How Do VCs Decide If Startups Deserve Time But Not Capital?

VCs give time without capital for promising teams needing experience, premature timing, or traction below thresholds. Learn to interpret tracking signals.

VCs allocate time without capital when they see long-term potential but current gaps: promising founding team that needs more operating experience, interesting market opportunity with premature timing, solid traction that hasn't reached investment thresholds yet, business model showing promise but requiring validation, or strategic value for portfolio knowledge despite not fitting fund thesis.

Time investment signals "not now" rather than "never" Understanding this category helps founders interpret "let's stay in touch" accurately and leverage investor time productively.

Why Time Without Capital Matters

Understanding the "track but don't invest" category explains investor behavior:

What time without capital signals:

Genuine interest in long-term potential

Current gaps prevent immediate investment

Relationship building for future rounds

Portfolio intelligence gathering value

Respect for founder despite pass

What immediate pass signals:

No long-term potential seen

Fundamental misalignment exists

Relationship building not worthwhile

No future scenario justifies investment

Polite rejection without substance

For deeper context, understand how investors classify deals internally after meetings.

Time vs Capital Allocation Framework

Decision Type | Gets Time Investment | Gets Capital Investment | What It Reveals |

|---|---|---|---|

Strong match now | Partner meetings, weekly updates | Term sheet, immediate commitment | Everything aligns today |

Future potential | Quarterly check-ins, advice calls | Not yet, but potentially next round | Gaps exist but closeable |

Portfolio intelligence | Occasional conversations | Never, but valuable relationship | Learn from founder's insights |

Polite pass | Generic "stay in touch" | Never | No real interest |

Hard pass | No time or follow-up | Never | Fundamental misfit |

The pattern: Time allocation reveals investor's true assessment of long-term potential.

The Five "Time But Not Capital" Scenarios

1. Promising Team Needing Operating Experience

Founders have potential but lack execution proof:

What triggers this: Strong technical or domain expertise, impressive backgrounds, clear intelligence and drive, but no track record leading companies, managing teams, or scaling operations.

Why time yes, capital no: Team could become excellent with more experience, too risky to bet on now without execution proof, worth tracking to see if they develop.

What investors do: Offer mentorship, make introductions, check in quarterly, wait for operating evidence.

Future scenario: "Come back when you've hired 10 people and managed them for 12 months."

Learn what tells investors founders can hire strong executives later.

2. Interesting Market with Premature Timing

Right opportunity, wrong moment:

What triggers this: Market exists but adoption curve too early, technology dependencies not mature yet, infrastructure gaps remain, regulatory environment uncertain.

Why time yes, capital no: Opportunity could be massive in 2-3 years, too risky to invest before market readiness, worth monitoring market evolution.

What investors do: Track market developments, watch for catalysts, maintain relationship for future timing.

Future scenario: "Let's talk again when [market condition] changes."

3. Solid Traction Below Investment Thresholds

Good progress but not enough yet:

What triggers this: Growing but below $1M ARR for Series A fund, retention solid but customer count too low, unit economics working but volume insufficient, team executing well but scale not proven.

Why time yes, capital no: Trajectory looks promising, current metrics don't justify valuation or check size, worth watching next 6-12 months of growth.

What investors do: Request monthly metrics updates, offer strategic advice, stay engaged for next round.

Future scenario: "Reach $2M ARR with these retention metrics and let's talk."

4. Business Model Showing Promise But Needs Validation

Concept interesting but unproven economics:

What triggers this: Novel monetization approach, unit economics assumptions untested, marketplace dynamics unclear, expansion revenue model theoretical.

Why time yes, capital no: Could work but too much assumption risk now, wants to see proof points before committing, worth tracking validation progress.

What investors do: Help brainstorm validation experiments, review results periodically, wait for economic proof.

Future scenario: "Prove these three assumptions and we'll move quickly."

5. Strategic Value for Portfolio Intelligence

Learn from founder even without investing:

What triggers this: Founder has unique market insights, startup illuminates emerging category, data or perspective valuable for portfolio companies, relationship provides ecosystem understanding.

Why time yes, capital no: Doesn't fit investment thesis but valuable knowledge source, relationship benefits portfolio indirectly, genuine respect for founder's expertise.

What investors do: Take calls to learn about market, make strategic introductions, share insights both ways.

Future scenario: May never invest but relationship remains valuable.

Check how investors evaluate founder-market fit for investment decisions.

