How Long Should Fundraising Momentum Last Before Investors Lose Interest?

Fundraising momentum has 90-120 day optimal window. Beyond that, investor interest deteriorates and skepticism increases. Learn the timeline phases.

Fundraising momentum has a 90-120 day optimal window before investor interest deteriorates: first 30 days establish legitimacy through initial meetings, days 31-60 generate competitive tension through multiple conversations, days 61-90 convert interest to term sheets, and beyond 120 days signals stalling or lack of conviction.

Extended timelines signal soft demand, founder indecision, or deal quality concerns. VCs pattern-match fundraising velocity to founder capability and market validation. Understanding momentum decay helps founders compress timelines and maintain urgency.

Why Momentum Timeline Matters

Understanding how fundraising velocity affects perception explains urgency requirements:

What fast fundraising signals:

Strong market validation exists

Multiple investors see the opportunity

Founder can execute decisively

Deal quality creates competitive pressure

What slow fundraising signals:

Weak market validation or demand

Few investors genuinely interested

Founder lacks decisiveness or clarity

Deal quality concerns driving hesitation

For deeper context, understand how long fundraising really takes in different scenarios.

The Fundraising Momentum Timeline

Phase | Timeline | What Should Happen | What Investors Think |

|---|---|---|---|

Initial outreach | Days 1-30 | First meetings, generating interest | "Is there market pull for this deal?" |

Active engagement | Days 31-60 | Multiple partner meetings, due diligence | "Who else is interested? Should we move fast?" |

Decision window | Days 61-90 | Term sheets, final negotiations | "We need to close or lose the deal" |

Momentum decay | Days 91-120 | Interest cooling, questions emerging | "Why hasn't this closed? What's wrong?" |

Deal death zone | Beyond 120 days | Investors assume something is broken | "This has been shopped for months—pass" |

The pattern: Velocity signals quality. Slow fundraising creates skepticism spiral.

The Five Momentum Phases

1. Initial Outreach Phase (Days 1-30)

Establishing legitimacy and generating first meetings:

What should happen: 20-40 investor meetings scheduled. Initial conversations with diverse investor types. Clear messaging and pitch refinement. Building list of engaged investors.

What investors think: "Is this founder organized and strategic about fundraising?"

Red flags at this stage: Taking meetings randomly without strategy. Unclear on round size or terms. Can't articulate why specific investors fit.

Momentum indicator: Ability to get meetings signals network strength and initial appeal.

2. Active Engagement Phase (Days 31-60)

Generating competitive tension and partner meetings:

What should happen: 5-10 investors moving to partner meetings. Due diligence requests coming in. Multiple investors asking about timeline. Competitive dynamics becoming visible.

What investors think: "We need to move fast or miss this deal. Who else is interested?"

Red flags at this stage: No partner meetings yet. Only one or two investors engaged. Founder can't create urgency. No due diligence requests.

Momentum indicator: Multiple simultaneous processes signal strong interest.

Learn about understanding VC decision-making timelines and expectations.

3. Decision Window (Days 61-90)

Converting interest to term sheets:

What should happen: First term sheets arriving. Final diligence completing. References being checked. Negotiations beginning. Clear lead emerging.

What investors think: "If we want in, we need to commit now."

Red flags at this stage: Still in exploratory conversations. No term sheets yet. Investors asking to "circle back later." Founder extending timeline without reason.

Momentum indicator: Term sheets and commitment signals prove deal quality.

4. Momentum Decay Phase (Days 91-120)

Interest cooling without closure:

What happens: Investors start questioning timeline. FOMO dissipates. Due diligence fatigue sets in. Competitive tension disappears. New questions emerge about why it's taking so long.

What investors think: "If this were great, it would have closed. What's the issue?"

Red flags investors see: Extended process without clear reason. Founder seems indecisive. Other investors have passed. Market conditions cited as excuse.

Danger zone: Once momentum breaks, rebuilding is extremely difficult.

5. Deal Death Zone (Beyond 120 Days)

Investors assume fundamental problems exist:

What happens: Active interest evaporates. "No" answers accelerate. Investors assume others have passed for good reasons. Deal feels stale and shopped. New investors see red flags in timeline alone.

What investors think: "This has been out there for months. Everyone's passed. Why would we be different?"

Recovery difficulty: Exceptionally hard to close after 120+ days without major new traction.

Reality check: Some deals close beyond 120 days, but momentum loss creates uphill battle.

Check how to follow up with VCs without appearing desperate during extended processes.

