How Do Founders Maintain Outreach Quality While Scaling Volume?

Founders scale outreach through templating with customization, research automation, batch processing, feedback loops, and strategic pacing. Learn quality-at-scale methods.

Founders maintain outreach quality at scale through five methods: templating with customization points, research automation for personalization signals, batch processing with quality gates, systematic feedback loops tracking response patterns, and strategic volume pacing preventing burnout.

Quality and quantity appear contradictory but aren't mutually exclusive. Understanding where to standardize versus personalize enables efficient outreach that still feels authentic. The goal is maximizing response rates while reaching sufficient investor volume for competitive dynamics.

Why Quality-Volume Balance Matters

Understanding how to scale without sacrificing effectiveness explains successful fundraising approaches:

What quality maintenance enables:

Higher response rates per email sent

Stronger investor relationships from outreach

Better conversion from meeting to interest

Preserved founder reputation and credibility

Efficient use of limited fundraising time

What volume sacrifice creates:

Insufficient competitive dynamics

Extended fundraising timelines

Limited option set for negotiations

Higher risk of deal falling through

Missed opportunities with right investors

For deeper context, understand why most VC cold emails fail to get responses.

The Five Quality-at-Scale Methods

1. Templating with Customization Points

Create framework allowing mass customization:

What to template: Email structure, value proposition core, company description, ask clarity, signature formatting.

What to customize: Investor name and firm, specific thesis fit mention, portfolio company reference, personalized opening hook, reason for targeting them specifically.

Why it works: 80% efficiency from template, 20% personalization drives 80% of response impact.

Implementation approach: Create 3-5 email variations by investor type. Build merge fields for customization points. Test templates with small batches first. Iterate based on response data.

Quality threshold: Each email should feel personally written even if templated underneath.

2. Research Automation for Personalization Signals

Use tools to gather customization data efficiently:

What to automate: Recent fund announcements and investments, portfolio company overlap identification, partner background and focus areas, thesis statement extraction, mutual connection discovery.

What stays manual: Interpretation of why you fit, crafting specific thesis connection, determining best partner contact, evaluating genuine fit quality.

Why it works: Research time per investor drops from 20 minutes to 5 minutes while maintaining personalization quality.

Tools that help: Crunchbase for recent activity, LinkedIn Sales Navigator for connections, firm websites for thesis statements, Twitter for partner interests.

Quality maintenance: Automation gathers signals, founder judgment applies them meaningfully.

Learn about how to streamline outreach using efficient processes.

3. Batch Processing with Quality Gates

Structure outreach in quality-controlled batches:

Batch approach: Research 20-30 investors in single session, write all emails in focused block, quality review before sending batch, send batch over 2-3 days, track responses before next batch.

Quality gates: Minimum personalization checklist required, peer review for first 5 of each batch, response rate threshold to continue approach, mandatory pause if responses drop below 3%.

Why it works: Maintains quality mindset while achieving volume efficiency. Catch quality degradation before burning entire list.

Batch sizing: 20-30 investors per batch for seed/Series A. Adjust based on list size and timeline urgency.

Critical rule: Stop sending if quality drops. Fix approach before continuing.

4. Systematic Feedback Loops

Track what works and iterate continuously:

What to track: Open rates by subject line variation, response rates by email template, meeting conversion by approach type, patterns in successful versus ignored emails.

How to implement: Spreadsheet tracking all outreach, tag emails by approach variation, record outcomes consistently, weekly analysis of what's working, monthly adjustment to templates.

Why it matters: Data reveals which quality elements actually drive responses versus which are effort without return.

Iteration speed: Adjust templates after every 50 emails sent based on response patterns observed.

Insight application: Double down on what works, eliminate what doesn't, test new approaches in small batches.

5. Strategic Volume Pacing

Balance throughput with sustainability:

Pacing approach: 10-15 high-quality emails daily maximum, research and writing in separate time blocks, mandatory quality review before sending, buffer days for response follow-up, avoid weekend or late-night sending.

Why it works: Prevents rushed emails that sacrifice quality, maintains energy and attention for personalization, allows proper response management, preserves founder mental state.

Burnout prevention: Quality collapses when founder exhausted. Sustainable pace maintains both.

Timeline planning: 100 investors targeted = 7-10 days of outreach at quality pace, not rushing through in 2 days.

