How Do Partner Meetings Work at Venture Capital Firms?

Partner meetings are weekly VC sessions where investment decisions happen. Learn how the process works and how to influence outcomes.

Partner meetings are weekly internal sessions where VCs discuss active deals, make investment decisions, and allocate firm resources, typically lasting 2-4 hours with all partners presenting and debating opportunities.

Getting to partner meeting is a significant milestone, it means at least one partner is championing your deal. However, partner meeting isn't the finish line, it's where deals face the toughest scrutiny from partners who haven't met you. Understanding this process helps founders prepare their champions and set realistic timelines.

What Happens at Partner Meetings

Inside the typical VC partner meeting:

Standard structure:

Weekly, usually Monday or Tuesday mornings

2-4 hours depending on firm size

All general partners attend (associates may join)

3-8 deals discussed per meeting

Mix of new opportunities and follow-ups

What gets discussed:

New deals partners want to pursue

Updates on active due diligence

Final investment decisions

Portfolio company issues

Market trends and themes

For context on reaching this stage, understand why most VC outreach fails to progress.

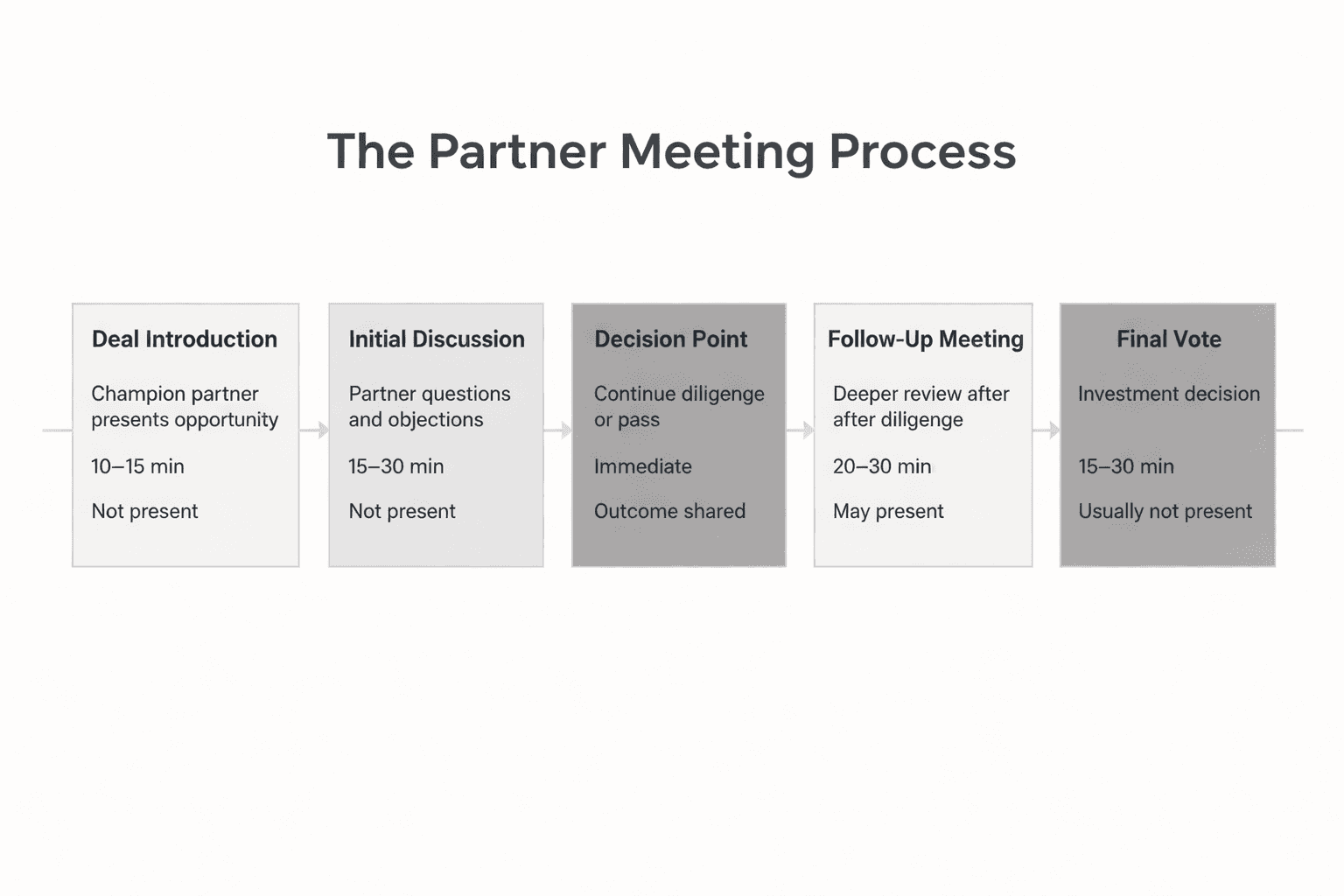

The Partner Meeting Process

Most firms require 2-4 partner meeting discussions before final approval.

How Partners Evaluate Deals

1. The Sponsoring Partner's Pitch

Your champion presents your company:

What they cover: Investment thesis, market opportunity, team assessment, competitive landscape, deal terms, key risks.

What they're doing: Advocating for you while maintaining credibility with partners.

Your role: Equip them with compelling materials and answers to tough questions.

2. Partner Questions and Pushback

Non-sponsoring partners challenge the deal:

Common questions:

"Why will this team win?"

"What's the competitive moat?"

"Why is this the right valuation?"

"What's the path to $1B+ outcome?"

What's really happening: Partners test whether the sponsoring partner has done thorough work and whether the thesis holds up.

3. Pattern Matching and Experience

Partners apply collective knowledge:

What influences decisions:

Similar deals they've seen succeed or fail

Market expertise from portfolio companies

Network knowledge about team, market, competition

Gut instincts from thousands of pitches

Reality: A single partner's negative experience with similar company can kill a deal.

