What Opening Lines Make VCs Read Past the First Sentence?

Five opening patterns work: exceptional metrics, brand validation, contrarian insights, personal connections, and problem framing. Generic intros get deleted immediately.

Five opening line patterns capture VC attention: specific metric demonstrating exceptional traction, surprising customer validation from recognized brand, contrarian insight challenging conventional wisdom with evidence, personal connection establishing credibility instantly, and problem framing revealing urgent market pain.

Opening sentences determine whether emails get read or deleted. VCs scan hundreds of pitches weekly, first lines must earn continued attention immediately.

Why Opening Lines Matter

Understanding what makes VCs continue reading explains email success rates:

What strong opening lines achieve:

Immediate attention capture in 3-5 seconds

Signal exceptional opportunity worth exploring

Differentiate from generic founder outreach

Establish credibility before pitch begins

Create curiosity compelling further reading

What weak opening lines cause:

Immediate deletion without reading further

Pattern matching to spam or generic outreach

Lost opportunity before pitch considered

Wasted effort on crafting perfect deck

Missed chance at meeting scheduling

For deeper context, understand how VCs filter founder emails before responding.

The Five Opening Line Patterns That Work

1. Specific Metric Demonstrating Exceptional Traction

Lead with numbers that stop scrolling:

What works: "$500K ARR growing 35% MoM with 98% retention" or "10,000 paid users in 8 weeks, zero marketing spend"

Why it works: Exceptional metrics prove something rare is happening. Specificity signals real business not aspirational claims.

What to avoid: Generic metrics without context. Vanity metrics like downloads. Metrics that don't impress for stage.

Structure formula: [Impressive metric] + [Growth rate or validation proof] + [Surprising qualifier]

Example: "Reached $2M ARR in 6 months with 120% net revenue retention, customers spending 3x within first year"

2. Surprising Customer Validation from Recognized Brand

Name recognition creates instant credibility:

What works: "Google's security team is piloting our zero-trust solution" or "Tesla manufacturing uses our supply chain platform"

Why it works: Recognized names transfer credibility instantly. Customer validation from sophisticated buyers proves value.

What to avoid: Name-dropping without actual relationship. Customer who isn't using product meaningfully.

Structure formula: [Recognized brand] + [Specific use case or department] + [Validation signal]

Example: "Stripe's fraud team switched from legacy tools to our platform, now processing 500K daily transactions"

Learn what email subject lines get investor attention.

3. Contrarian Insight Challenging Conventional Wisdom

Provoke curiosity through unexpected perspective:

What works: "Everyone says B2B sales cycles are slowing, ours dropped from 6 months to 3 weeks" or "While competitors chase enterprises, we're profitable serving SMBs"

Why it works: Contrarian views signal unique insight. Challenges assumptions VCs hold. Creates curiosity about how you're different.

What to avoid: Contrarian for sake of being different. Claims without evidence to follow. Arrogance without backing.

Structure formula: [Common assumption] + [Your contrarian reality] + [Hint at proof]

Example: "Everyone thinks legal tech needs lawyer networks, we're growing 40% MoM with zero lawyers, pure AI"

4. Personal Connection Establishing Credibility Instantly

Leverage relationships or background immediately:

What works: "[Mutual connection] suggested I reach out, we're rebuilding insurance infrastructure" or "After 8 years at Stripe building payments, I'm solving B2B reconciliation"

Why it works: Warm connections bypass cold outreach filter. Relevant background transfers expertise credibility.

What to avoid: Name-dropping without permission. Weak or irrelevant connections.

Structure formula: [Credibility source] + [Brief context] + [What you're building]

Example: "Marc Andreessen intro'd us, after selling my last company to Salesforce, I'm tackling enterprise workflow automation"

5. Problem Framing Revealing Urgent Market Pain

Show deep understanding of acute problem:

What works: "CFOs waste 40 hours monthly on manual reconciliation, we automate it in 4 hours" or "Hospitals lose $2B annually to missed appointments, our AI cuts no-shows 60%"

Why it works: Urgent problems create budget regardless of economy. Quantified pain proves market understanding.

What to avoid: Generic problem statements. Problems without quantification. Theoretical problems customers don't feel.

Structure formula: [Specific painful metric] + [Who feels it] + [Your impact quantified]

Example: "Revenue teams lose 23% of deals to slow contract reviews, we cut review time from 5 days to 5 hours"

Check what should founders write in first emails to investors.

