What Causes Investors to Stop Asking Follow-Up Questions?

Investors stop asking questions when answers reveal fundamental flaws, founders show uncoachability, or competitive/business model issues emerge. Learn the signals.

Investors stop asking follow-up questions when they've mentally categorized the deal as a pass: answers reveal fundamental flaws they can't overlook, founder responses demonstrate lack of coachability or self-awareness, competitive analysis uncovers insurmountable challenges, business model issues emerge that cap returns below venture scale, or pattern-matching triggers red flags from past failed investments.

Engaged questioning signals genuine interest; silence or surface-level conversation signals disengagement. Understanding what kills investor curiosity helps founders recognize when deals are dying and why.

Why Question Flow Matters

Understanding what stops investor engagement explains deal momentum loss:

What active questioning signals:

Genuine interest in the opportunity

Investor seeing path to yes

Due diligence mindset activated

Mental model building in progress

Deal moving toward partner discussion

What questioning cessation reveals:

Mental pass decision already made

No path to yes visible anymore

Due diligence effort not worthwhile

Courtesy conversation mode activated

Deal effectively dead internally

For deeper context, understand what causes investors to disengage mid-pitch.

Engagement vs Disengagement Indicators

Signal Type | Active Engagement | Disengagement | What It Reveals |

|---|---|---|---|

Question depth | Increasingly specific, drilling deeper | Surface-level only, no follow-ups | Whether investor is building conviction |

Question type | "How" and "why" questions | Polite but generic questions | If they're evaluating seriously |

Follow-up pattern | Each answer spawns more questions | Answers met with silence or topic change | Whether they see potential |

Meeting energy | Investor leaning in, taking notes | Polite but checking time | Level of genuine interest |

Next steps | Specific asks for data, next meeting | Vague "we'll be in touch" | If deal is progressing |

The pattern: Questions indicate interest, silence indicates disengagement.

The Five Question-Killing Triggers

1. Answers Reveal Fundamental Flaws

Responses expose dealbreakers they can't overlook:

What triggers this: Unit economics that will never work at scale, market size too small for venture returns, competitive moat non-existent, regulatory risks too high, technical feasibility questionable.

Why questions stop: Further digging won't change the fundamental issue, investor has seen enough to pass, no amount of traction fixes the core problem.

What investors do: Shift to polite conversation mode, ask surface-level questions only, start wrapping up meeting.

Why it matters: Some flaws are immediately disqualifying regardless of other strengths.

2. Founder Responses Demonstrate Lack of Coachability

Defensiveness or arrogance kills engagement:

What triggers this: Founder gets defensive when challenged, dismisses competitor strengths, can't acknowledge weaknesses, arrogant about market understanding, unwilling to consider alternative perspectives.

Why questions stop: Investors won't partner with unteachable founders, further conversation won't change assessment, pattern indicates future difficulties working together.

What investors notice: "This founder won't listen to input" or "Too defensive to be coachable."

Red flag: Investor body language shifts from engaged to distant after defensive responses.

Learn how investors judge if founders are coachable.

3. Competitive Analysis Uncovers Insurmountable Challenges

Market realities make success improbable:

What triggers this: Well-funded competitor launching similar product, incumbent has obvious path to replicate, market consolidating around established players, switching costs too high for customers.

Why questions stop: Competitive dynamics make investment too risky, no clear path to winning against better-positioned players, investor doesn't see differentiation that matters.

What investors think: "Why would we bet on this when [competitor] exists?"

The insight: Sometimes competition isn't just a challenge, it's a complete blocker.

4. Business Model Issues Cap Returns Below Venture Scale

Economics don't support venture outcomes:

What triggers this: Low margins can't support venture growth rates, customer acquisition costs too high relative to lifetime value, market growth too slow for required returns, capital intensity prevents profitability.

Why questions stop: Math doesn't work for venture returns, further digging won't change unit economics reality, better to pass quickly than waste time.

What investors calculate: "Even if they succeed, returns won't justify our fund model."

Deal-killer: Venture requires specific return profiles, below that threshold means automatic pass.

Check common mistakes founders make when raising startup capital.

5. Pattern-Matching Triggers Red Flags

Experience recognizes failure patterns:

What triggers this: Deal structure resembles past failures, founder behavior matches previous problem investments, market dynamics mirror categories that never worked, go-to-market approach consistently fails.

Why questions stop: Pattern recognition creates strong conviction to pass, investor has seen this movie before and knows the ending, asking more questions won't change outcome.

What investors remember: "This feels exactly like [failed company]."

The instinct: Sometimes gut feel based on pattern-matching overrides all other factors.

