How Do Investors Respond to Emails Mentioning Competitive Funding?

Investors respond to competitive funding mentions based on credibility and specificity. Learn four response patterns and how to use signals correctly.

Investors respond to competitive funding mentions in one of four ways: accelerated engagement when the signal is credible, skeptical probing when the claim feels manufactured, polite disengagement when the mention feels manipulative, or neutral continuation when the signal is too vague to register.

The difference between acceleration and damage comes down to one variable: verifiability. Mentioning competition that cannot survive a 10-minute network check destroys credibility faster than any other cold email mistake.

Why Competitive Mentions Cut Both Ways

What credible competitive mentions achieve:

Trigger fear of loss, the most reliable accelerant in VC decision-making

Signal market validation without requiring the founder to claim it directly

Create urgency that compresses standard 3-6 month evaluation timelines

What weak competitive mentions cause:

Immediate credibility damage that survives into subsequent meetings

Network verification that exposes the claim within 24 hours

Permanent removal from consideration regardless of company quality

For deeper context, understand deal velocity and why timing signals matter more than most founders assume when reaching an investor's inbox.

The Four Investor Reaction Patterns

1. Accelerated Engagement: When the Signal Is Credible

What triggers it: A named firm with a matching stage reputation is mentioned. The investor can verify through two or three network calls. The competitive mention appears naturally inside a strong email, not as the opening line or as a pressure tactic.

What it looks like: Response time drops from weeks to 48 hours. Partner-level attention replaces associate screening.

What investors ask next: "Which firm and how far along is that conversation?" They are not asking to be polite, and they are verifying within the hour.

Red flag: The competing firm named does not typically invest at your stage or check size. VCs know each other's mandates precisely.

2. Skeptical Probing: When the Claim Feels Uncertain

What triggers it: The mention is plausible but unverifiable. "Several firms are actively evaluating" without names, or a firm mentioned that loosely fits but is not known for your sector.

What it looks like: A response arrives, but the first question is entirely about the competitive claim, not the product, metrics, or market.

What investors ask next: "Can you tell me more about where those conversations stand?" A probe designed to find inconsistency, not gather information.

What founders should do: Answer directly with whatever is actually true. Vagueness here converts skeptical probing into disengagement.

Learn how to write compelling cold emails to VCs and where competitive signals fit inside a message structure that survives scrutiny.

3. Polite Disengagement: When the Mention Feels Manipulative

What triggers it: The competitive mention is the email's primary hook. Pressure language dominates: "closing soon," "final spots," "this round will fill this week," without any substantiating detail.

What it looks like: A polite, fast decline or no response at all. The investor does not engage because engaging rewards the manipulation pattern.

What investors say internally: "If the deal were real, the email would not need to sell urgency this hard."

4. Neutral Continuation: When the Signal Is Too Vague to Register

What triggers it: The competitive mention is too generic to create any reaction. "We are in conversations with a number of investors" or "there is strong interest from the market."

What it looks like: Standard response cadence, exactly as if the competitive mention did not exist.

What founders should do: Either name a real firm or remove the mention entirely. A vague signal is worse than no signal because it uses credibility on language that produces no result.

Investor Response by Email Competitive Signal Type

Signal Type | Investor Response | Timeline Impact | Credibility Risk |

|---|---|---|---|

Named firm, matching stage | Accelerated engagement, 24-48hr reply | Compresses by 4-8 weeks | Very low: verifiable |

Named firm, wrong stage/sector | Skeptical probing, credibility damage | No compression, potential removal | High: verifiable mismatch |

"Multiple firms evaluating" | Neutral to skeptical, standard pace | Minimal to none | Medium: unverifiable |

"Strong investor interest" | Neutral, no reaction | None | Low: too vague to matter |

Urgency without naming anyone | Polite disengagement | Negative: flags desperation | Very high: pattern recognized |

Existing term sheet, named | Maximum acceleration | Compresses by 6-10 weeks | Very low: easily confirmed |

The pattern: Specificity determines reaction. Named and verifiable signals accelerate. Vague signals neutralize. Manipulative framing disengages. Every step down in specificity costs timeline compression and credibility simultaneously.

