How Do Founders Find VCs Who Understand Technical Complexity in Their Space?

Technically fluent VCs are found through portfolio patterns, partner backgrounds, and founder referrals. Learn six methods ranked by reliability and confidence.

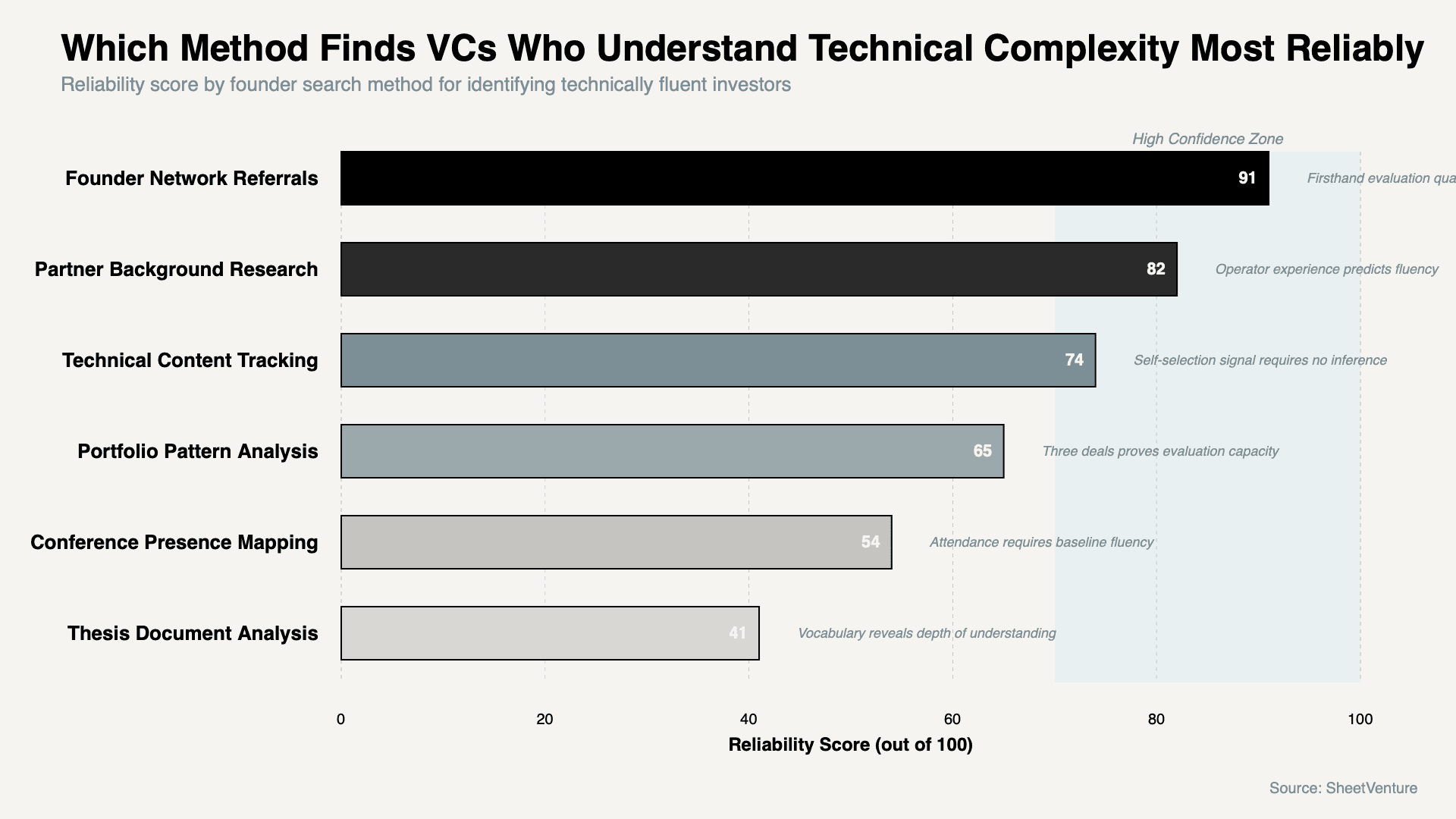

Founders find technically fluent VCs through six search methods: portfolio pattern analysis, partner background research, technical content tracking, conference presence mapping, founder network referrals, and thesis document analysis.

Generic VC outreach fails technical founders at a higher rate than any other founder type because complexity requires a partner who can evaluate without an expert intermediary. Finding the right room matters more than perfecting the pitch.

