produce a return with better operators?"

"At what market size does this deal stop working for our ownership model?"

"Would we back this founder in a completely different market?"

"What's the single reason this specific founder wins in this specific market?"

Why they ask: Each question isolates whether committee conviction lives with the person, the market, or only at their intersection. Deals that can't answer all five cleanly rarely survive internal discussion.

Use investor intelligence to identify which VCs run founder-first versus market-first thesis frameworks before you pitch.

How to Pitch Both Without Letting Committees Choose

Prepare to show:

A market size argument built bottom-up from real customer behavior, not top-down TAM slides

A founder narrative explaining why this specific background creates advantage in this specific market

Adaptability evidence, moments where the team expanded scope or pivoted under constraint

A base case return model that holds even when market assumptions are cut by 30-40%

The principle: Don't let the committee separate the two factors. Make the pitch argue that founder quality and market size are the same thesis, one without the other collapses the investment case entirely.

Access investor database to find committees whose historical investments reflect the founder-market weighting that matches where your pitch is strongest.

The Bottom Line

Investment committees weigh founder quality and market size in sequence, market clears a structural threshold first, then founder quality determines execution confidence within a validated opportunity. Earlier stages weight founders more heavily; later stages demand market proof that replaces conviction.

Exceptional founders earn smaller risk discounts on market claims. The strongest pitches refuse to let committees choose between the two, they build the case that this founder and this market are inseparable arguments. Prepare both with equal rigor and equal evidence.

SheetVenture helps founders find committees whose investment thesis matches how they're weighted, so the right argument lands in the right room.