How Do Investors Assess If Founders Are Learning Fast Enough?

Investors assess learning speed through iteration velocity, insight quality, and feedback adaptation. Learn the five signals VCs use to evaluate founders.

Investors assess founder learning speed through five signals: iteration velocity on product and strategy, quality of insights from customer conversations, evolution of metrics understanding, adaptation to feedback between meetings, and pattern recognition development over time.

Fast learners compress years of experience into months. VCs bet on trajectory, founders who learn quickly will outpace competition regardless of starting point.

Why Learning Speed Matters

Understanding investor perspective explains the focus:

What fast learning signals:

Founder will adapt to market changes

Mistakes become lessons, not repeated failures

Competitive advantage compounds over time

Coachable and responsive to board input

What slow learning signals:

Same mistakes repeated across conversations

Defensive rather than curious mindset

May not survive inevitable pivots

Difficult board relationship ahead

For deeper context, understand how investors judge founder coachability.

Fast vs. Slow Learning Comparison

Signal | Fast Learner | Slow Learner |

|---|---|---|

Iteration speed | Ships weekly, tests constantly | Months between updates |

Customer insights | Deep, specific learnings | Surface-level observations |

Metric evolution | Tracks what matters, drops vanity | Same dashboard for months |

Feedback response | Implements between meetings | Defends original position |

Pattern recognition | Connects dots across experiences | Treats each problem as new |

Failure processing | Extracts lessons, moves forward | Blames external factors |

The pattern: Fast learners demonstrate visible progress between every investor interaction.

The Five Assessment Methods

1. Iteration Velocity Tracking

How fast do you ship and learn?

Fast learning signs: Weekly product updates, rapid A/B testing, quick pivots on failed experiments, shipping MVPs to test assumptions.

Slow learning signs: Quarterly releases, perfectionism blocking feedback, same product for 6+ months without iteration.

What investors ask: "Walk me through what you've shipped and learned in the last 30 days"

2. Customer Insight Quality

What have you learned from users?

Fast learning signs: Specific quotes, surprising discoveries, changed assumptions, nuanced segment understanding.

Slow learning signs: Generic feedback, confirmation bias, no unexpected learnings, can't articulate customer segments.

What investors ask: "What's the most surprising thing customers taught you recently?"

Learn how to demonstrate traction that shows real market learning.

3. Metrics Understanding Evolution

Are you measuring what matters?

Fast learning signs: Metrics evolved based on learnings, dropped vanity metrics, found leading indicators, cohort-level analysis.

Slow learning signs: Same KPIs since day one, tracking everything without prioritization, no metric-driven decisions.

What investors ask: "How has your dashboard changed in the last 6 months and why?"

4. Feedback Adaptation Between Meetings

Do you implement input?

Fast learning signs: Addressed concerns from last meeting, tested suggested approaches, updated thinking based on feedback.

Slow learning signs: Same pitch as 3 months ago, defensive about previous feedback, no visible progress on flagged issues.

What investors notice: Progress between conversations reveals true learning speed.

5. Pattern Recognition Development

Are you connecting dots faster?

Fast learning signs: Applies lessons across domains, anticipates problems before they occur, recognizes market patterns early.

Slow learning signs: Each challenge feels novel, doesn't apply past learnings, surprised by predictable obstacles.

What investors ask: "What patterns have you recognized that inform your current strategy?"

