What Makes VC Firms Accelerate Decisions for Competitive Deals?

VC firms accelerate decisions through competing interest, traction clarity, and timeline control. Learn five conditions that compress standard evaluation timelines.

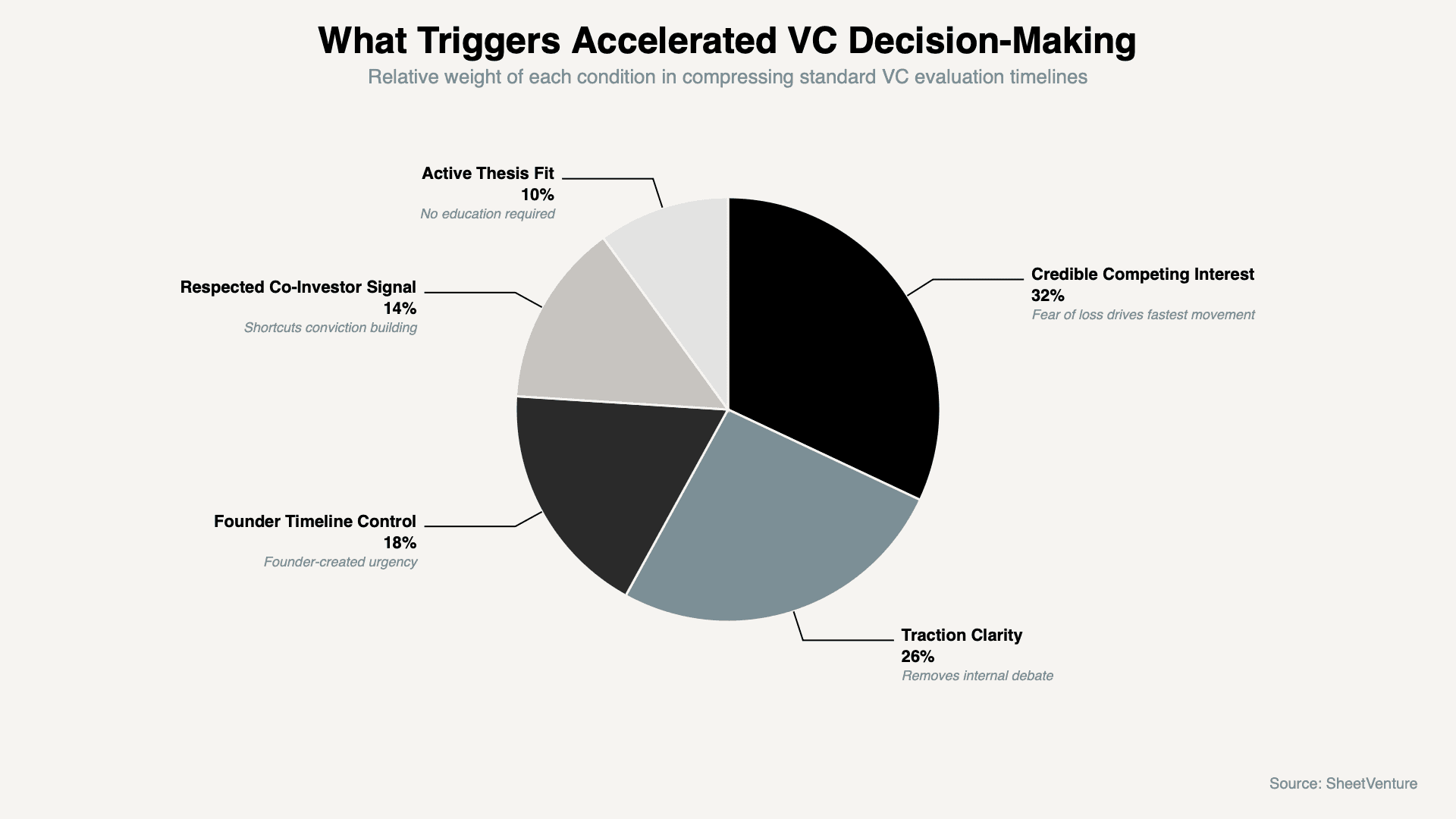

VC firms accelerate decisions when five conditions converge: credible competing interest signals, exceptional traction that removes evaluation ambiguity, a founder who controls the timeline without manufacturing urgency, social proof from investors they respect, and a deal that fits their current thesis without requiring internal education.

Speed is never random. VCs move fast when the cost of waiting exceeds the cost of moving.

Why VC Decision Timelines Are Elastic

Standard VC processes run 3-6 months. Competitive deals close in weeks. The difference is never luck:

What causes firms to accelerate:

Fear of losing a deal to a competitor they respect

Traction clear enough to skip internal debate

Signal from trusted co-investors already moving

What keeps firms in slow mode:

No perceived competition for the deal

Evaluation uncertainty requiring more data

A founder waiting passively for responses

For deeper context, understand deal velocity and why it matters more than most founders realize.