What Determines Partner Meeting Outcomes

Deals that advance: Clear thesis, strong champion conviction, no major concerns, competitive urgency, acceptable terms.

Deals that stall: Thesis doesn't resonate, too many questions, experienced partner objects, valuation concerns, better opportunity exists.

How Founders Can Influence Partner Meetings

You won't be in the room, but you can shape the conversation:

Before partner meeting:

Provide comprehensive deck and materials

Anticipate objections and arm champion with answers

Share customer references and data room

Create urgency through competitive process

Information your champion needs:

Clear investment thesis (why now, why you)

Answers to predictable hard questions

Comparable company analysis

Customer and reference contacts

Learn how to craft compelling cold outreach that starts strong champion relationships.

Timeline Expectations

Typical progression: First mention → Initial feedback (24-48 hours) → Follow-up meeting (1–2 weeks) → Final decision (2-4 weeks total).

Common delays: Partners traveling, additional diligence requests, other deals taking priority, internal debates.

Red Flags in the Process

Warning signs: Multiple meetings without progress, requests for obscure information, champion enthusiasm declining, long update gaps, junior team taking over.

What to do: Ask directly: "Where does this stand? What concerns remain?"

Check SheetVenture's resources for frameworks on navigating this process.

Firm Size Differences

Small funds (2-3 partners): Faster decisions, fewer meetings required, often one partner can champion to close.

Mid-size funds (4-6 partners): Standard 2-4 meeting process, consensus usually required.

Large funds (7+ partners): More formal process, investment committee structures, longer timelines.

Use SheetVenture's intelligence to understand specific firms' decision-making processes.

The Bottom Line

Partner meetings are weekly 2-4 hour sessions where VCs present, debate, and decide on investments. Getting there means you have a champion; success requires that champion convincing skeptical partners. Most deals need 2-4 partner meeting discussions over 2-4 weeks. Founders influence outcomes by providing compelling materials, anticipating objections, and creating urgency. Your champion argues your case, arm them well.

You're not in the room. But your preparation is.

SheetVenture helps founders understand VC processes, so you know what happens when you're not in the room.