How Do Investors Evaluate If Growth Is Organic or Forced?

Investors distinguish organic from forced growth through acquisition mix, retention, and unit economics. Learn the five evaluation methods VCs use.

Investors distinguish organic from forced growth through five signals: customer acquisition source mix, unit economics sustainability, retention without incentives, growth consistency patterns, and word-of-mouth indicators.

Organic growth suggests genuine product-market fit, forced growth often collapses when spending stops. VCs want growth that sustains and compounds, not growth rented through unsustainable tactics.

Why This Distinction Matters

Understanding investor concern explains the scrutiny:

What organic growth signals:

Real product-market fit exists

Customers genuinely value the product

Growth will sustain without constant spending

Scalable, capital-efficient model

What forced growth signals:

Dependency on unsustainable tactics

Growth disappears when incentives stop

Unit economics may never work

Masking fundamental product issues

For deeper context, understand how investors evaluate customer traction quality.

Organic vs. Forced Growth Comparison

Signal | Organic Growth | Forced Growth |

|---|---|---|

Acquisition mix | 40%+ organic/referral | 90%+ paid channels |

Unit economics | CAC stable or improving | CAC rising with scale |

Retention | Strong without discounts | Requires ongoing incentives |

Growth pattern | Steady, compounding | Spiky, discount-driven |

Word-of-mouth | High NPS, referrals | Low virality, no advocacy |

Spend dependency | Grows without proportional spend | Stops when spending stops |

The pattern: Organic growth strengthens over time; forced growth requires ever-increasing investment.

The Five Evaluation Methods

1. Customer Acquisition Source Analysis

Where do customers actually come from?

Organic indicators: Direct traffic, referrals, organic search, word-of-mouth, inbound inquiries.

Forced indicators: Paid ads only, heavy discounting, aggressive outbound, influencer deals.

What investors ask: "Show me acquisition by channel for the last 6 months."

Red flag: Can't separate organic from paid or doesn't track sources.

2. Unit Economics Under Scrutiny

Do the numbers work without subsidies?

Organic economics: CAC stable at scale, LTV grows through expansion, payback under 12 months.

Forced economics: CAC increasing with volume, LTV inflated by assumptions, payback extending.

What investors ask: "What happens to CAC if you cut paid spend by 50%?"

Red flag: Unit economics only work at current (subsidized) levels.

3. Retention Without Incentives

Do customers stay without bribes?

Organic retention: 90%+ retention, customers stay for product value, low support burden.

Forced retention: Discounts needed to prevent churn, loyalty programs masking dissatisfaction.

What investors ask: "What's retention for customers acquired without discounts?"

Learn how to demonstrate traction that signals real product-market fit.

4. Growth Pattern Analysis

Is growth steady or spiky?

Organic pattern: Consistent MoM growth, predictable seasonality, compounding trajectory.

Forced pattern: Spikes during promotions, drops between campaigns, unpredictable trajectory.

What investors notice: Hockey stick from promotion ≠ hockey stick from product-market fit.

5. Word-of-Mouth Indicators

Are customers selling for you?

Organic signals: High NPS (50+), customer referrals without incentives, organic social mentions, case study willingness.

Forced signals: Low NPS, referrals only with rewards, no organic advocacy, customers won't go on record.

What investors ask: "What percentage of new customers come from referrals?"