Investor Time Allocation by Deal Category

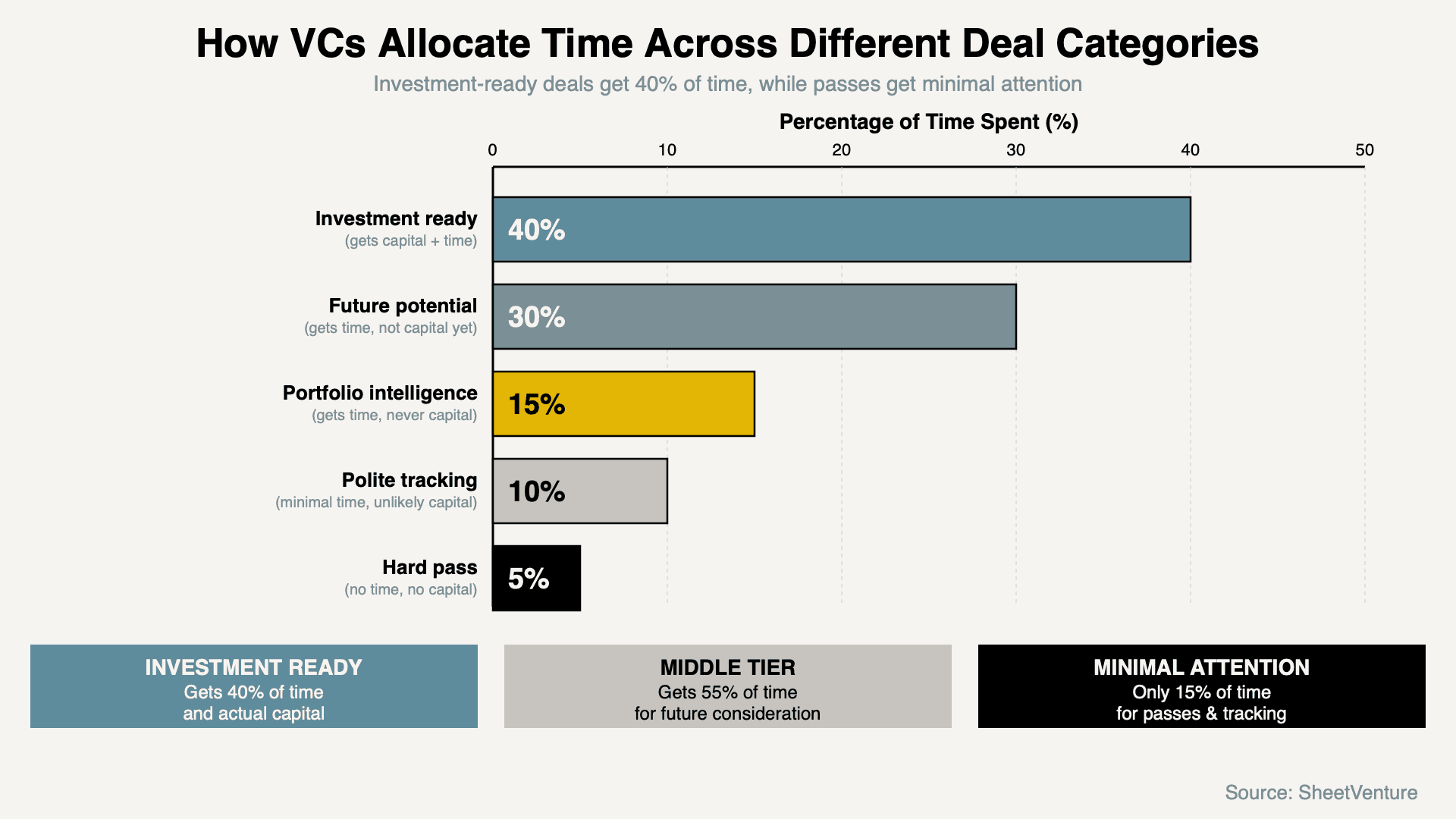

Below is how VCs distribute their time across different deal categories:

The pattern: VCs spend 45% of their time on deals they're not investing in currently, tracking future potential and gathering portfolio intelligence. Time allocation reveals true assessment of long-term potential versus polite rejection.

Reading Time Investment Signals Accurately

Signs of genuine "time but not capital":

Specific feedback on what needs to change, regular check-ins scheduled, introductions to relevant contacts, strategic advice offered, clear milestones mentioned for future consideration.

Signs of polite pass disguised as tracking:

Vague "stay in touch" with no specifics, no follow-up after initial meeting, generic advice without depth, never available when you reach out, no concrete feedback on gaps.

The test: Do they proactively check in or only respond when you reach out?

Leveraging Time Investment Productively

How to maximize investor time without capital:

Ask for specific feedback on gaps, request introductions to customers or talent, seek advice on strategic decisions, share regular progress updates, demonstrate you're closing the gaps they identified.

What not to do: Treat it as soft yes and push for investment, ignore their feedback about gaps, stop updating them, assume interest will convert automatically.

The principle: Respect time investment by showing progress on identified gaps.

Use SheetVenture for comprehensive investor data and relationship management.

Converting Time to Capital Later

What triggers the conversion:

You've closed the specific gaps they identified, metrics reached thresholds they mentioned, market timing shifted in your favor, team developments addressed concerns, proof points validated assumptions.

How to re-engage: "You mentioned wanting to see X, Y, Z. We've now achieved that. Would love to share updated metrics."

Success rate: Significantly higher than cold outreach if you genuinely addressed feedback.

Timing: Usually 6-18 months between time investment and capital consideration.

The Bottom Line

VCs allocate time without capital when they see long-term potential but current gaps: promising founding team needing operating experience, interesting market with premature timing, solid traction below investment thresholds, business model requiring validation, or strategic portfolio intelligence value.

Time investment signals "not now" rather than "never." Distinguish genuine tracking from polite rejection by checking for specific feedback, regular engagement, and clear milestone articulation. Leverage time investment by demonstrating progress on identified gaps and maintaining relationship through transparent updates.

Time today can become capital tomorrow.

SheetVenture helps founders understand investor signals and maintain productive relationships, so time investment converts to capital when gaps close.