What Does Investor Interest Without Follow-Up Actually Mean?

Investor interest without follow-up usually signals polite rejection. Learn to decode signals and identify genuine investment intent versus politeness.

Investor interest without follow-up typically signals polite rejection, deprioritization, or "soft pass" not genuine investment intent.

When investors express enthusiasm during meetings but don't initiate next steps within 48-72 hours, the interest was likely surface-level. VCs meet hundreds of founders yearly and have developed diplomatic ways to end conversations without explicit rejection.

Genuine interest produces immediate action: follow-up emails, introduction requests, and scheduled next meetings. Silence after expressed interest is the most common form of investor "no."

Why Interest Without Action Happens

Understanding investor behavior explains the gap:

What investors are thinking:

"Interesting but not compelling enough to prioritize"

"Good founder, wrong timing for our fund"

"Let me see how this develops before committing time"

"Polite exit without burning the relationship"

Why they don't say no directly:

Preserving optionality if company improves

Avoiding uncomfortable conversations

Maintaining reputation as founder-friendly

Uncertainty about their own conviction

For deeper insight, understand how investors distinguish real interest from polite interest.

The Interest-to-Action Spectrum

Interest Level | What They Say | What They Do | What It Means |

|---|---|---|---|

High interest | "This is exciting, let's move fast" | Follow-up within 24 hours, schedules next meeting | Genuine pursuit |

Moderate interest | "Very interesting, let me think about it" | Follow-up within 1 week, requests materials | Worth watching |

Low interest | "Love what you're building" | No follow-up, vague responses to your outreach | Polite pass |

No interest | "Not a fit right now" | Explicit pass, no further engagement | Clear rejection |

The pattern: Genuine interest creates immediate, concrete action. Everything else is noise.

Decoding Common "Interest" Signals

Positive Words, No Action

What founders hear: "This is really exciting", "Love the team", "Great market opportunity".

What it often means: Standard meeting politeness, not investment intent.

Reality check: VCs compliment most founders. Compliments without calendar invites mean nothing.

Request for Updates

What founders hear: "Keep me posted on your progress".

What it often means: "I'm passing but want optionality if you succeed".

Better interpretation: You're on a watchlist, not an investment list.

Introduction to Junior Team

What founders hear: "Let me connect you with our associate".

What it often means: Delegating to decline, or genuine diligence, context matters.

How to tell: Did the partner stay engaged, or hand off entirely?

"We're Interested But..."

What founders hear: "We're interested but need to see more traction/revenue/customers".

What it often means: Soft pass with face-saving excuse for both parties.

Translation: "Not interested enough to invest now, might reconsider if metrics dramatically improve".

What Genuine Interest Looks Like

Concrete action signals:

Follow-up email within 24-48 hours

Specific next meeting scheduled

Requests for data room access

Partner introduction (not just associate)

Reference calls initiated

Term sheet discussion timeline mentioned

Urgency signals:

"When are you closing?"

"Who else are you talking to?"

"Can we meet again this week?"

"I want to bring you to our partner meeting"

Learn how to build investor relationships that generate genuine follow-through.