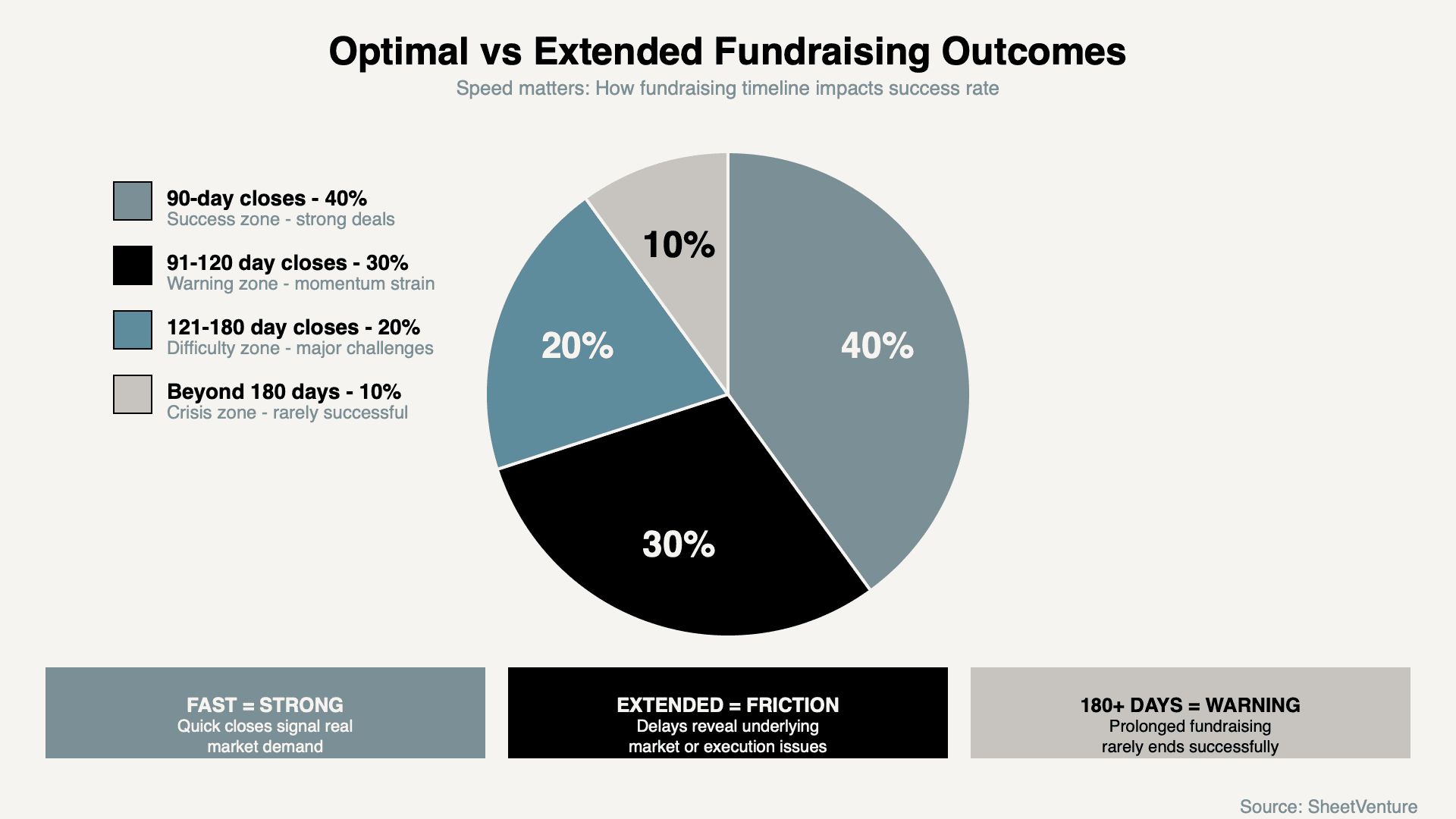

Fundraising Timeline Distribution

Factors That Extend Timelines

Legitimate timeline extensions:

Complex due diligence requirements. Multi-party syndicate coordination. Holiday periods (Nov-Dec, summer). Regulatory approvals needed. Strategic investor board approvals.

Timeline extensions that concern investors:

Founder indecision or shopping. Missing documents or financials. Changing terms or valuation. Waiting for better traction. Multiple failed processes.

Use SheetVenture's intelligence to identify investors known for fast decision-making processes.

Maintaining Momentum Beyond 90 Days

If timeline extends, actively manage perception:

Communicate clear reasons for timeline. Show new traction during process. Maintain regular updates to engaged investors. Create mini-deadlines within longer process. Be transparent about status and challenges.

What kills momentum: Radio silence. Vague updates. No progress visible. Founder seems to disappear. Process feels stalled indefinitely.

The Bottom Line

Fundraising momentum has a 90-120 day optimal window before investor interest deteriorates. First 30 days establish legitimacy, days 31-60 generate competitive tension, days 61-90 convert to term sheets, and beyond 120 days signals stalling.

Extended timelines create skepticism spiral where investors assume others have passed for good reasons. Compress timelines through organized outreach, decisive execution, and creating genuine competitive dynamics. Velocity signals quality, slow fundraising breeds doubt.

SheetVenture helps founders maintain fundraising momentum, so investor interest converts to term sheets before momentum decays.