What Makes Traction Credible to Venture Capitalists?

Credible traction shows consistent growth, retention, and logical metrics. Learn the six factors VCs use to separate real traction from vanity.

Credible traction shows consistent growth patterns, paying customers over free users, retention proving value delivery, organic acquisition alongside paid, and metrics that reconcile logically.

VCs see inflated numbers constantly, they've developed filters for separating real traction from vanity metrics. Credibility comes from coherence: numbers that tell the same story from multiple angles.

Why Credibility Matters More Than Size

Understanding investor skepticism explains the bar:

What investors know:

Metrics can be gamed or cherry-picked

Early growth often comes from unsustainable sources

Vanity metrics hide fundamental problems

Many founders present best-case interpretations

What credibility proves:

Founder understands their business deeply

Metrics reflect real customer value

Growth comes from repeatable sources

Numbers can be trusted for diligence

For deeper context, understand how investors evaluate customer traction quality.

The Six Credibility Factors

1. Consistent Growth Patterns

Steady beats spiky:

Credible: 15% MoM growth sustained over 6+ months with explainable variations.

Not credible: 100% growth one month, flat the next, with no clear explanation.

Why it matters: Consistent patterns suggest repeatable mechanics, not lucky breaks.

2. Paying Over Free

Revenue validates value:

Credible: 500 paying customers at $200/month with 90% retention.

Not credible: 50,000 free signups with 2% conversion and unknown engagement.

Why it matters: Payment proves customers value the product enough to spend money.

3. Retention Proving Value

Customers stay and expand:

Credible: 95% logo retention, 110% NRR, improving cohort curves.

Not credible: High acquisition but churn eating growth, declining engagement.

Why it matters: Retention proves product-market fit better than acquisition.

4. Organic Alongside Paid

Multiple acquisition sources:

Credible: 40% organic, 35% referral, 25% paid, diversified and trackable.

Not credible: 95% from paid ads with unknown unit economics sustainability.

Why it matters: Organic signals genuine demand beyond paid reach.

Learn how to demonstrate traction that signals fundraising readiness.

5. Logical Metric Reconciliation

Numbers tell coherent story:

Credible: Customer count × ACV = ARR. Growth rate matches cohort additions. CAC × customers ≈ marketing spend.

Not credible: Numbers don't add up when cross-checked. Metrics from different sources conflict.

Why it matters: Internal consistency proves operational grip and honest reporting.

6. Quality Over Quantity

Customer profile strength:

Credible: 20 enterprise logos with expanding contracts and referenceable champions.

Not credible: 200 small accounts with high churn and no case studies.

Why it matters: Strong customers validate market positioning and indicate scalability.

