What Makes Certain Months Better for Closing Deals Than Others?

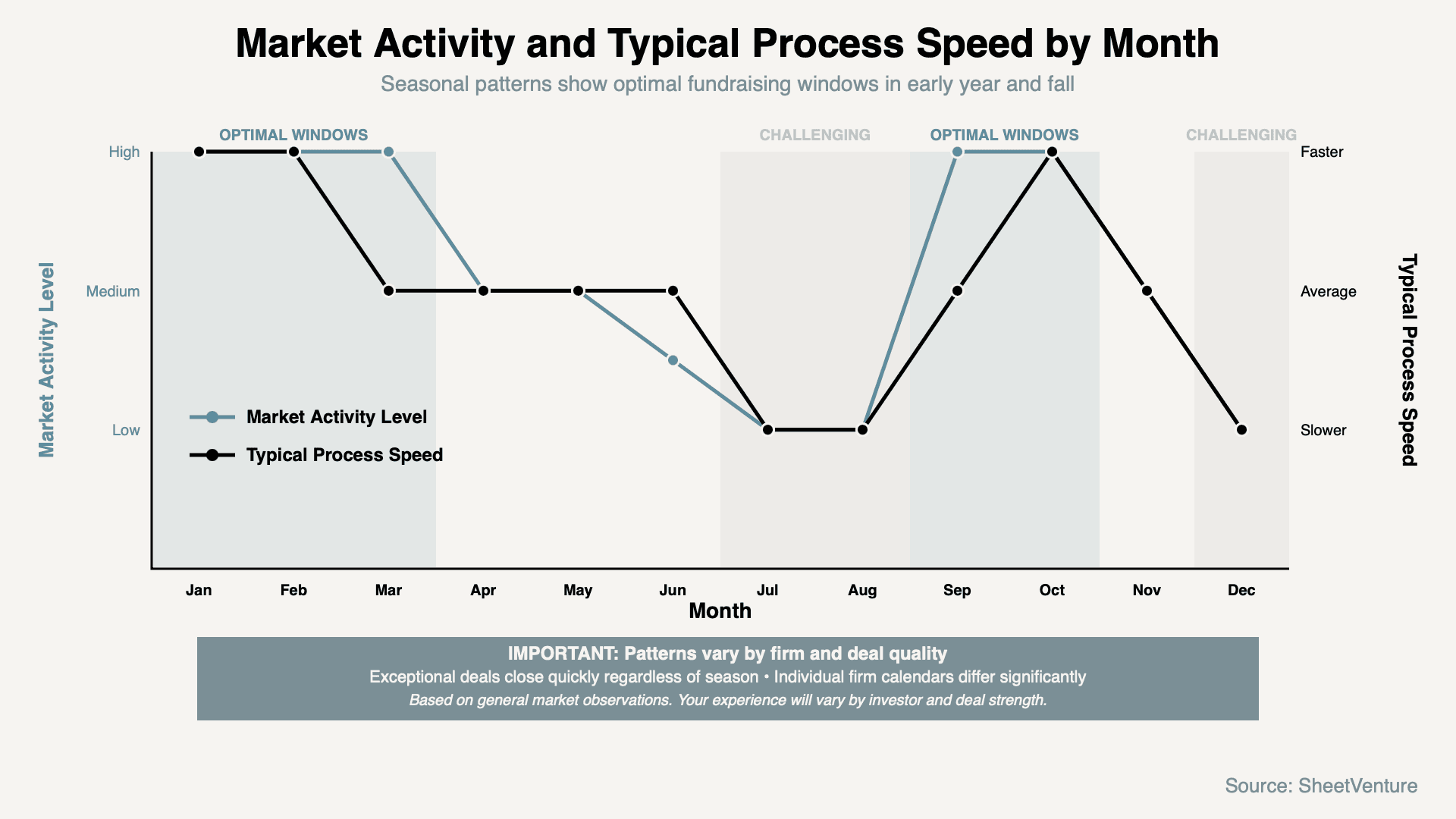

Seasonal patterns affect fundraising: January-February and September-October typically stronger, summer and holidays slower. Deal quality matters most though.

