What Closing Call-to-Action Gets More VC Meeting Confirmations?

The right cold email CTA doubles VC meeting confirmations. Learn five structures that convert investor interest into confirmed calendar slots.

The closing call-to-action in a VC cold email determines whether interest converts to a calendar invite or dies in the reply draft. Five CTA structures outperform the rest: the specific time offer, the single-question close, the soft permission ask, the deadline anchor, and the value-first close. Generic asks like "would love to connect" convert at under 2%.

The right CTA structure applied to the right investor type doubles confirmation rates without changing anything else in the email.

Why Most Email CTAs Fail Before the Meeting Happens

What strong CTAs achieve:

Remove decision friction by making the next step obvious and small

Signal founder confidence without creating pressure that feels manipulative

Convert existing interest into a confirmed calendar slot

What weak CTAs cause:

Interested investors who delay responding until the moment passes

Vague replies that signal interest but never convert to confirmed time

Founder positioned as supplicant rather than someone worth meeting urgently

For deeper context, understand cold email responses and what happens after an investor decides your email is worth reading.

The Five CTA Structures That Convert

1. The Specific Time Offer

What this looks like: "I have Tuesday at 2pm or Thursday at 10am EST available this week, happy to send a calendar invite if either works." The investor makes one binary decision instead of opening their calendar and composing a reply suggesting times.

What investors do: Reply with one word confirming a slot because the decision cost is near zero.

Red flag: Offering times more than two weeks out signals no urgency and allows the conversation to cool before the meeting happens.

2. The Single-Question Close

What this looks like: "Quick question before I send the deck: are you currently looking at infrastructure plays at seed, or focused elsewhere right now?" The investor answers a low-stakes question and the conversation opens naturally toward a meeting without the founder explicitly asking for one.

What investors do: Answer the question because it requires no commitment, then engage further because the founder demonstrated thesis awareness.

Red flag: The question must be genuinely useful information, not a transparent trick. Investors recognize hollow questions immediately.

Learn what email subject lines get investor attention and how subject line decisions connect to CTA performance at the end of the same email.

3. The Soft Permission Ask

What this looks like: "Would it be worth a 15-minute call to see if there is any fit worth exploring?" The word "worth" frames the ask as a mutual evaluation rather than a pitch, and gives the investor an easy yes that feels low-risk.

What investors do: Say yes more readily because the commitment framing is bilateral and the time investment is minimal.

Red flag: Soft permission asks only work when the email body has already established enough signal to make the call feel worthwhile. Without a strong hook, soft permission reads as timid.

4. The Deadline Anchor

What this looks like: "We are scheduling first meetings for this month before the round fills. Happy to share the deck ahead of a call if timing works." The anchor must be grounded in something real: a close date, a lead investor moving, or a round structure creating genuine constraint.

What investors do: Respond faster when the cost of delay is made concrete rather than implied.

Red flag: Deadline anchors without substance get verified and dismissed within 24 hours, triggering the same polite disengagement as manufactured urgency.

5. The Value-First Close

What this looks like: "I attached a one-page market breakdown on [sector problem] that might be relevant given your investment in [portfolio company]. Happy to walk through how we fit in on a quick call." The investor receives value before being asked to give time.

What investors do: Engage with the material and respond because the interaction already has positive ROI before the meeting happens.

Red flag: The value offered must be genuinely relevant to the investor's portfolio or thesis. Generic attachments do not trigger this dynamic.