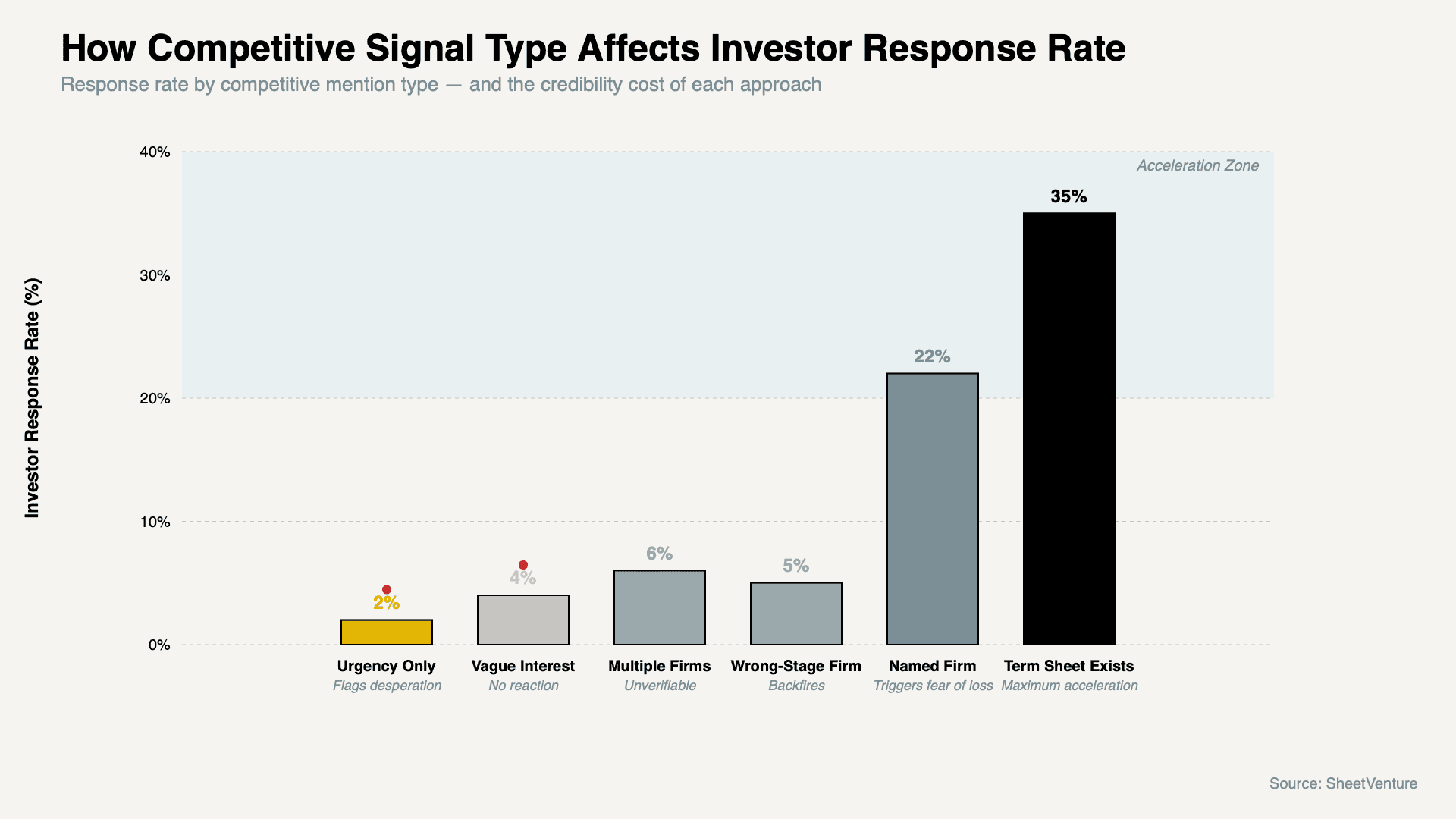

How Competitive Signal Type Affects Investor Response Rate

The chart shows how response rates climb only when competitive signals are specific and verifiable, confirming that vague mentions and urgency tactics sit at the bottom of the scale while named firms and existing term sheets sit in the acceleration zone.

Questions Investors Ask When a Competitive Mention Lands

"Which firm specifically and who is the partner you are working with?"

"Has a term sheet been issued or is it still exploratory conversations?"

"What timeline have they given you for a decision?"

"When do you need to respond to them?"

Why these work in reverse: Every question is designed to find the gap between what was implied and what is actually true. A founder who answers all four cleanly accelerates. A founder who hedges signals the mention was inflated.

Use investor intelligence to identify which firms are actively deploying in your sector right now, so competitive mentions reflect real pipeline, not manufactured pressure.

How to Use Competitive Signals Without Destroying Credibility

Only name firms where a conversation is genuinely active, not firms you have emailed without response

Place the competitive signal mid-email after establishing company quality, never as the opening hook

Use precise language: "in diligence with" carries more weight than "in conversations with"

If you have no real competitive interest yet, build it through parallel outreach before mentioning it

The principle: Competitive mentions are a reporting tool, not a sales tool. Report what is actually happening and let the investor draw urgency conclusions themselves. Founders who manufacture urgency always get caught. Founders who report genuine competition always get taken seriously.

Access SheetVenture's sheet to build real parallel pipeline across 15-25 firms simultaneously, so competitive signals in your emails reflect an actual process, not a tactic.

The Bottom Line

Investors respond to competitive funding mentions based entirely on verifiability and placement. Credible named signals accelerate decisions by weeks, vague mentions neutralize, and manufactured urgency permanently damages credibility. The four response patterns map directly to how specific and honest the competitive signal is. Build real competitive pipeline before claiming it. Report what is true and let the fear of loss do its own work.

SheetVenture helps founders build genuine parallel investor pipelines so the competitive signals in your emails are always true, always verifiable, and always working in your favor.