What Makes VCs Dismiss Founders Who Challenge Their Assumptions?

VCs dismiss founders whose challenges signal defensiveness, lack data support, reveal no self-awareness, confuse arrogance with confidence, or suggest relationship problems.

VCs dismiss challenging founders when challenges signal defensiveness rather than conviction, founders lack data to support contrarian views, challenges reveal lack of self-awareness, founders confuse arrogance with confidence, or disagreement style suggests future relationship problems.

Thoughtful pushback impresses investors; defensive arrogance repels them. The line between confident conviction and unchallengeable arrogance determines whether investors lean in or walk away.

Why This Distinction Matters

Understanding what differentiates productive challenge from dismissible defensiveness:

What productive challenge signals:

Founder has deeply considered alternatives

Conviction backed by evidence and reasoning

Open to new information while defending thesis

Self-awareness about uncertainty areas

Respectful disagreement style

What dismissible challenge signals:

Defensiveness masking insecurity

Arrogance preventing coachability

Lack of intellectual humility

Unwillingness to consider alternatives

Poor interpersonal dynamics preview

For deeper context, understand how investors judge if founders are coachable.

Productive vs Dismissible Challenge Patterns

Challenge Type | Productive Approach | Dismissible Approach | What VCs Conclude |

|---|---|---|---|

Disagreeing with market sizing | "Here's why we see it differently, with data..." | "You're wrong. We know better." | Data-backed = confidence; unsupported = arrogance |

Responding to competition concerns | "Fair point. Here's our differentiation..." | "That competitor doesn't matter." | Thoughtful = strategic; dismissive = naive |

Addressing team gaps | "We know we need X, here's our plan..." | "We don't need those roles yet." | Self-aware = coachable; denial = rigid |

Defending unconventional approach | "Most do Y, but here's why Z works for us..." | "Everyone else is doing it wrong." | Reasoned = conviction; blanket = hubris |

Reacting to financial scrutiny | "Let me explain our assumptions..." | "These numbers are solid, trust us." | Transparent = partnership; defensive = trouble |

The pattern: Productive challenge invites dialogue; dismissible challenge shuts down conversation.

The Five Challenge Types That Trigger Dismissal

1. Defensiveness Masking Insecurity

Emotional reaction to legitimate questions:

What triggers dismissal: Founder gets visibly defensive. Tone becomes hostile. Body language closes off. Treats questions as personal attacks.

Why VCs dismiss: Signals founder can't handle pressure. Predicts difficult board member. Shows poor crisis response capability.

What founders say: "You clearly don't understand our business", "That's not how this works", "You're missing the point"

Productive alternative: "That's a fair concern. Let me explain our thinking and hear your perspective"

Investor thinking: "If they react this way to a question, imagine them during crisis"

2. Arrogance Preventing Coachability

Founder knows everything, investors know nothing:

What triggers dismissal: Dismissing all investor input. Claiming unique insight no one else has. Treating experience as irrelevant. Assuming all skepticism is lack of vision.

Why VCs dismiss: Arrogant founders don't learn. Don't improve. Don't build strong teams. Create toxic cultures.

What founders say: "You VCs all think the same way" "This is why founders ignore VCs" "We've thought about this more than anyone"

Productive alternative: "We've reached a different conclusion. Happy to walk through our reasoning and hear your experience"

Investor thinking: "This founder won't listen to customers, employees, or board. Pass."

Learn what behaviors signal strong founders during conversations.

3. Lack of Data Supporting Contrarian Views

Opinion presented as fact without evidence:

What triggers dismissal: Bold claims without supporting data. Dismissing concerns without counter-evidence. Relying on "trust me" when asked for proof.

Why VCs dismiss: Conviction without evidence suggests lack of rigor. Inability to prove contrarian thesis means it's likely wrong.

What founders say: "We just know the market is bigger", "Our approach will obviously work better", "Everyone agrees with us"

Productive alternative: "Here's the data showing why we believe this. What would convince you?"

Investor thinking: "Confidence without evidence is delusion, not vision."

4. Lack of Self-Awareness About Weaknesses

Refusing to acknowledge obvious gaps:

What triggers dismissal: Claiming no weaknesses exist. Dismissing all risks as irrelevant. Refusing to acknowledge uncertainty. Unable to articulate what could go wrong.

Why VCs dismiss: Founders without self-awareness can't course-correct. Don't build complementary teams. Fail to mitigate risks.

What founders say: "We've thought of everything", "There's no real risk here", "We don't have any weaknesses".

Productive alternative: "Here are the three biggest risks we see and how we're mitigating them. What concerns you most?"

Investor thinking: "Every company has risks. Founders who can't see them are dangerous."

5. Disagreement Style Suggesting Future Problems

How founders challenge predicts working relationship:

What triggers dismissal: Combative tone. Condescending explanations. Refusal to find common ground. Making it personal rather than substantive.

Why VCs dismiss: Relationship lasts years through hard times. Difficult founders make board meetings miserable. Style predicts how they'll treat employees.

What founders display: Eye rolling. Interrupting. Raised voice. Sarcastic tone. Personal attacks.

Productive alternative: Calm, respectful disagreement. "I see your concern differently. Here's why, but I'm curious about your perspective."

Investor thinking: "Life's too short to work with people who make everything harder."

Check what causes investors to disengage mid-pitch.