The Five Conditions That Compress VC Timelines

1. Credible Competing Interest

Fear of loss is the single most reliable accelerant:

What this looks like: Another respected firm is actively evaluating or has expressed a term sheet. VCs verify competing interest through their networks within 24 hours. Named firms with reputations that match your stage carry weight. Vague references to "multiple interested parties" carry none.

What investors ask: "Who else are you talking to and how far along are those conversations?"

Red flag: Manufactured urgency without verifiable competing interest. Experienced VCs recognize fabricated pressure immediately.

2. Traction That Eliminates Internal Debate

Exceptional metrics compress partner alignment timelines:

What this looks like: Numbers so clear they remove extended internal discussion. Strong MoM growth, high retention, and efficient CAC force conviction faster than any pitch narrative.

What investors ask: "Can you walk me through the last six months of metrics?"

Red flag: Traction requiring heavy interpretation to look impressive. If the numbers need explaining, they won't accelerate anything.

Learn how investors evaluate customer traction quality and what separates metrics that build conviction from metrics that extend timelines.

3. Founder Control of the Timeline

Founders who set and hold deadlines move faster than those who wait:

What this looks like: A clearly communicated close date with a credible reason, existing term sheet, board decision, or round structure creating a real constraint. Partners who feel the window is genuinely closing reallocate bandwidth faster.

What investors ask: "What's your timeline and what's driving it?"

Red flag: Founders who extend deadlines when pushed back on. One extension signals the deadline was never real.

4. Social Proof From Investors They Respect

Co-investor signal shortcuts internal conviction-building:

What this looks like: A partner at a firm the VC respects is already committed. VCs use peer signal to reduce their own diligence burden. A lead from a top-tier seed fund signals sophisticated evaluation has already happened.

What investors ask: "Who's already committed and at what terms?"

Red flag: Social proof from investors the firm doesn't know. Unknown angels trigger questions about why stronger investors passed.

5. Thesis Fit That Requires No Internal Education

Deals matching a live thesis close faster than deals requiring new conviction:

What this looks like: The firm has already invested in adjacent sectors or the partner has written publicly about the problem. The deal slots into existing conviction rather than requiring new belief formation from scratch.

What investors ask: "We've been looking at this space, how are you different from [comparable company]?"

Red flag: Pitching a firm that has never invested near your category and expecting compression. Thesis-adjacent deals move fast. Thesis-building deals move slow regardless of quality.

Decision Speed by Condition Combination

Conditions Present | Typical Timeline | Acceleration Level |

|---|---|---|

Thesis fit only | 10-14 weeks | None, standard process |

Thesis fit + strong traction | 6-8 weeks | Moderate compression |

Competing interest + thesis fit | 3-5 weeks | Significant compression |

All five conditions present | 1-3 weeks | Maximum, term sheet urgency |

Competing interest without credibility | 10-14 weeks | None, backfires |

Strong traction without competition | 6-10 weeks | Mild compression only |

The pattern: No single condition compresses timelines alone. All five together create conditions where VCs genuinely fear losing the deal.

What Triggers Accelerated VC Decision-Making

Questions to Test a Firm's Speed Capacity

"What would need to be true to move faster than your standard process?"

"Have you invested in this space before or is this thesis-building?"

"Who else on the partnership needs to align before you can move to term sheet?"

"If we had a competing term sheet in two weeks, is that a timeline you could work within?"

Why these work: Each question forces the firm to reveal where they are in conviction-building. A firm that can't answer the last question directly has no internal alignment, no external pressure will accelerate them.

Use investor intelligence to identify which firms have a documented history of moving fast on competitive deals in your sector.

How to Engineer Competitive Conditions Before They Exist

Run parallel processes with 15-25 firms simultaneously, competitive dynamics require real options

Sequence outreach so multiple firms reach diligence at the same time

Set a close date before you start and reference it consistently

Prioritize thesis-aligned firms first, speed requires a short path to conviction

The principle: Competitive dynamics aren't stumbled into, they're engineered through process design. Parallel outreach at sufficient volume is the structural prerequisite for everything else.

Access SheetVenture's database to build a parallel outreach list of firms actively investing in your sector right now.

The Bottom Line

VC firms accelerate decisions when credible competing interest, traction clarity, founder timeline control, respected co-investor signal, and active thesis fit converge simultaneously. No single condition compresses timelines alone. The founders who close fast engineer the conditions that make firms afraid to move slowly. Run parallel processes, set real deadlines, and let traction do the convincing.

SheetVenture helps founders build parallel investor pipelines, so competitive dynamics are engineered from the start, not hoped for at the end.