Check how to build and organize your investor pipeline before fundraising.

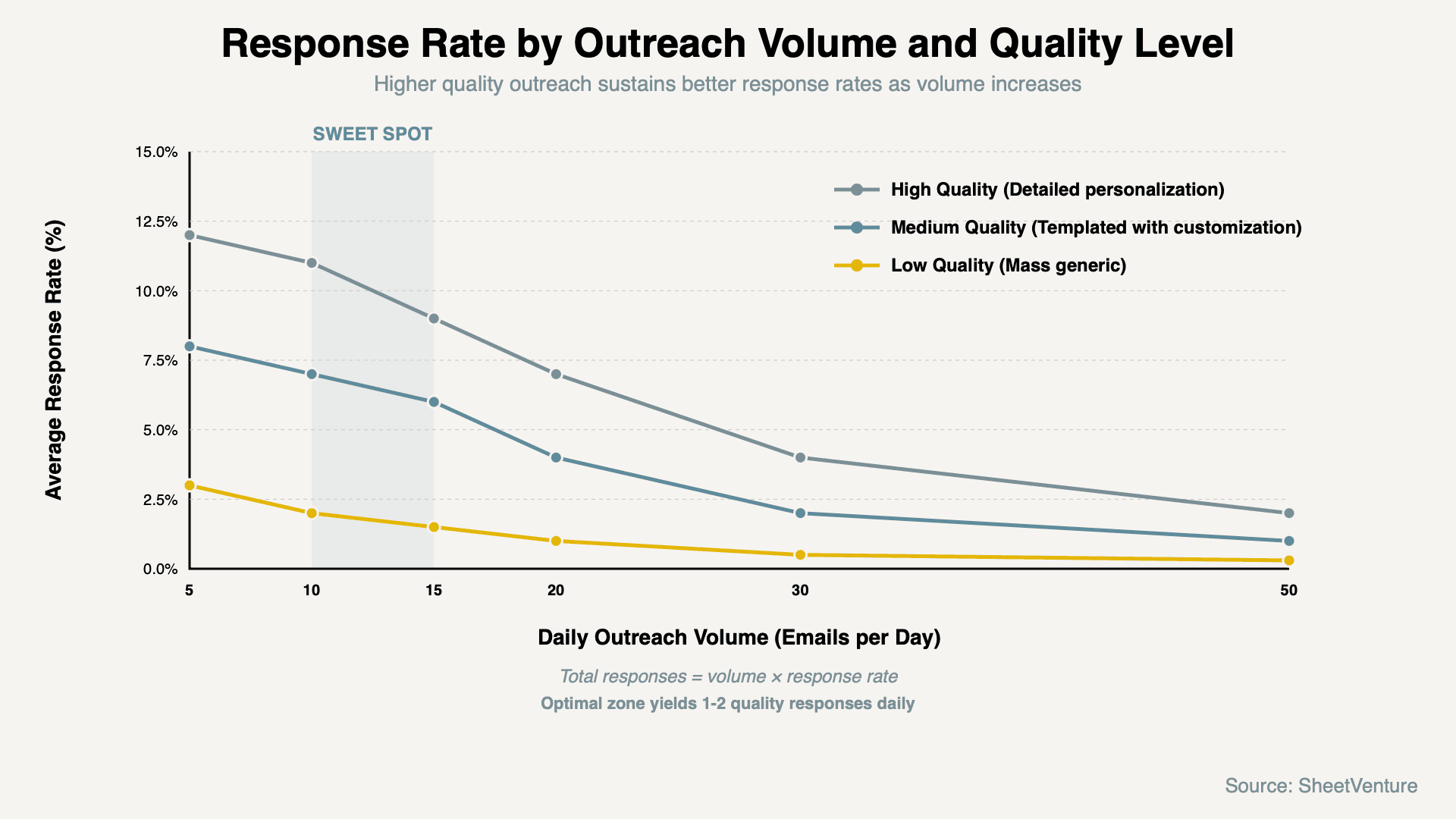

Quality vs Volume Impact on Response Rates

Position: After "The Five Quality-at-Scale Methods" section

Quality-Volume Trade-off Framework

Outreach Volume | Achievable Quality Level | Expected Response Rate | Total Responses | Best For |

|---|---|---|---|---|

5-10 emails/day | High - detailed personalization | 8-12% | 1 response/day | Tier-1 VCs, warm intro follow-ups |