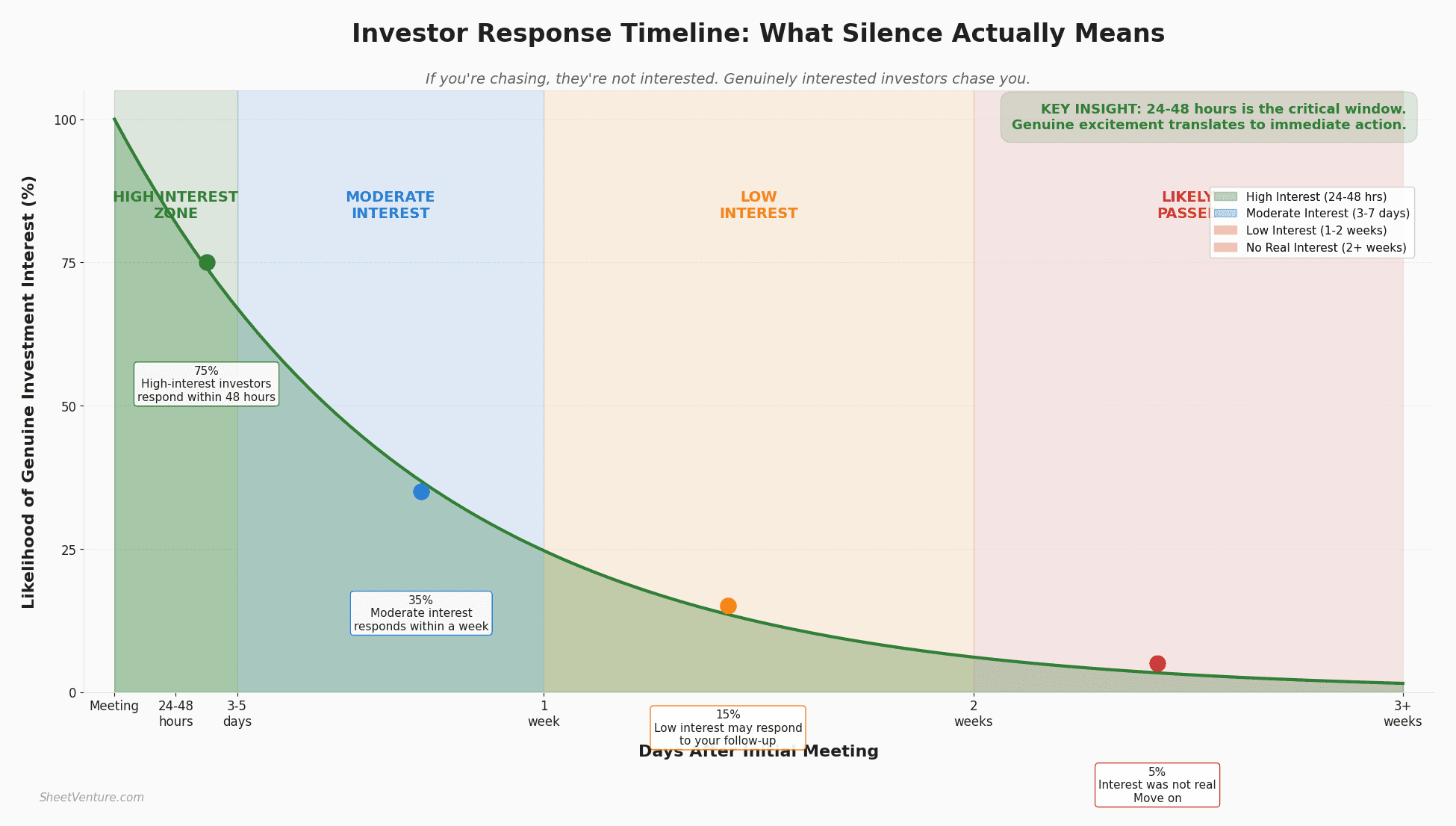

The Follow-Up Timeline Reality

24-48 hours: High-interest investors respond. Genuine excitement translates to immediate action.

3-7 days: Moderate interest or busy investors respond. Still potentially real, but lower priority.

1-2 weeks: Low interest. May respond to your follow-up but likely not moving forward.

2+ weeks: Interest was not real. Move on.

Key insight: If you're chasing, they're not interested. Genuinely interested investors chase you.

How to Test Whether Interest Is Real

Direct approach: "What would be the next step from here?"

Timeline question: "What's your typical process from here to decision?"

Commitment test: "Would it be helpful to schedule our next conversation now?"

Reality check: If they deflect all three, interest isn't real.

Check SheetVenture's resources for frameworks on evaluating investor engagement quality.

What to Do With "Interested" But Silent Investors

One follow-up: Send within 1 week with specific update.

Read the response: Quick substantive reply = some interest; delayed/vague = moving on.

Don't chase: More than 2 follow-ups without response = passed.

Keep door open: Add to update list for future.

Use SheetVenture's intelligence to identify investors with responsive engagement patterns.

The Bottom Line

Investor interest without follow-up usually means polite rejection, not genuine intent. Real interest produces immediate action: follow-up emails within 24-48 hours, scheduled next meetings, and concrete process steps.

Words like "exciting" and "love it" mean nothing without calendar invites. Test interest with direct questions about next steps. If you're chasing, they're not interested. Focus energy on investors whose actions match their words.

Actions reveal interest. Words alone are just politeness.

SheetVenture helps founders interpret investor signals, so you know which interest is worth pursuing.