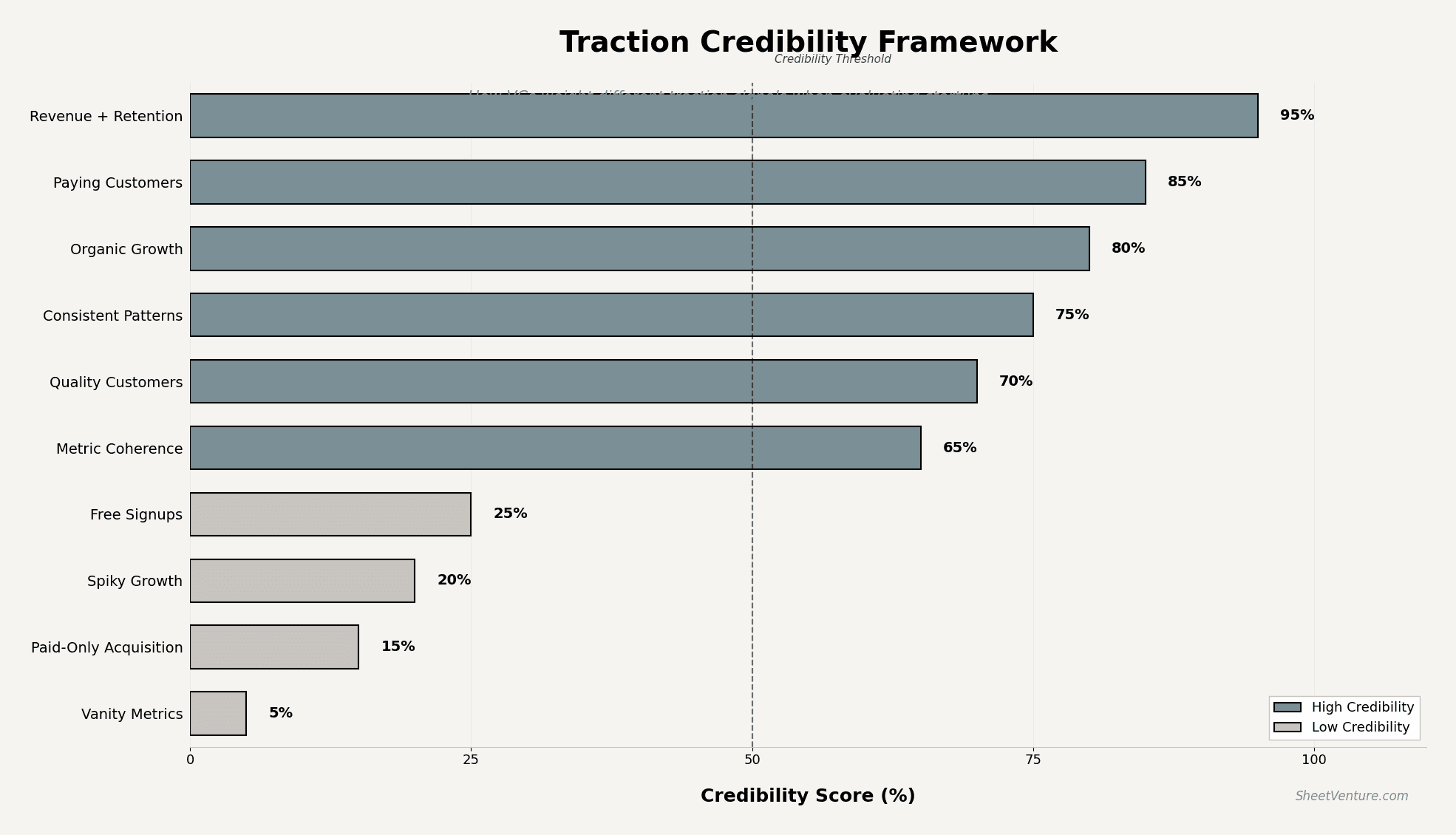

Traction Credibility Framework

[See graph below showing how different traction signals map to credibility levels]

The graph illustrates how VCs weight different traction signals. Revenue with retention scores highest; vanity metrics score lowest regardless of size.

Red Flags That Destroy Credibility

Instant credibility killers:

Metrics that change between conversations

Inability to explain growth drivers

Round numbers suggesting estimates ("about 100 customers")

Defensiveness when asked for breakdowns

Presenting GMV as revenue, signups as users

What happens: One credibility red flag makes investors question everything else.

Check SheetVenture's resources for frameworks on presenting credible metrics.

How to Build Credible Traction Narratives

Before the pitch:

Reconcile all metrics across sources

Prepare cohort-level breakdowns

Know growth drivers specifically

Document methodology for calculations

During the pitch:

Present ranges honestly ("$180-220K MRR")

Acknowledge weaknesses proactively

Show trends, not just snapshots

Offer to share raw data access

The principle: Transparency builds credibility. Spin destroys it.

Questions That Test Credibility

Expect investors to ask:

"Walk me through how you calculated that"

"Show me the cohort breakdown"

"What percentage is organic vs. paid?"

"How has this metric changed quarter over quarter?"

"Can I talk to three customers?"

Use SheetVenture's intelligence to find investors who match your traction stage.

The Bottom Line

Credible traction shows consistent growth, paying customers, strong retention, diversified acquisition, logical metric reconciliation, and quality customer profiles. VCs see inflated numbers constantly, credibility comes from coherence and transparency. Numbers should tell the same story from every angle. One inconsistency makes everything suspect. Present honestly, acknowledge gaps, and let real traction speak for itself.

Credible beats impressive. Every time.

SheetVenture helps founders present credible traction, so your metrics build trust instead of skepticism.