10-15 emails/day | Medium-high - templated + custom | 6-9% | 1-2 responses/day | Most seed/Series A fundraises |

15-20 emails/day | Medium - framework personalization | 4-7% | 1 response/day | Time-constrained raises |

20-30 emails/day | Medium-low - minimal customization | 2-4% | 1 response/day | Volume-dependent strategies |

30+ emails/day | Low - mostly generic | 0.5-2% | <1 response/day | Spray and pray (not recommended) |

The math: Quality drives response rate. Volume provides opportunities. Total responses = volume × response rate. Optimize for total responses, not just volume.

Personalization Priority Matrix

Personalization Element | Impact on Response | Time Investment | Priority Level |

|---|---|---|---|

Investor name and firm | Critical - 40% impact | Low - 30 seconds | Must have - never skip |

Thesis fit explanation | Critical - 30% impact | Medium - 2 minutes | Must have - never skip |

Opening hook customization | High - 20% impact | Medium - 2 minutes | Must have - never skip |

Portfolio company reference | Medium - 5% impact | Low - 1 minute | Include when relevant |

Recent investment mention | Medium - 3% impact | Low - 1 minute | Include when recent |

Partner background details | Low - 2% impact | High - 5 minutes | Optional enhancement |

The principle: Focus 80% of customization time on the top three critical elements. They drive 90% of response impact.

Quality Maintenance Checklist

Before sending each batch:

[ ] Name and firm correct for every email

[ ] Opening hook unique and specific

[ ] Thesis fit explicitly stated

[ ] Portfolio reference accurate if included

[ ] Ask is clear and specific

[ ] No typos or formatting errors

[ ] Sender information complete

[ ] Timing appropriate (not weekend/late night)

Quality test: If investor could tell this was mass-sent, rewrite it.

Use SheetVenture's intelligence to efficiently gather personalization data at scale.

Common Quality Degradation Patterns

Warning signs quality is dropping:

Response rates declining batch over batch, emails taking less time per investor, skipping research steps to save time, copy-pasting without verifying accuracy, sending late at night or when tired.

Recovery actions: Pause outreach immediately, review last batch for quality issues, adjust process to prevent recurrence, reduce volume per day, restart only when quality restored.

Prevention: Build quality gates into process. Make quality checks non-negotiable. Pace outreach sustainably.

Volume Strategy by Fundraising Stage

Pre-seed/Seed (target 80-150 investors):

10-15 emails daily for 8-12 days. Higher personalization due to relationship importance. Focus on angels and micro VCs. Quality over volume priority.

Series A (target 50-100 investors):

10-15 emails daily for 5-8 days. Balanced quality-volume approach. Target institutional VCs more. Leverage existing relationships.

Series B+ (target 30-60 investors):

5-10 emails daily, very high quality. Relationship-based mostly. High personalization critical. Volume less important than fit.

The principle: Earlier stage needs higher volume, later stage needs higher quality, but never sacrifice quality below response threshold.

Check how to build a target investor list before your fundraise.

Measuring Quality Effectiveness

Key metrics to track:

Response rate per batch, meeting conversion from responses, investor quality of responses, time per email average, total responses per week.

Success indicators: 5-10% response rate maintained, 30%+ of responses convert to meetings, responding investors match target profile, sustainable pace without burnout.

Failure signals: Response rate below 3%, only off-target investors responding, increasing time per email with declining responses, founder exhaustion affecting quality.

Adjustment triggers: Two consecutive batches below 3% response = pause and fix approach.

The Bottom Line

Founders maintain outreach quality at scale through templating with customization points, research automation for personalization signals, batch processing with quality gates, systematic feedback loops, and strategic volume pacing. Quality drives response rates while volume provides opportunities.

Optimal approach sends 10-15 high-quality emails daily achieving 6-9% response rates. Critical personalization points are investor name, thesis fit, and opening hook. Quality degradation happens quickly beyond 15 emails daily. Track response rates by batch and adjust immediately when quality drops.

SheetVenture helps founders efficiently gather personalization data, so you scale outreach volume without sacrificing the quality that drives responses.