Question Flow Patterns Over Meetings

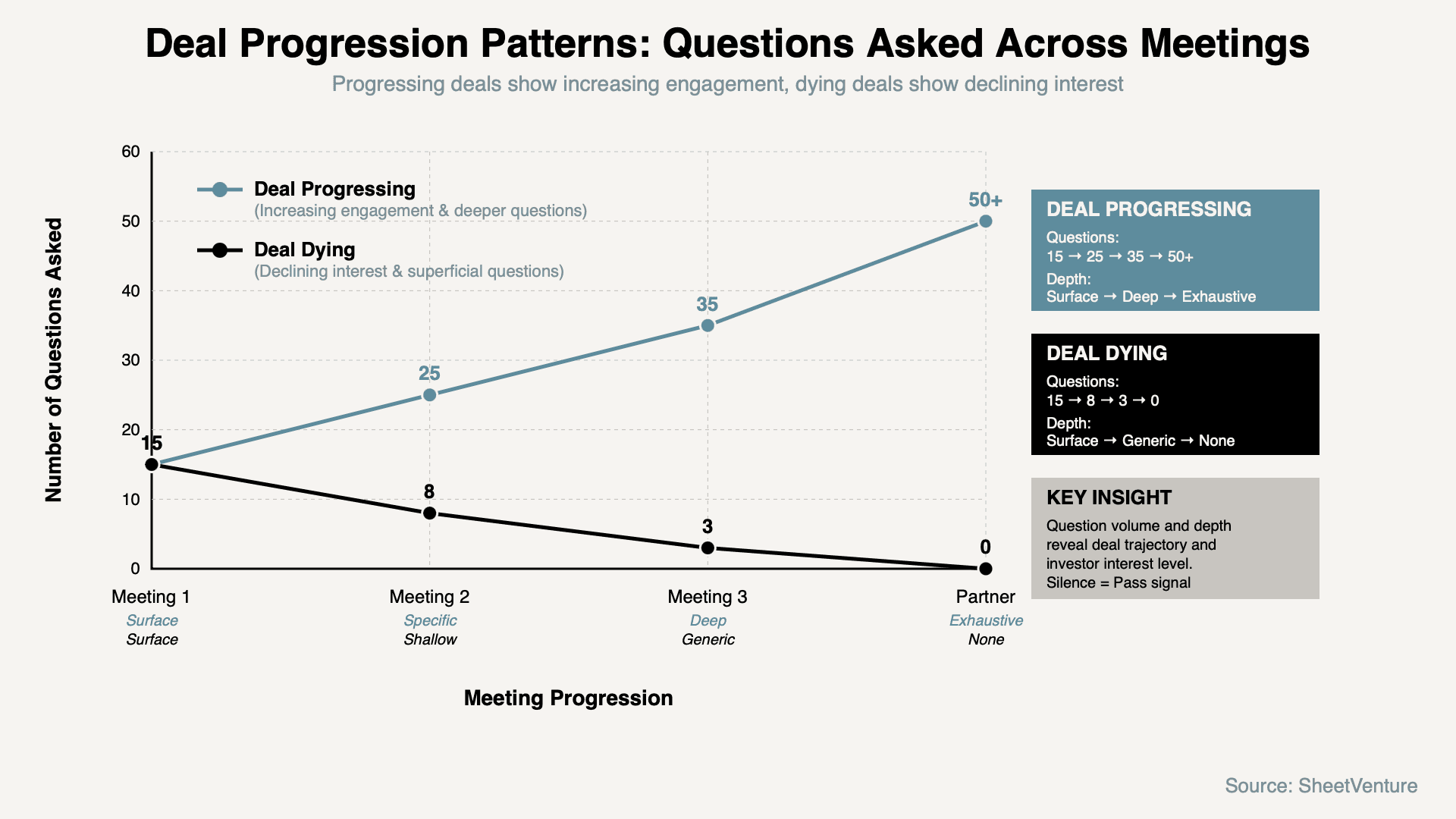

Below is how question engagement evolves across different scenarios:

The pattern: Question volume and depth indicate deal trajectory. Progressing deals see increasing questions and deeper engagement across meetings. Dying deals show declining questions and surface-level conversation.

Questions That Expose Why Investors Stopped Asking

Founders can probe to understand disengagement:

"What aspects would you like to explore deeper?"

"What concerns should I address?"

"Are there specific areas where you need more clarity?"

"What would you need to see to move forward?"

Why these work: Direct questions force investors to either re-engage or reveal their concerns.

Check SheetVenture's resources for frameworks on reading investor engagement signals.

How to Restart Question Flow

If questions stop mid-meeting:

Address the elephant in the room directly, ask what concerns emerged, provide new information that reframes the issue, acknowledge the challenge and explain mitigation, shift to different angle that might spark interest.

When it works: Investor realized they had wrong mental model and new information changes assessment.

When it doesn't: Fundamental flaw exists that no reframing fixes.

The principle: Sometimes you can resurrect interest, but often disengagement is permanent.

Use SheetVenture's intelligence to identify investors whose thesis aligns with your strengths.

The Bottom Line

Investors stop asking follow-up questions when they've mentally categorized the deal as a pass. Answers reveal fundamental flaws they can't overlook, founder responses demonstrate lack of coachability, competitive analysis uncovers insurmountable challenges, business model issues cap returns below venture scale, or pattern-matching triggers red flags.

Engaged questioning signals genuine interest; silence or surface-level conversation signals disengagement. Question volume and depth indicate deal trajectory. Recognize when curiosity dies and understand why rather than chasing dead deals.

SheetVenture helps founders recognize investor engagement signals, so you focus energy on deals with real momentum, not dead conversations.