How Do VCs Coordinate When Multiple Firms Are Courting Same Startup?

VCs coordinate through back-channel communication, syndicate discussions, lead negotiations, competitive positioning, and relationship timing respect. Learn the mechanisms.

VCs coordinate through five mechanisms: back-channel communication sharing deal status and interest levels, syndicate partnership discussions about co-investing, lead investor negotiations setting terms others follow, competitive positioning to differentiate firm value-add, and respect for relationship timing avoiding interference with existing conversations.

Competitive deals involve both collaboration and competition simultaneously. Understanding coordination dynamics helps founders recognize when investors are truly competing versus coordinating behind scenes to manage their relationships.

Why VC Coordination Matters

Understanding how investors communicate during competitive processes explains founder experiences:

What coordination enables:

Efficient syndicate formation

Avoided duplicate diligence efforts

Maintained investor relationships

Clear lead-follow dynamics

Reduced founder manipulation attempts

What coordination prevents:

Destructive bidding wars

Relationship damage between VCs

Redundant diligence processes

Confused deal structure

Founder playing investors off each other

For deeper context, understand how investors interpret momentum during a fundraising round.

The Five Coordination Mechanisms

1. Back-Channel Communication

VCs talk directly despite competitive appearance:

What gets shared:

-"We're looking at X company, are you in process?"

-"What stage are you at with this deal?"

-"Are you leading or following?"

-"What's your timeline?"

Why they communicate: Maintain long-term relationships. Avoid wasting time on lost deals. Identify syndicate opportunities. Coordinate diligence timing.

What founders don't see: Phone calls between partners. Texts exchanging deal status. Dinners discussing portfolio strategy. Conference conversations about deals.

The reality: Competitive processes aren't as competitive as founders believe. VCs prioritize relationship preservation over winning every deal.

Example: "Hey, I see you met with [company]. We're interested too. Want to co-lead if terms work?"

2. Syndicate Partnership Discussions

VCs negotiate co-investing early:

What gets discussed: Who leads vs follows. Ownership split between firms. Board seat allocation. Pro-rata rights distribution. Follow-on commitment expectations.

When this happens: Often before term sheet presented. During diligence simultaneously. As negotiation alternative to competing.

Why it matters: Reduces competition by creating collaboration. Allows VCs to pool capital and conviction. Shares diligence costs and time.

What founders experience: Multiple investors suddenly aligned. Similar terms from different firms. Coordinated timing on decisions. Joint partnership proposals.

Strategy implication: Founder can influence syndicate composition if aware coordination happening.

Learn what role do introductions play in investor decision-making.

3. Lead Investor Negotiations

One VC sets terms others react to:

How it works: Lead investor proposes term sheet. Other interested investors decide match/beat/pass. Follow investors negotiate allocation with lead. Structure gets determined by lead's terms.

Lead responsibilities: Setting valuation. Defining round structure. Taking board seat. Leading diligence. Coordinating syndicate.

Follower dynamics: Accept lead's terms to participate. Focus on allocation size negotiation. May pass if terms unattractive. Rarely compete directly on structure.

Why this matters: True competition happens at lead level. Follower competition is about allocation not terms.

Founder leverage: Multiple leads compete differently than multiple followers.

4. Competitive Positioning

VCs differentiate on value beyond terms:

What they compete on: Portfolio support quality. Network depth for hiring/customers. Strategic expertise in category. Brand reputation value. Board member quality. Follow-on capital certainty.

How they position:

-"Here's our portfolio helping portfolio companies..."

-"We've built X companies in your space..."

-"Our network includes Y executives..."

-"We can deploy Z in future rounds..."

Why this works: At similar valuations, founders choose based on partner quality and firm resources.

What founders evaluate: Which firm actually helps versus just talks about helping. Track record with similar companies. Partner chemistry and trust.

The pitch shift: From "invest in us" to "choose us as partners for years."