Why Technical Complexity Changes the Investor Search

What technically fluent VCs provide:

Evaluation capacity without expensive third-party expert diligence

Faster conviction because they understand the moat without translation

Credibility signals to other investors that sophisticated evaluation has happened

What technically mismatched VCs cause:

Extended timelines while sourcing outside experts to validate basic claims

Pass decisions driven by inability to evaluate rather than actual weakness

For deeper context, understand how VCs evaluate startups without clear comparables and why technical complexity amplifies that challenge.

The Six Methods That Surface Technically Fluent VCs

1. Portfolio Pattern Analysis

What this looks like: A firm with three or more portfolio companies in adjacent technical domains has already built internal evaluation capacity. Two deals is coincidence. Three is a thesis with infrastructure behind it.

What to do: Prioritize firms showing three or more technically adjacent investments above firms with better brand recognition but no relevant portfolio history.

2. Partner Background Research

What this looks like: A partner who spent years as a machine learning engineer understands ML infrastructure pitches differently than one from investment banking. Technical background guarantees the conversation happens at the right level.

What to do: Match your domain to partners with direct operator experience, not just investment experience in adjacent sectors.

Learn how to research a VC firm before your first meeting and what signals distinguish technical fluency from surface familiarity.

3. Technical Content Tracking

What this looks like: A partner publishing detailed posts on distributed systems or presenting at technical conferences has demonstrated both interest and capacity. Public technical content is a self-selection signal requiring no inference.

What to do: Follow partners producing technical content in your domain for 30 to 60 days before reaching out. Reference specific content to signal genuine fit.

4. Conference Presence Mapping

What this looks like: A partner appearing at NeurIPS or DEF CON has made a deliberate choice about attention. Technical conferences require genuine interest because the content is inaccessible without baseline fluency.

What to do: Reach out within two weeks of a relevant conference appearance while the topic is still active.

5. Founder Network Referrals

What this looks like: A founder who closed a round with a specific partner can tell you in one conversation whether that partner asked questions at the right technical level. No desk research replicates this.

What to do: Speak to at least one founder who has taken money from that partner before pitching.

6. Thesis Document Analysis

What this looks like: A firm publishing a thesis using precise technical language has different evaluation capacity than one describing the same space in business outcome language only.

What to do: Read for technical specificity, not just sector alignment. Vague enthusiasm for a technical domain is not fluency.

Which Search Method Surfaces Technically Fluent VCs Most Reliably

The chart shows how human signal sources consistently outrank desk research methods, with founder referrals and partner background sitting firmly in the high confidence zone while thesis document analysis sits lowest because polished language frequently overstates actual technical depth.

How to Qualify Technical Fluency Before the First Meeting

Qualification Method | What It Reveals | Time Required | Confidence Level |

|---|---|---|---|

Speak to a portfolio founder | Real evaluation depth at partner meeting level | 30 minutes | Very high |

Read all partner technical writing | Vocabulary precision and conceptual depth | 45 minutes | High |

Review partner career history | Operator experience predicting fluency | 15 minutes | High |

Analyze portfolio for technical adjacency | Existing evaluation infrastructure | 20 minutes | Medium-high |

Check technical conference attendance | Genuine domain interest beyond investment | 10 minutes | Medium |

Read firm thesis documents | Surface-level sector alignment only | 10 minutes | Low to medium |

The pattern: Human signal sources produce higher confidence than desk research. Founders who skip the portfolio founder call and rely only on thesis documents consistently misjudge technical fit.

Questions That Test Technical Fluency in the First Meeting

"What is the hardest technical problem you think we still have to solve?"

"Which part of our architecture creates the most defensible moat?"

"What technical hires matter most at our stage?"

Why these work: A partner responding with business outcome language to a technical question reveals their evaluation ceiling in the first five minutes.

Use active investor data to identify which firms have closed technically complex deals in your domain in the last 18 months.

How to Prioritize Technically Fluent VCs Before Outreach

Build a shortlist using portfolio pattern analysis first, then verify with partner background research

Speak to at least one founder at each target firm before sending the first email

Deprioritize firms where the thesis document uses only business language for a technical domain

The principle: Methods requiring human contact are the only ones that reveal whether the partner in the room will understand what you built.

Access SheetVenture's database to filter investors by recent deal activity in technically complex sectors so your shortlist starts with verified deployment history.

The Bottom Line

Founders find technically fluent VCs through founder network referrals, partner background research, technical content tracking, portfolio pattern analysis, conference presence mapping, and thesis document analysis in that order of reliability.

Human signal sources consistently outperform desk research because they reveal evaluation capacity directly. Build the shortlist from portfolio evidence, verify with a founder conversation, and pitch only rooms where technical complexity is already understood.

SheetVenture helps founders identify investors with verified deal history in technically complex sectors so your outreach targets fluency, not just sector overlap.