Five factors make certain months better for closing deals: VC fund deployment cycles creating Q4 and Q1 urgency, partner availability during non-vacation periods, competitive market dynamics during peak fundraising seasons, fiscal year-end considerations, and conference schedule clustering.

Deal velocity fluctuates predictably throughout the year based on investor calendars and market patterns. Understanding seasonal trends helps founders time outreach strategically, though exceptional deals close quickly regardless of month.

Why Seasonal Timing Matters

Understanding how calendar affects deal velocity explains fundraising patterns:

What optimal timing enables:

Higher partner availability for meetings

Competitive dynamics from active markets

Fund deployment urgency creating pressure

Faster response times and decisions

Multiple parallel processes possible

What challenging timing creates:

Extended processes from partner vacations

Slower decisions from quiet markets

Holiday interruptions breaking momentum

Reduced competitive pressure

Longer gaps between meeting stages

For deeper context, understand how long fundraising really takes in different contexts.

The Five Seasonal Factors

1. VC Fund Deployment Cycles

Quarterly and annual patterns create urgency variations:

Q4 (October-December): Many funds push to deploy capital before year-end. Annual investment targets create deadline motivation. Portfolio construction goals drive urgency. Year-end reporting encourages closing pending deals.

Q1 (January-March): Fresh annual budgets activate. New year momentum from Q4 carries forward. Partners return from holidays with renewed energy. Full-year deployment planning begins.

Q2-Q3 (April-September): Mid-year typically slower except September. Less quarterly deadline pressure. Budget assessments may pause deployment. Summer vacations fragment decision-making.

Why it matters: Aligning with fund urgency periods can accelerate processes, though strong deals override these patterns.

Reality check: Fund deployment timing varies significantly by firm. Not all VCs operate on calendar-year cycles.

2. Partner Availability Patterns

Vacation schedules impact decision-making speed:

Typically higher availability: January through May, September through mid-November. Most partners in office regularly. Full team available for partner meetings. Sustained decision-making momentum.

Typically lower availability: June through August (summer), late December (holidays). Partners taking staggered vacations. Family obligations increase. Partner meetings harder to schedule.

Why it matters: Missing one decision-maker can delay processes by weeks. Serial unavailability extends timelines significantly.

Important caveat: Top-tier VCs often work through summers for hot deals. Availability patterns vary dramatically by firm culture.

Learn about the best time of year to raise funds.

3. Competitive Market Dynamics

Deal flow seasonality creates different environments:

Peak fundraising seasons: January through March, September through October. Many startups actively fundraising simultaneously. Competitive dynamics benefit founders. VCs experience deal flow surges.

Quieter periods: July through August, December. Fewer companies actively raising. Less competitive pressure on investors. Risk of appearing isolated if only active deal.

Why it matters: Competition creates urgency and FOMO. Being one of few deals reduces leverage but may get more attention.

The tradeoff: Peak seasons mean more competition for initial meetings but better terms when you secure interest.

4. Conference and Event Clustering

Industry events affect investor availability and mindset:

Major conference periods: January (CES), March (SXSW), May (multiple tech conferences), September (TechCrunch Disrupt). Partners traveling for events. Networking opportunities increase. Decision-making pauses during travel.

Why it matters: Conferences can either accelerate (if you're present) or delay (if you're not) deal momentum.

Strategic consideration: Target outreach before/after major conferences rather than during them.

Check when to start fundraising based on market signals.

5. Fiscal Year-End Considerations

Budget cycles affect both VCs and their portfolio companies:

December corporate year-ends: Many B2B customers exhaust budgets. Customer buying patterns pause. January-February sees renewed purchasing. Affects startup traction momentum.

VC firm fiscal years: Many align with calendar year. Some operate on different fiscal calendars. Year-end reporting creates various pressures.

