What Signals Show a VC Firm Is Shifting Investment Focus?

VC firms signal focus shifts through partner hires, deal velocity, and fund size changes. Learn six signals founders must track.

VC firms signal focus shifts through six observable patterns: partner hiring outside their historical thesis, portfolio company announcements in new sectors, speaking engagements at unfamiliar conferences, fund size changes that demand different deal profiles, LP communication shifts, and deal velocity changes by category.

Firms rarely announce pivots publicly, founders who read the signals early gain access before competition intensifies. Those who miss them waste outreach on investors who've already moved on.

Why This Intelligence Gap Costs Founders

What happens when founders catch the shift early:

First-mover access before the firm's new thesis is competitive

Pitching while partners are still building conviction and seeking deal flow

Better odds of becoming a defining portfolio company in the new focus area

What happens when founders miss the shift:

Pitching a thesis the firm has quietly abandoned

Polite passes that feel confusing without the context

Missing the window when the firm was actively seeking exactly what you're building

For deeper context, understand investment thesis dynamics and how firms construct and evolve their focus over time.

Six Signals That Reveal a Shifting VC Focus

1. Partner Hiring Outside Historical Expertise

What this looks like: A consumer-focused firm hires a partner with deep enterprise SaaS background. Partner hires precede deal flow by 12-18 months, signaling where the firm intends to write checks before a single deal closes in the new area.

Where to track it: LinkedIn announcements, firm website team pages, and partner bios referencing new domain expertise.

What to do: When a relevant partner joins, reach out within 60 days. They need deal flow to validate their hire.

2. Portfolio Announcements in New Sectors

What this looks like: A firm known for B2B SaaS announces three consecutive investments in infrastructure or deep tech. The portfolio page tells a different story than the stated thesis on the about page.

Where to track it: Firm portfolio pages, Crunchbase investor profiles, and deal announcement newsletters.

What to do: Check for pattern across new sector deals, one is exploration, two is direction, three is a thesis forming.

Learn how to research VCs before your pitch and what signals distinguish surface-level interest from genuine directional commitment.

3. Speaking Engagements and Conference Presence

What this looks like: A partner who historically spoke only at SaaS conferences begins appearing on climate tech or AI infrastructure panels. Public intellectual investment consistently precedes financial investment.

Where to track it: Conference agendas, podcast appearances, and published essays from individual partners.

What to do: Follow individual partners, not just firm accounts. They signal thesis evolution months before it becomes firm-level deal flow.

4. Fund Size Changes That Demand a New Deal Profile

What this looks like: A seed fund that raised $50M closes a new $200M fund. At that size, writing $500K checks no longer makes sense, the fund must move upstream or write larger checks into fewer companies.

Where to track it: SEC Form D filings, fund close announcements, and tech media coverage.

What to do: When a fund closes significantly larger than its predecessor, assume the deal profile is shifting.

5. LP Communication and Annual Letter Signals

What this looks like: Annual letters emphasizing new macro themes, AI infrastructure, energy transition, defense tech, signal where the next fund's thesis is forming. Phrases like "we're increasingly excited about" signal evolution before formal announcements.

Where to track it: Partner interviews referencing LP conversations and annual letter excerpts in trade press.

6. Deal Velocity Changes by Category

What this looks like: A firm closing four consumer deals per year drops to one while accelerating enterprise deal flow. Deceleration precedes formal thesis abandonment; acceleration signals active commitment.

Where to track it: Crunchbase deal history by firm and quarterly deal pace analysis by sector.

Signal Strength by Category

Signal Type | Lead Time Before Deals | Reliability | Ease of Tracking |

|---|---|---|---|

Partner hiring | 12-8 months | Very high | Medium, LinkedIn, firm site |

Portfolio announcements | 6-12 months | High | Easy, Crunchbase, press |

Speaking engagements | 9-15 months | Medium-high | Medium, conference agendas |

Fund size change | 6-12 months | High | Easy, SEC filings, press |

LP communication signals | 12-24 months | High | Hard, often private |

Deal velocity shifts | 3-6 months | Very high | Medium, deal tracking tools |

The pattern: Partner hires and LP signals are earliest but hardest to track. Deal velocity is the latest but most concrete confirmation a shift has occurred.

