How Do VCs Decide If Founders Are Building for Long Term vs Just Fundraising?

VCs evaluate builder mentality through product priorities, team investments, metric focus, time allocation, and capital deployment tradeoffs. Learn the signals.

VCs distinguish long-term builders from fundraising-focused founders through five behavioral signals: product development decisions prioritizing customer value over pitch-ability, team investments in unglamorous but critical infrastructure, metric focus on fundamentals versus vanity numbers, founder time allocation on execution versus networking, and willingness to make hard tradeoffs that delay short-term optics.

Fundraising-focused founders optimize for next round; long-term builders optimize for enduring value.

Why This Distinction Matters

Understanding what separates builders from fundraisers explains investor scrutiny:

What long-term building signals:

Sustainable competitive advantages emerging

Foundation for compounding growth exists

Company survives market downturns

Value creation independent of capital availability

What fundraising focus signals:

Growth collapses between rounds

Metrics optimized for pitch, not business health

Team burns out from unsustainable pace

Business model never solidifies

For deeper context, understand common mistakes founders make when raising startup capital.

Builder vs Fundraiser Behavioral Patterns

Behavior Category | Long-Term Builder | Fundraising-Focused | What VCs Notice |

|---|---|---|---|

Product decisions | Build moats and retention features | Build demo-able features for pitch | "What are you building that won't show results for 18 months?" |

Team investments | Hire infrastructure/operations roles | Hire only customer-facing roles | "Do you have anyone building unsexy backend systems?" |

Metric priorities | Focus on retention, unit economics | Focus on growth rate, user counts | "What metrics do you track that don't go in pitch deck?" |

