What Is the Difference Between Startup Progress and Acceleration for VCs?

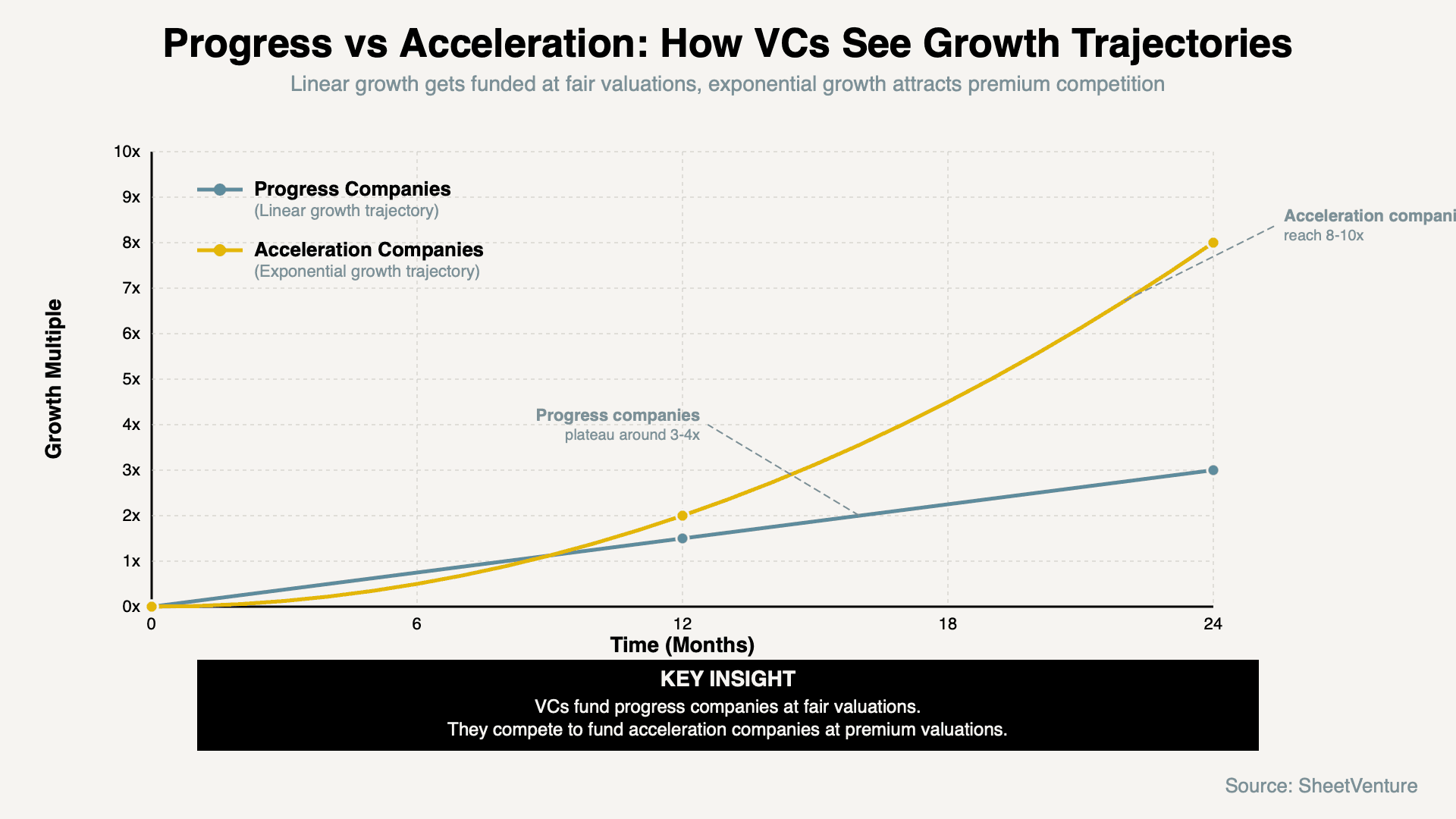

VCs distinguish linear progress from compounding acceleration. Acceleration shows growth rate increasing, competitive advantages strengthening, and efficiency improving with scale.

VCs distinguish progress (linear improvement) from acceleration (compounding growth): progress shows consistent execution hitting milestones, acceleration demonstrates growth rate itself increasing, competitive advantages strengthening, efficiency improving with scale, and market position compounding.

Progress validates you can execute; acceleration proves you're capturing increasing market share with improving economics. Understanding this distinction helps founders recognize when they've achieved funding inflection points versus simply hitting operational targets.

Why the Distinction Matters

Understanding progress versus acceleration explains different investor responses:

What progress signals:

Competent execution capability

Team delivers on commitments

Business fundamentals functioning

Metrics moving in right direction

Operational maturity developing

What acceleration signals:

Competitive position strengthening

Growth rate increasing not just growing

Unit economics improving with scale

Market momentum building exponentially

Winner dynamics emerging

For deeper context, understand how investors evaluate startups at pre-seed stages.

Progress vs Acceleration Framework

Dimension | Progress Pattern | Acceleration Pattern | What VCs Conclude |

|---|---|---|---|

Growth rate | Steady 15% MoM consistently | 10% → 15% → 22% → 30% MoM | Acceleration = compounding opportunity |

Customer acquisition | Adding customers at constant rate | Customer acquisition rate itself increasing | Acceleration = market pull strengthening |

Competitive position | Maintaining market share | Gaining share from competitors | Acceleration = winning dynamics |

Unit economics | Stable CAC and LTV | CAC declining, LTV expanding | Acceleration = economies of scale |

Team capability | Executing planned roadmap | Executing faster than planned | Acceleration = operational leverage |

The pattern: Progress is linear; acceleration is exponential.