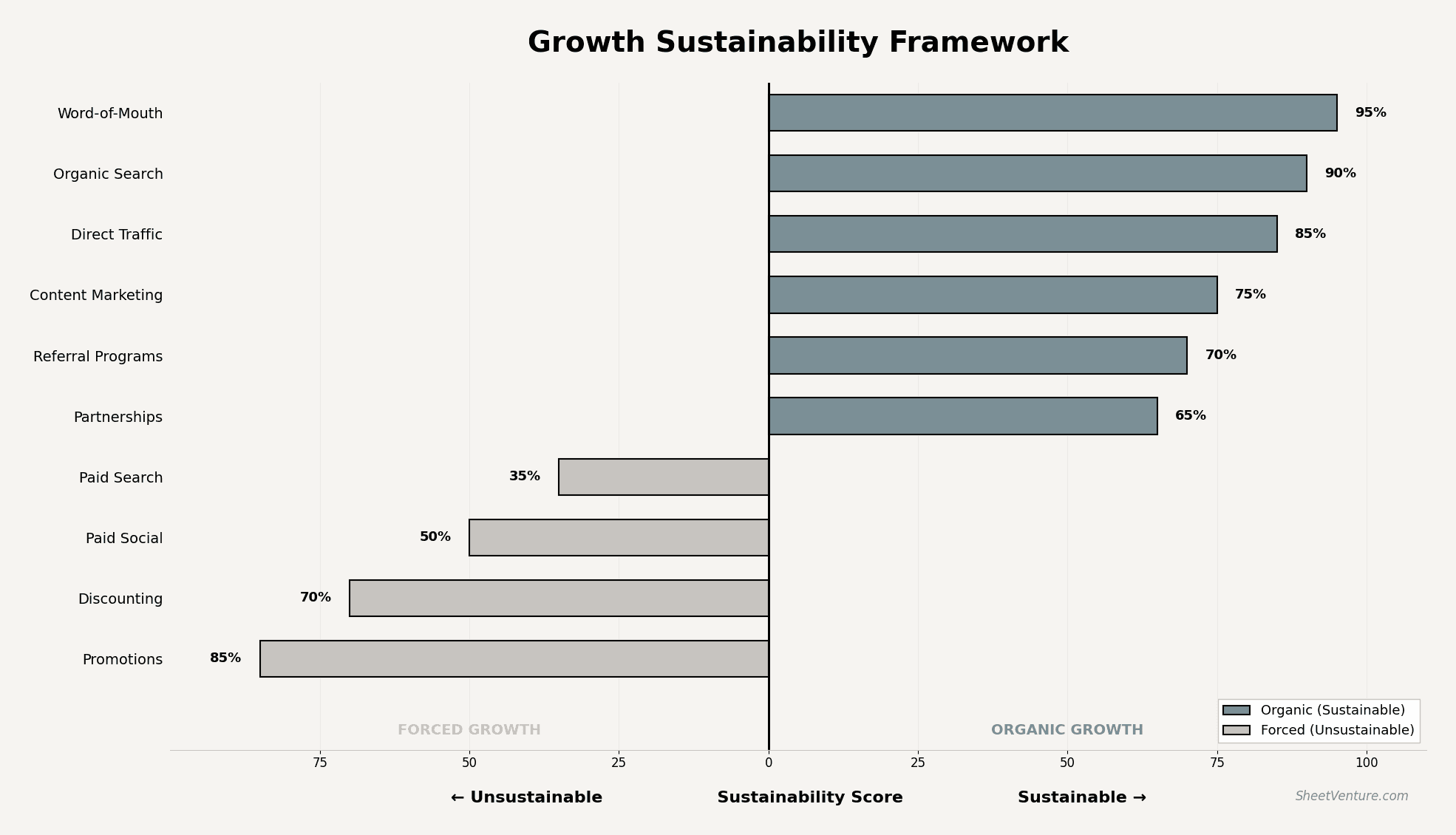

Growth Sustainability Framework

The graph shows how different growth sources map to sustainability. Organic sources compound; forced sources require constant reinvestment.

Questions Investors Ask to Test Growth Quality

Expect these probes:

"What happens to growth if you pause paid acquisition?"

"Show me cohort retention without promotional pricing"

"What's your organic vs. paid split by quarter?"

"How has CAC trended as you've scaled?"

"What's your NPS and referral rate?"

Why they ask: Each question isolates organic from forced signals.

Check SheetVenture's resources for frameworks on presenting sustainable growth metrics.

How to Demonstrate Organic Growth

Prepare to show:

Channel attribution with organic separated

Cohort analysis without promotional customers

CAC trends over 6+ months

Retention curves by acquisition source

NPS scores and referral percentages

The principle: Let data prove organic traction. Claims without evidence signal forced growth.

Use SheetVenture's intelligence to find investors who prioritize sustainable growth metrics.

The Bottom Line

Investors evaluate organic vs. forced growth through acquisition source mix, unit economics sustainability, retention without incentives, growth consistency, and word-of-mouth signals. Organic growth proves product-market fit and compounds over time. Forced growth masks problems and collapses when spending stops.

Prepare channel attribution, cohort analysis, and CAC trends to demonstrate organic traction. VCs want growth that sustains, not growth rented through unsustainable tactics.

SheetVenture helps founders demonstrate sustainable growth, so investors see traction that lasts.