5. Respect for Relationship Timing

VCs honor existing conversation priority:

The etiquette: If firm A is deep in conversations, firm B doesn't aggressively interfere. VCs respect "we're in process with X" signals. Late entrants acknowledge position disadvantage.

Why it exists: Maintain community relationships. Avoid reputation as relationship breaker. Long-term cooperation matters more than single deal.

When violated: Hot deals with multiple strong leads. New aggressive VCs establishing themselves. Breakout companies creating bidding frenzy.

What founders observe: Some VCs back off when hearing others engaged. Respect for process timing. Waiting turn rather than forcing parallel processes.

Strategic consideration: Timing of VC conversations influences competitive dynamics.

Check how investors react to slow versus fast fundraising processes.

Coordination vs Competition Framework

Deal Scenario | Coordination Level | Competition Level | Founder Experience |

|---|---|---|---|

Clear lead + followers | High - syndicate formation | Low - allocation only | Smooth process, aligned terms |

Multiple lead candidates | Medium - terms alignment | High - valuation/structure | Competing term sheets, negotiation leverage |

Hot "must-win" deal | Low - every firm for themselves | Very High - aggressive bidding | Multiple aggressive offers, quick timeline |

Standard deal | High - collaborative approach | Medium - positioning on value | Professional process, relationship-based |

Struggling raise | Very High - rescue syndicate | Low - risk sharing focus | Coordinated rescue terms, minimal competition |