The Five Acceleration Indicators

1. Growth Rate Increasing Not Just Growing

The rate of growth itself accelerates:

Progress indicator: 15% MoM growth consistently for 12 months, predictable linear trajectory, hitting targets reliably.

Acceleration indicator: Growth rate increasing from 10% → 15% → 20% → 25% MoM, trajectory bending upward, exceeding conservative projections.

Why it matters: Consistent growth is good; accelerating growth suggests exponential potential and winner-take-most dynamics.

Investor thinking: "This isn't just a good business, this could be a breakout"

What triggers acceleration: Product-market fit deepening, network effects kicking in, brand recognition building, viral loops activating.

2. Competitive Advantages Strengthening

Market position compounds over time:

Progress indicator: Maintaining competitive parity, defending market share, keeping up with competitors.

Acceleration indicator: Taking share from competitors, widening competitive gaps, building moats that strengthen, competitors struggling to respond.

Why it matters: Progress maintains position; acceleration creates separation that compounds into dominance.

Investor thinking: "They're not just competing, they're pulling away from the pack"

What triggers acceleration: Network effects materializing, data advantages accumulating, brand becoming category defining, switching costs increasing.

Learn how investors assess startup defensibility.

3. Efficiency Improving with Scale

Unit economics get better as you grow:

Progress indicator: Maintaining unit economics as you scale, CAC and LTV stable, margins consistent.

Acceleration indicator: CAC decreasing 20-30% annually, LTV expanding through retention and upsells, gross margins improving, operational efficiency increasing.

Why it matters: Stable economics prove business works; improving economics prove advantages compound with scale.

Investor thinking: "Not only are they growing, they're getting more efficient as they grow"

What triggers acceleration: Economies of scale kicking in, brand reducing CAC, customer success improving LTV, operational leverage increasing.

4. Market Position Compounding

Success creates more success automatically:

Progress indicator: Each customer acquired through same effort, linear relationship between input and output.

Acceleration indicator: Each customer making next customer easier to acquire, referrals accelerating, inbound growing faster than outbound, marketplace liquidity improving.

Why it matters: Linear growth requires constant fuel; compounding growth becomes self-sustaining.

Investor thinking: "This is starting to take on a life of its own"

What triggers acceleration: Network effects, word-of-mouth, community building, two-sided marketplace dynamics.

5. Execution Velocity Increasing

Team ships faster over time not just consistently:

Progress indicator: Consistent sprint velocity, predictable release cadence, meeting roadmap commitments.

Acceleration indicator: Sprint velocity increasing, shipping faster than before, roadmap accelerating, hiring multiplying output more than linearly.

Why it matters: Consistent execution is table stakes; accelerating execution creates compounding competitive advantage.

Investor thinking: "Not only do they execute, they're getting faster at executing"

What triggers acceleration: Team gel improving, systems/processes leveraging, technical debt under control, talent quality upgrading.

Check what tells investors founders can hire strong executives later.

This demonstrates how acceleration companies diverge dramatically from progress companies over time, justifying higher valuations and investor urgency.

When Progress Becomes Acceleration

Inflection point signals:

Three consecutive months of increasing growth rate, CAC declining while volume increasing, organic acquisition outpacing paid, customer acquisition rate itself accelerating, team productivity per person increasing.

Why timing matters: Recognizing acceleration early allows founders to capitalize through aggressive fundraising, hiring, and market capture.

Investor behavior shift: Progress companies get evaluated carefully; acceleration companies create competitive term sheets.

How VCs Respond Differently

To progress companies:

Measured diligence process, valuation tied to current metrics, terms reflect risk still present, capital deployment conservative, follow-on dependent on continued hitting targets.

To acceleration companies:

Expedited diligence to not lose deal, valuation reflects trajectory not just current state, aggressive terms to win competitive process, larger checks to capture opportunity, proactive about follow-on funding.

Why responses differ: Progress companies are fundable; acceleration companies are must-win opportunities.

Demonstrating Acceleration to Investors

How to show acceleration:

Present growth rate trends not just growth, show improving unit economics trajectory, demonstrate competitive position strengthening, highlight efficiency gains with scale, prove execution velocity increasing.

Presentation approach: Lead with trajectory not snapshot, show what's improving not just working, connect improvements to compounding advantages.

Red flags: Only showing absolute metrics, can't demonstrate rate of change, metrics improving but not accelerating, trajectory is linear not exponential.

Use SheetVenture's intelligence to identify investors who recognize and fund acceleration early.

Progress vs Acceleration Decision Matrix

Your Situation | VC Response | Recommended Action |

|---|---|---|

Strong progress, no acceleration | Standard process, fair valuation | Continue executing, find acceleration triggers |

Weak progress, no acceleration | Extended diligence or pass | Fix fundamentals before fundraising |

Strong progress, early acceleration | Increased interest, competitive terms | Fundraise now, capitalize on momentum |

Strong progress, clear acceleration | Competitive process, premium valuation | Create urgency, multiple simultaneous processes |

Inconsistent progress | Skepticism dominates | Build consistency before pitching acceleration |

The framework: Match fundraising strategy to where you are on progress-acceleration spectrum.

The Bottom Line

VCs distinguish progress (linear improvement) from acceleration (compounding growth). Progress shows consistent execution hitting milestones; acceleration demonstrates growth rate itself increasing, competitive advantages strengthening, efficiency improving with scale, and market position compounding.

Progress validates execution capability; acceleration proves winner dynamics emerging. Demonstrate acceleration through growth rate trends, improving unit economics trajectories, competitive position strengthening, and efficiency gains with scale. VCs fund progress companies at fair valuations and compete to fund acceleration companies at premiums.

SheetVenture helps founders identify and demonstrate acceleration signals, o investors see compounding opportunities, not just linear execution.