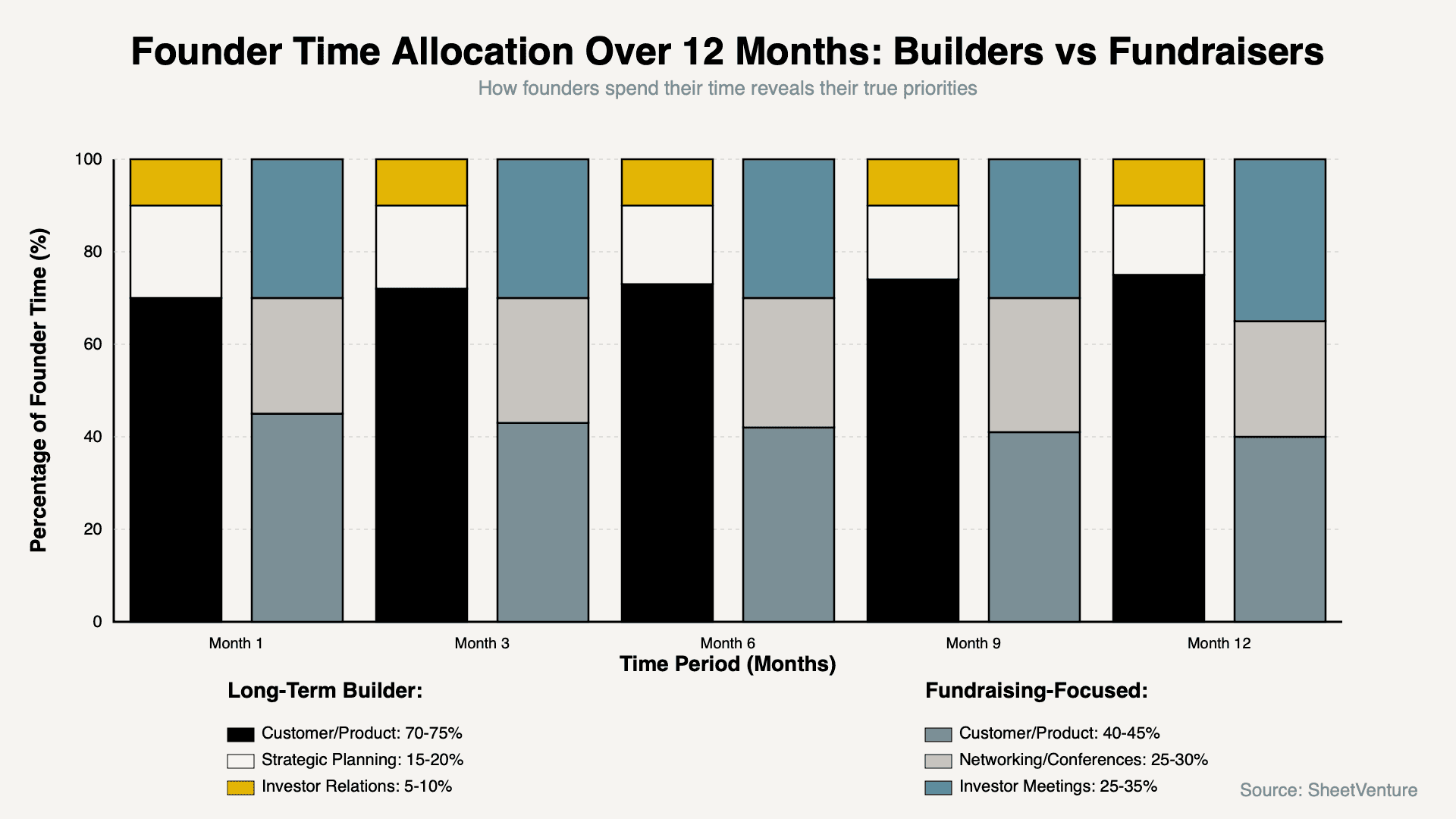

Time allocation | 80% execution, 20% networking | 50%+ on investor relationships | "How much time do you spend talking to customers vs investors?" |

Capital deployment | Invest in long-term capabilities | Spend to hit next round milestones | "What have you built that won't pay off until Series B?" |

The pattern: Builders invest in fundamentals; fundraisers optimize for perception.

The Five Builder vs Fundraiser Signals

1. Product Development Priorities

What gets built reveals true motivation:

Long-term builder signals: Investing in retention features before acquisition features. Building infrastructure that won't matter for 12+ months. Technical debt paydown despite no short-term metrics impact.

Fundraising focus signals: All development oriented toward pitch metrics. Neglecting technical infrastructure. Demo-driven roadmap decisions.

What investors ask: "What are you building that won't impress investors but matters for customers?"

Red flag: Can't name any current projects that don't directly support fundraising narrative.

2. Team Investment Decisions

Hiring reveals priorities:

Long-term builder signals: Hiring operations, finance, or infrastructure roles early. Building systems and processes before they're painful. Team composition balanced beyond revenue generation.

Fundraising focus signals: Only hiring roles that directly touch customers or revenue. Neglecting operations until breaking point.

What investors notice: "Do you have anyone working on things that won't show up in next pitch?"

Learn how investors think about capital efficiency.

3. Metric Focus and Tracking

What founders measure reveals what they value:

Long-term builder signals: Tracking retention cohorts religiously. Monitoring unit economics weekly. Deep analysis of churn reasons. Focus on fundamentals over vanity metrics.

Fundraising focus signals: Only tracking metrics that go in pitch deck. User counts without engagement depth. Growth rate obsession without economic sustainability.

What investors ask: "What metrics do you track internally that aren't in your pitch deck?"

Red flag: Can't articulate metrics beyond headline numbers for fundraising.

4. Founder Time Allocation

How founders spend time shows priorities:

Long-term builder signals: Majority time with customers and product. Limited conference attendance. Deep work on strategic problems.

Fundraising focus signals: Constant investor coffee meetings. Heavy conference circuit presence. Always "taking meetings" with potential investors.

What investors notice: Response time patterns. Are they in execution mode or perpetual raise mode?

Check how to use investor funds for growth wisely.

5. Capital Deployment Tradeoffs

How funding gets spent reveals intention:

Long-term builder signals: Investing in capabilities that won't pay off for 12-18 months. Building foundation before scaling aggressively. Conservative runway management with buffer.

Fundraising focus signals: All capital deployed to hit next round milestones. Aggressive burn to maximize growth rate. Runway management assumes next round closes on time.

What investors ask: "Show me your budget. What are you spending on that won't matter until after next raise?"

Builders spend 70%+ time on execution. Fundraisers spend 50%+ time on investor relationships.

Questions VCs Ask to Test Builder Mentality

Expect these diagnostic questions:

"What are you building now that won't show results for 18 months?"

"What metrics do you track that don't go in the pitch deck?"

"How much time do you spend with customers versus investors?"

"Show me a decision where you sacrificed short-term metrics for long-term health"

Why they ask: Each question reveals whether you're optimizing for next round or next decade.

Use SheetVenture's intelligence to identify investors who value long-term building over fundraising theatrics.

Demonstrating Builder Mentality

How to prove long-term focus:

Point to infrastructure investments with delayed payoff. Show metric tracking beyond pitch deck numbers. Describe team roles that don't directly drive revenue. Share customer-driven decisions that hurt short-term optics.

The principle: Builders make tradeoffs that fundraisers won't, and can articulate why those tradeoffs matter.

Check SheetVenture's resources for frameworks on demonstrating long-term building commitment.

The Bottom Line

VCs distinguish long-term builders from fundraising-focused founders through five signals: product development prioritizing customer value over pitch-ability, team investments in unglamorous infrastructure, metric focus on fundamentals versus vanity numbers, founder time allocation on execution versus networking, and willingness to make hard tradeoffs.

Demonstrate investments with delayed payoff, metrics beyond pitch deck, and customer-driven decisions that hurt short-term optics.

SheetVenture helps founders demonstrate long-term building commitment, so investors see sustainable value creation, not fundraising theater.