Why it matters: Strong recent traction helps fundraising. Customer buying seasonality affects when metrics look strongest.

General Seasonal Patterns Table

Period | General Pattern | Key Characteristics | Founder Considerations |

|---|---|---|---|

January-February | Typically stronger | Fresh budgets, high energy, Q1 momentum | Often cited as optimal start period |

March-May | Generally active | Sustained activity, spring break may cause brief pauses | Solid months for maintaining momentum |

June-August | Often slower | Summer vacations, fragmented availability | Expect longer response times |

September-October | Typically stronger | Return from summer, Q4 urgency building | Frequently recommended timing |

November | Mixed | Strong early month, Thanksgiving slowdown | Close before holiday or wait until January |

December | Usually slower | Holiday season, year-end wrap-up | Processes often extend into new year |

Important disclaimer: These patterns represent general trends observed in the market, not guaranteed timelines. Individual firm behavior varies significantly. Deal quality and competitive dynamics matter far more than calendar timing.

Seasonal Fundraising Activity Patterns

Key disclaimer on graph: "Based on general market observations. Your experience will vary by investor and deal strength."

What Overrides Seasonal Patterns

When timing matters less:

Exceptional traction and growth rates. Highly competitive deals with multiple term sheets. Strong existing investor relationships. Strategic fit creating urgency. Follow-on rounds from current investors. Breakthrough technology or market timing.

When timing matters more:

First-time fundraisers without warm networks. Modest but fundable traction levels. Cold outreach heavy processes. Specific partner availability needed. Challenging macro environments.

The principle: Stronger your position, less calendar matters. Weaker position, timing becomes more relevant.

Reality: A great deal in August beats a mediocre deal in January.

Planning Around Seasonal Considerations

General timing principles:

Consider starting outreach September-October or January-February when planning allows. Avoid relying on December closings without buffer runway. Account for summer vacation slowdowns in timeline estimates. Build extra time for holiday period processes.

Critical caveat: Never delay fundraising due to calendar if runway is limited. Cash management trumps timing optimization.

Buffer recommendations: Add significant buffer to expected timelines regardless of season. Account for slower-than-expected partner decisions. Plan for unexpected delays at any time of year.

Use SheetVenture's intelligence to identify which specific investors remain consistently active year-round.

Reading Seasonal Signals from VCs

What VCs might say during slower periods:

"Let's reconnect after summer." "Check back in September." "Our team will be at full capacity in January." "We're focused on portfolio through [timeframe]."

Interpretation: Timing delay, not necessarily rejection. Opportunity to build additional traction. Maintain relationship with periodic updates. Re-engage when they indicate readiness.

What suggests genuine interest regardless of timing:

-"Can we move quickly on this?"

-"What's your timeline for closing?"

-"Who else are you talking to?"

-"Let's schedule this week despite [vacation/holiday]."

Interpretation: Real interest overriding calendar. Competitive dynamics at play. Strong enough deal to warrant immediate attention.

Geographic Variations

International considerations:

European markets often see extended August slowdowns. Asian markets have different holiday calendars (Chinese New Year impacts February). Different fiscal year patterns globally. Regional vacation cultures vary significantly.

Strategy: Research specific investor geography and cultural calendar when timing outreach.

Check SheetVenture for investor-specific activity patterns and preferences.

The Bottom Line

Five factors influence seasonal deal velocity: fund deployment cycles, partner availability, competitive market dynamics, conference schedules, and fiscal considerations. Generally, January-February and September-October see higher activity and faster processes, while summer months and December often see slowdowns.

However, these patterns vary dramatically by firm, and exceptional deals close quickly regardless of season. Never delay necessary fundraising for timing optimization. Calendar considerations matter most for borderline deals; strong opportunities create their own urgency. Plan for longer timelines during vacation periods but prioritize runway management over perfect timing.

SheetVenture tracks investor-specific activity patterns, so you understand individual firm behavior rather than relying on general seasonal assumptions.