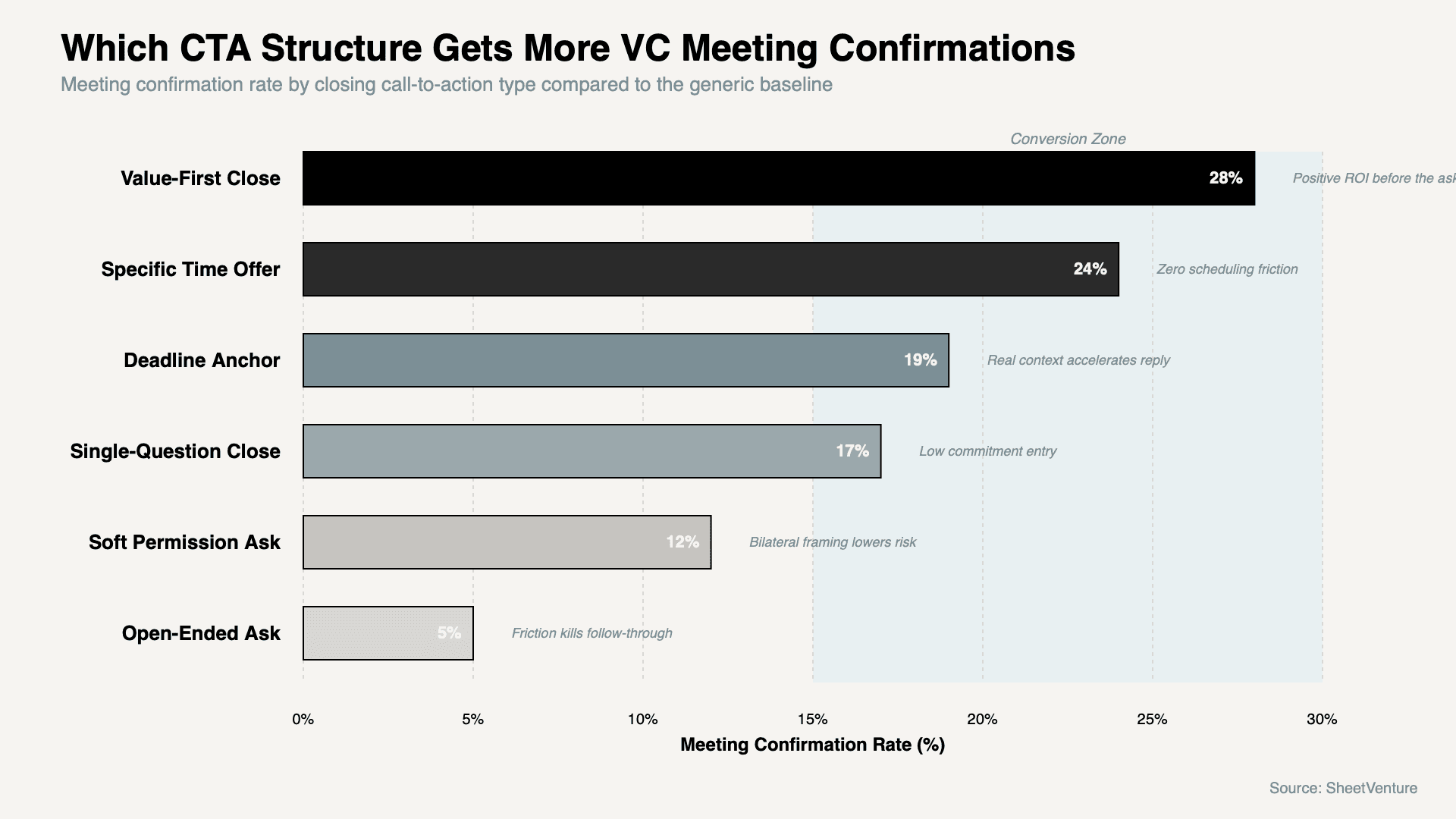

CTA Type vs Meeting Confirmation Rate

The chart shows how confirmation rates climb sharply when CTAs remove friction and lower commitment cost, while open-ended asks and missing CTAs sit far below the conversion zone regardless of how strong the email body is.

CTA Performance by Investor Type

Investor Type | Best Performing CTA | Worst Performing CTA | Why |

|---|---|---|---|

Tier-1 VC partner | Value-First Close | Deadline Anchor | Pressure signals misunderstanding of their position |

Emerging manager | Specific Time Offer | No CTA | High volume inbox needs friction removed |

Solo GP | Single-Question Close | Open-Ended Ask | Appreciates direct dialogue over formal scheduling |

Angel investor | Soft Permission Ask | Deadline Anchor | Relationship-first mindset, pressure backfires |

Micro-VC | Specific Time Offer | Value-First Close | Speed matters more than material at this tier |

Corporate VC | Value-First Close | Single-Question Close | Needs substance to justify internal meeting approval |

The pattern: No single CTA works universally. Investor type determines which friction point matters most. Founders who use one CTA for all investor types leave significant confirmation rate on the table.

Questions That Reveal Why a CTA Failed

Did the investor open but not reply? The CTA created too much decision friction.

Did the investor reply with interest but no time confirmed? The CTA was too open-ended to produce a calendar event.

Did the investor ask to reconnect later without a specific date? The deadline anchor was not credible enough to create urgency.

Did the investor forward to an associate instead of replying directly? The value offered did not match their seniority level.

Why these diagnoses matter: Each failure pattern points to a different CTA fix. Fixing the wrong element wastes the entire next batch on the same conversion problem.

Use investor intelligence to identify which investor types make up your target list before selecting the CTA structure that matches their decision behavior.

How to Test and Improve CTA Conversion Rates

Run two CTA variations simultaneously across batches of 20-25 emails and compare confirmation rates after 50 sends

Track open-to-reply rate separately from reply-to-confirmed-meeting rate to identify exactly where drop-off occurs

Match CTA type to investor tier before sending, not after analyzing failed results

Replace any CTA producing below 8% confirmation rate immediately

The principle: CTA testing is the highest-leverage edit available in outreach because it changes confirmation rates without requiring any change to company quality or narrative. A founder with average traction and the right CTA outconverts a founder with strong traction and the wrong one.

Access SheetVenture's database to segment your investor list by type before matching CTA structures, so every email closes with the approach most likely to confirm that specific investor.

The Bottom Line

The closing call-to-action determines whether investor interest converts to a confirmed meeting or disappears between reply intent and reply action. Value-first closes and specific time offers lead conversion rates because they remove friction and reframe the ask. Deadline anchors work only when grounded in reality.

Generic open-ended asks consistently underperform regardless of how strong the email body is. Test CTA structures systematically, match them to investor type, and replace anything below threshold without hesitation.

SheetVenture helps founders identify which investors are actively meeting right now so your CTA lands when the timing is already working in your favor.