The Art of Productive Challenge

How to challenge effectively:

Lead with acknowledgment: "That's a fair point"

Back with evidence: "We've tested this with X customers"

Show reasoning: "We concluded Z because of A, B, C"

Invite dialogue: "What would you need to see?"

Demonstrate humility: "We could be wrong about D"

What this demonstrates: Conviction paired with intellectual humility. Confidence backed by evidence. Openness while defending thesis.

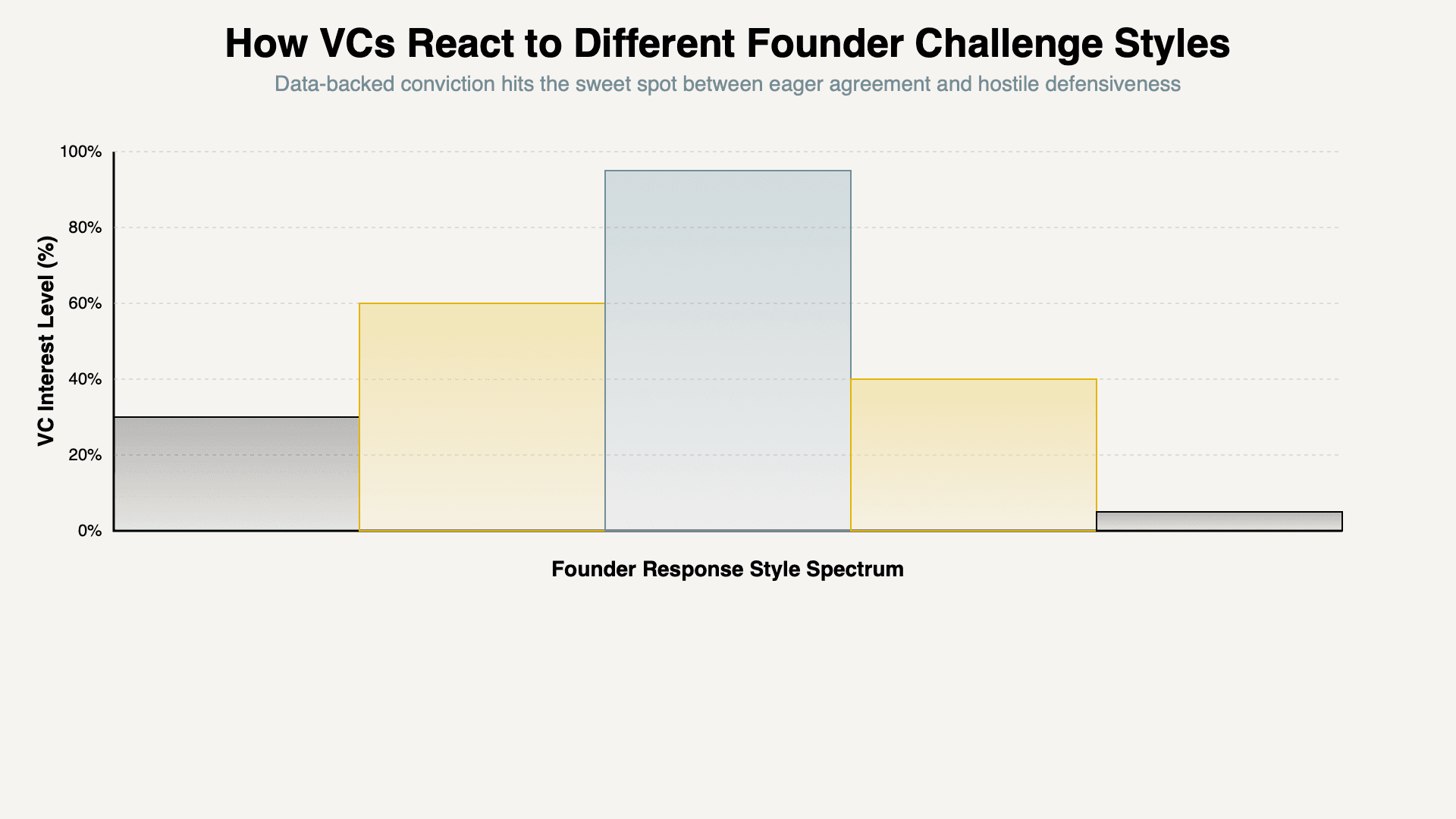

Founder Response Spectrum and VC Reaction

This shows founders that avoiding disagreement isn't the goal, disagreeing productively is.

Reading the Room During Disagreement

Signs your challenge is landing well:

Investor leaning in with interest. Asking follow-up questions. Acknowledging your points. Conversation feels collaborative.

Signs triggering dismissal:

Investor checking out or checking phone. Body language closing off. Questions becoming perfunctory. Meeting wrapping up quickly.

Course correction: "I sense this is a sticking point. Let me approach differently."

The Bottom Line

VCs dismiss challenging founders when challenges signal defensiveness, lack data support, reveal no self-awareness, confuse arrogance with confidence, or suggest relationship problems. Thoughtful pushback impresses; defensive arrogance repels.

Challenge productively by acknowledging concerns, backing views with evidence, showing self-awareness, and maintaining respect. The line between confident conviction and unchallengeable arrogance determines whether investors engage or dismiss.

SheetVenture helps founders navigate investor dynamics, so you advocate for your vision without triggering dismissal.