How Do Investors React to Time Pressure During Fundraising?

Investors accelerate for real competition, become skeptical of artificial pressure, and disengage from excessive urgency. Learn optimal pressure calibration strategies.

Investors react to time pressure based on perceived authenticity: real competitive dynamics accelerate decision-making, artificial pressure triggers skepticism, excessive urgency signals desperation, reasonable timelines demonstrate professionalism, and zero urgency suggests weak demand.

VCs distinguish between founders creating genuine FOMO through multiple competing processes versus those manufacturing pressure through arbitrary deadlines. Understanding how investors interpret different pressure levels helps founders calibrate urgency appropriately.

Why Time Pressure Interpretation Matters

Understanding how investors decode urgency explains their varied responses:

What healthy pressure signals:

Multiple investors competing simultaneously

Founder executing organized process

Market timing creating natural deadlines

Confidence backed by genuine alternatives

What unhealthy pressure signals:

Desperation disguised as urgency

Manipulation attempt through arbitrary deadlines

Weak position compensating with theater

Founder lacks real competitive dynamics

For deeper context, understand how investors interpret momentum during a fundraising round.

The Five Investor Reactions to Time Pressure

1. Acceleration (Real Competitive Dynamics)

Genuine competition drives faster decisions:

What triggers this: Multiple term sheets from credible investors. Specific competing firms named. Clear timeline driven by actual commitments. Founder busy with parallel processes.

How investors react: Move meetings up. Fast-track partner discussions. Accelerate due diligence. Make quick commitment decisions.

What investors think: "If we don't move fast, we'll lose this deal to competitors."

Success indicator: Investors proactively suggest faster timelines and expedited processes.

2. Skepticism (Artificial Pressure)

Manufactured urgency creates doubt:

What triggers this: Arbitrary deadlines without evidence. Vague claims about "lots of interest." Timeline pressure inconsistent with process stage. Founder desperate energy contradicting urgency claims.

How investors react: Slow down intentionally, ask for evidence of competition. Maintain normal timeline. Question everything more thoroughly.

What investors think: "This feels manipulative. What are they hiding?"

Warning sign: Investors become less engaged when pressure feels inauthentic.

Learn what causes investors to delay decisions after initial interest.

3. Disengagement (Excessive Urgency)

Unreasonable pressure pushes investors away:

What triggers this: Demanding decisions in 24-48 hours. No time for proper due diligence. Founder unwilling to accommodate reasonable investor timelines. Pressure tactics that feel coercive.

How investors react: Pass immediately. Assume founder is desperate or hiding problems. Share concerns with network about aggressive tactics.

What investors think: "If they're this desperate, something is wrong. We're out."

Damage level: Severe. Reputation impact extends beyond current round.

4. Appreciation (Reasonable Timelines)

Professional urgency demonstrates respect:

What triggers this: Clear timeline with 2-3 week decision window. Accommodates reasonable diligence needs. Updates on process milestones. Respects investor decision processes.

How investors react: Engage constructively. Move efficiently within their process. Appreciate organized approach.

What investors think: "This founder runs a professional process. We want to participate."

Optimal approach: Most successful fundraises use this pressure level.

Check common mistakes founders make when raising startup capital.

5. Concern (Zero Urgency)

Complete lack of pressure signals weak demand:

What triggers this: No timeline mentioned. "Take your time" approach. Founder overly available. No sense of competitive dynamics. Process drags indefinitely.

How investors react: Deprioritize. Assume no one else is interested. Take months to decide. Eventually pass due to lack of confidence.

What investors think: "If no one else wants this, why should we?"

Problem: Zero urgency is as damaging as excessive urgency.