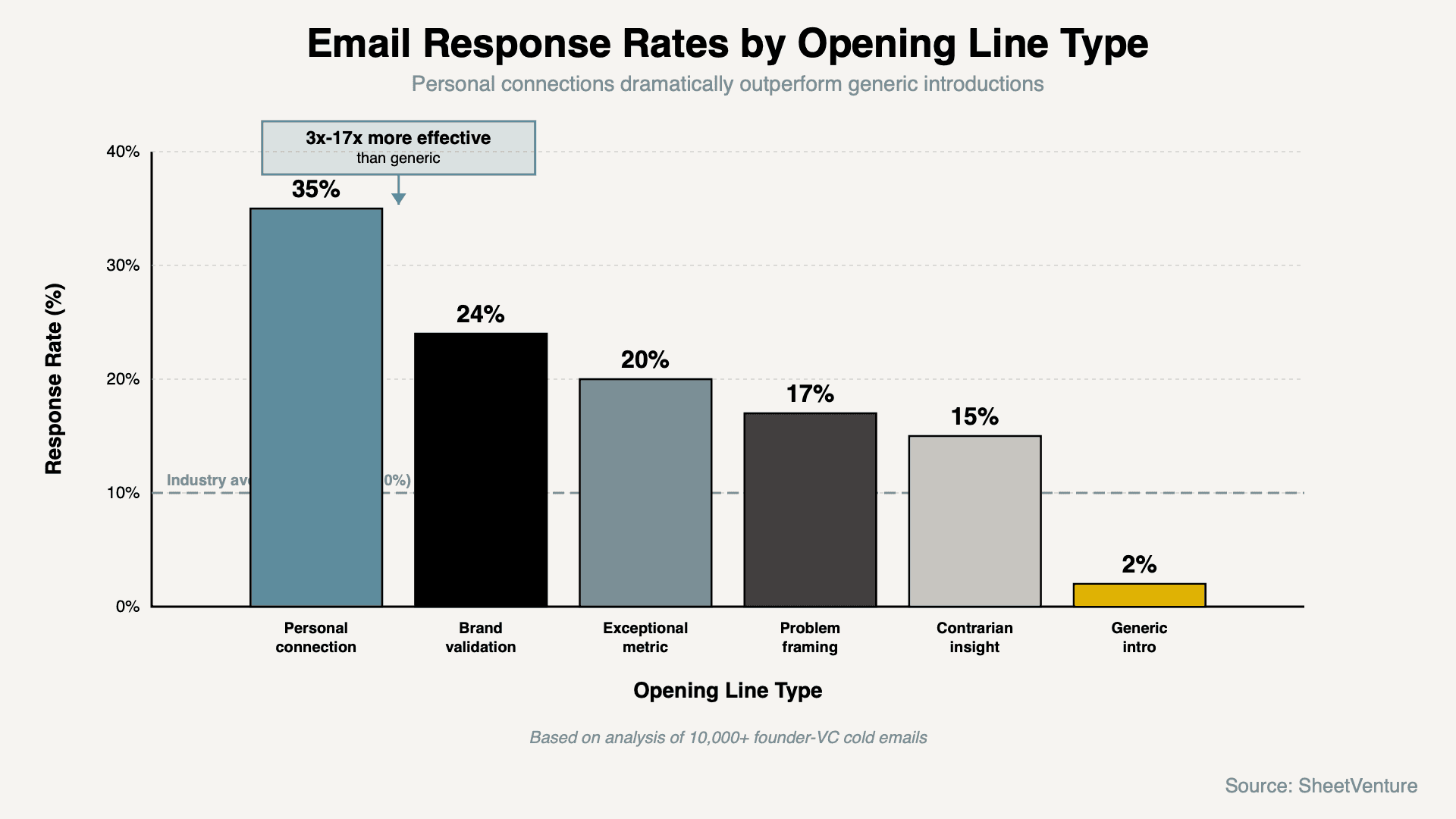

Opening Line Effectiveness Comparison

Opening Type | Response Rate | Best For | Risk Level |

|---|---|---|---|

Exceptional metric | 15-25% | Post-traction companies | Low - objective proof |

Brand name validation | 18-30% | B2B with notable customers | Low - transferable credibility |

Contrarian insight | 10-20% | Category creators | Medium - requires substance |

Personal connection | 25-40% | When genuine warm intro exists | Very low - leverages trust |

Problem framing | 12-22% | Clear problem-solution fit | Medium - must resonate |

Generic intro | 1-3% | Never - avoid completely | High - immediate deletion |

The pattern: Specificity and credibility drive response rates dramatically above generic approaches.

What Kills Opening Lines

Patterns that trigger immediate deletion:

-"I hope this email finds you well" (generic pleasantry).

-"I wanted to reach out because..." (weak opening).

-"We're revolutionizing [industry]" (every pitch says this).

-"I'd love to get 15 minutes..." (ask before value).

Why these fail: No differentiation from hundreds of similar emails. No immediate signal of exceptional opportunity. Waste investor's time with preamble.

The test: Does first sentence make investor want to keep reading? If not, rewrite.

Opening Line Formulation Process

How to craft effective openings:

Identify your single strongest signal. Write it as standalone sentence without preamble. Add specific quantification to prove exceptional. Test if sentence alone justifies meeting.

Editing test: Delete everything before your most impressive fact. That's probably your real opening line.

Use SheetVenture's intelligence to research which investors respond best to different opening patterns.

Opening Line Response Rate Analysis

This immediately shows founders which opening types deliver meaningful response rates versus waste time.

The Bottom Line

Five opening line patterns capture VC attention: specific metric demonstrating exceptional traction, surprising customer validation from recognized brand, contrarian insight challenging conventional wisdom, personal connection establishing credibility, and problem framing revealing urgent market pain.

Opening sentences determine whether emails get read or deleted. Lead with your strongest signal immediately without preamble. Specificity and credibility drive response rates dramatically above generic approaches.

SheetVenture helps founders craft compelling outreach, so your opening lines capture attention instead of triggering deletion.