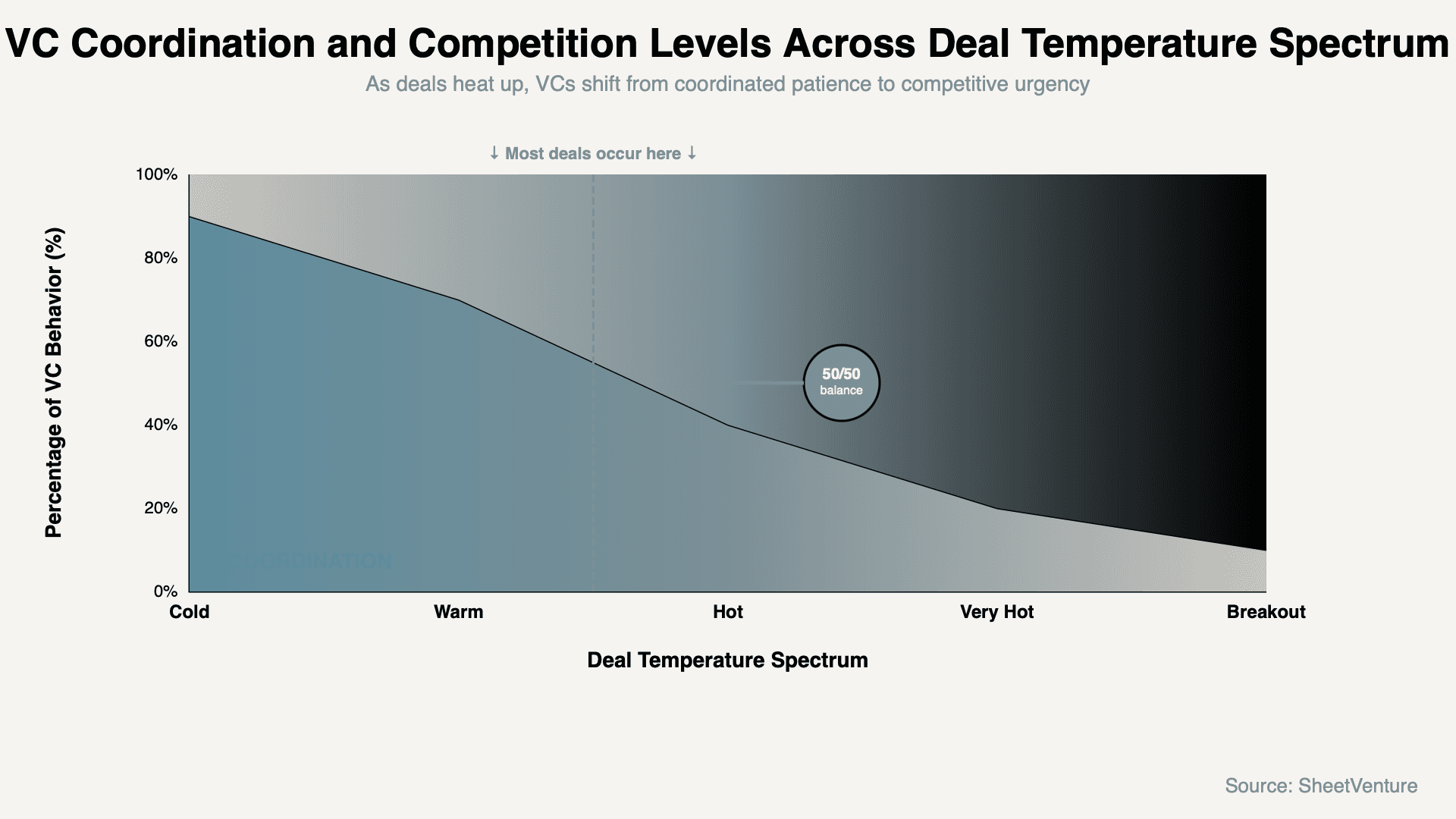

The pattern: Hotter deals reduce coordination; standard deals increase it.

How Founders Can Influence Coordination

Strategies that increase competition:

Create genuine urgency through traction. Run organized parallel processes. Share competitive interest transparently. Set clear decision timelines. Demonstrate multiple lead options exist.

What reduces competition:

Sequential conversations allowing coordination time. Long timelines enabling back-channel alignment. Weak alternatives limiting leverage. Accepting first decent offer. Not creating urgency.

The balance: Too much manipulation backfires. Genuine competition from execution quality works best.

Reading Coordination Signals

Signs VCs are coordinating:

Similar valuation proposals from multiple firms. Investors asking about each other's interest. Timing alignment on decisions. Joint partnership proposals emerging. Terms converging rather than diverging.

Signs of genuine competition:

Escalating valuations. Aggressive timelines. Differentiated term sheet structures. Partners emphasizing advantages over competitors. Clear attempts to win exclusively.

The test: Are terms getting better or standardizing? Better = competition. Standardizing = coordination.

Information Asymmetry and Coordination

What VCs know that founders don't:

Who else is looking at the deal. What stage other processes are at. Which firms typically syndicate together. Historical relationship dynamics. Market reputation and deal flow.

What founders control:

Transparency about process status. Timeline pressure creation. Which firms meet which other firms. Information flow management. Syndicate composition influence.

The principle: Information control is founder's main leverage against coordination.

Use SheetVenture's intelligence to research which VCs frequently co-invest and coordinate.

When Coordination Breaks Down

Scenarios causing pure competition:

Breakout company with massive potential. Multiple tier-one firms wanting exclusive lead. Founder explicitly creating auction dynamics. New entrant VC trying to establish market position. Deal so hot relationship preservation becomes secondary.

What happens: Bidding wars. Aggressive terms. Rapid escalation. Relationship strain between VCs. Founder maximum leverage.

Frequency: Rare. Most deals involve coordination. True bidding wars are outliers.

Founder mistake: Assuming all competitive processes are pure competition.

Coordination-Competition Spectrum

This shows founders that most deals involve mixed coordination-competition dynamics.

The Bottom Line

VCs coordinate through five mechanisms: back-channel communication sharing deal status, syndicate partnership discussions about co-investing, lead investor negotiations setting terms, competitive positioning on value-add, and respect for relationship timing. Competitive deals involve both collaboration and competition simultaneously.

Coordination increases in standard deals; competition increases in hot deals. Founders can influence dynamics through transparency, timing, and genuine alternative creation. Understanding coordination helps recognize when investors are truly competing versus coordinating behind scenes.

SheetVenture helps founders understand investor dynamics, so you recognize coordination patterns and maximize competitive leverage.