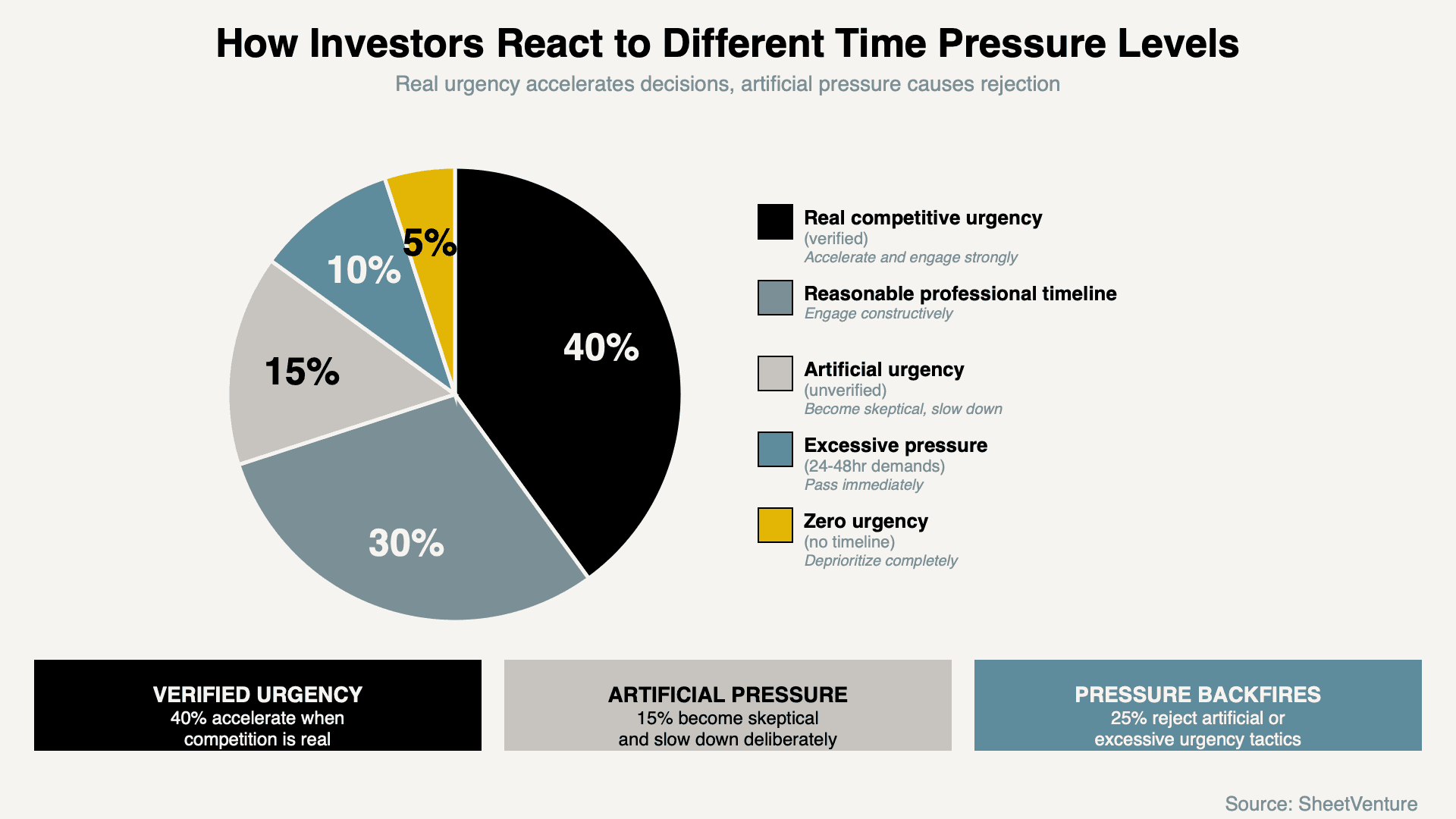

Investor Response Distribution to Time Pressure

This visually demonstrate that most positive investor engagement happens with real competition or reasonable timelines, while artificial or extreme pressure backfires.

Reading Investor Reactions to Your Pressure

Signs you've calibrated correctly:

Investors moving meetings up voluntarily. Partners getting involved faster. Constructive urgency acknowledgment. Efficient due diligence processes. Questions about competition but not skepticism.

Signs pressure is backfiring:

Investors slowing down intentionally. Increased skepticism about claims. Requests for extensive proof. Energy shifts from interest to caution. Ghosting after pressure applied.

The calibration test: Are investors leaning in or pulling back when you mention timeline?

Optimal Time Pressure Strategies

How to create healthy urgency:

Run organized parallel processes with multiple investors. Share specific timeline driven by business milestones. Accommodate reasonable diligence needs. Be transparent about competing interest without overselling. Let evidence speak louder than claims.

What to avoid:

Arbitrary deadlines without basis. Excessive follow-up creating desperation signals. Unwillingness to accommodate investor timelines. Vague claims about competition. Pressure tactics that feel manipulative.

The principle: Create urgency through substance, not tactics.

Use SheetVenture's intelligence to identify investors who move quickly when they see genuine competitive dynamics.

When Pressure Helps vs Hurts

Pressure helps when:

Multiple investors are genuinely engaged. Your traction validates quick decisions. Market timing creates natural deadlines. You have real alternatives including not raising.

Pressure hurts when:

You're talking to only one investor. Traction doesn't support urgency claims. Timeline feels arbitrary. You have no alternatives and it shows.

Reality check: Pressure only works when you have leverage. Without it, pressure reveals weakness.

The Bottom Line

Investors react to time pressure based on perceived authenticity: real competitive dynamics accelerate decision-making, artificial pressure triggers skepticism, excessive urgency signals desperation, reasonable timelines demonstrate professionalism, and zero urgency suggests weak demand. VCs distinguish genuine FOMO from manufactured pressure through evidence verification and founder behavior observation.

Calibrate urgency appropriately by creating real competitive dynamics, sharing transparent timelines, and accommodating reasonable diligence needs. Optimal pressure comes from substance, not tactics.

SheetVenture helps founders build genuine competitive dynamics, so time pressure accelerates rather than repels investor interest.