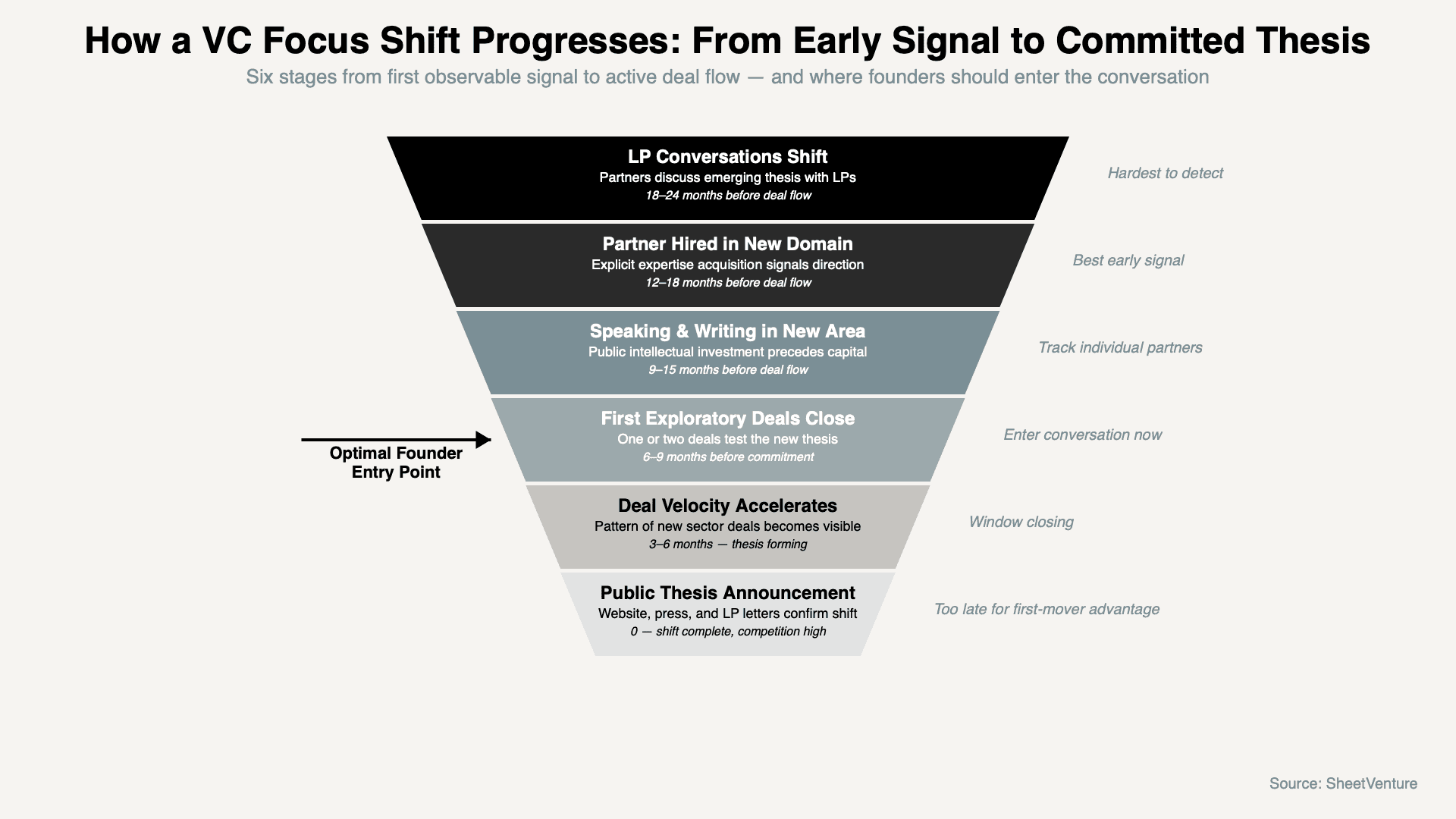

How VC Focus Shifts Progress From Signal to Committed Thesis

Questions to Ask That Reveal Focus Shifts Directly

"What themes are you exploring that aren't yet reflected in your portfolio?"

"Has your thesis around [sector] evolved over the last 12 months?"

"Are there areas you're building conviction in that haven't translated into deals yet?"

"Where are you seeing the most inbound you're genuinely excited about?"

Why these work: Partners discuss thesis evolution before it's public, asking signals you understand how firm strategy evolves.

Use active investor data to track which firms are writing checks right now versus firms that have quietly shifted away from your sector.

How to Act on Focus Shift Intelligence

Set Google Alerts for firm names combined with new sector keywords

Monitor Crunchbase deal history quarterly for velocity changes by category

Follow every partner individually on LinkedIn and X, not just firm accounts

Build a watchlist of firms showing two or more signals simultaneously

The principle: One signal is exploring. Two is directional. Three is a thesis forming, that's the window where outreach converts at the highest rate.

Access SheetVenture's sheet to identify which firms are actively deploying in your sector versus firms whose deal velocity signals they've already moved on.

The Bottom Line

VC firms signal focus shifts through partner hiring outside historical expertise, new sector portfolio announcements, speaking engagements in unfamiliar domains, fund size changes, LP communication shifts, and deal velocity changes. Firms rarely announce pivots publicly, the signal always precedes the statement.

Founders who read these patterns early gain first-mover access before competition intensifies. Track individuals, not just firms. Monitor deals, not just websites. Move when two or more signals align.

SheetVenture helps founders track active investor behavior in real time, so you pitch firms moving toward your sector, not away from it.