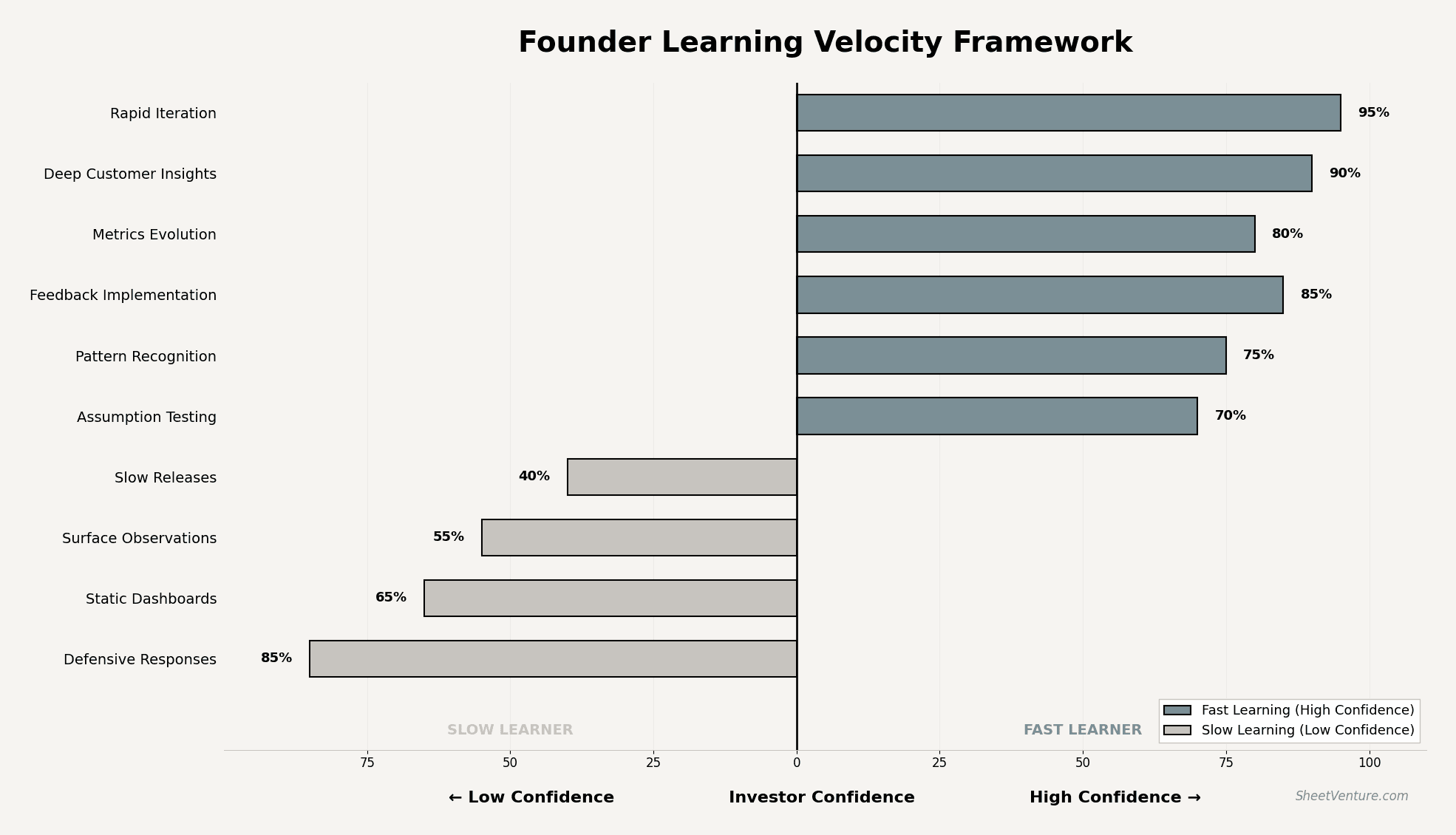

Founder Learning Velocity Framework

The graph shows how different learning behaviors map to investor confidence. Rapid iteration and insight quality score highest.

Questions That Test Learning Speed

Expect these probes:

"What did you believe 6 months ago that you've changed your mind on?"

"What's the biggest mistake you made and what did you learn?"

"How has your strategy evolved based on customer feedback?"

"What would you do differently if starting over today?"

"What have you learned since we last spoke?"

Why they ask: Answers reveal learning velocity and self-awareness.

Check SheetVenture's resources for frameworks on demonstrating rapid learning.

How to Demonstrate Fast Learning

Prepare to show:

Timeline of iterations with learnings from each

Before/after on key assumptions

Metrics evolution with reasoning

Specific customer insights that changed direction

Mistakes made and lessons extracted

The principle: Document your learning journey. Show visible progress between every interaction.

Use SheetVenture's intelligence to find investors who value learning velocity over current traction.

The Bottom Line

Investors assess learning speed through iteration velocity, customer insight quality, metrics evolution, feedback adaptation, and pattern recognition. Fast learners compress years into months and demonstrate visible progress between every interaction. Document your learning journey, show assumptions changed, experiments run, and lessons extracted. VCs bet on trajectory. Founders who learn fast will outpace competition regardless of where they start.

The best founders aren't the smartest. They're the fastest learners.

SheetVenture helps founders demonstrate learning velocity, so investors see trajectory, not just traction.