What Makes VCs Remember Certain Pitches Months After Initial Meeting?

VCs remember pitches through contrarian insights, founder narratives, and defying metrics. Learn five elements that create lasting recall after initial meetings.

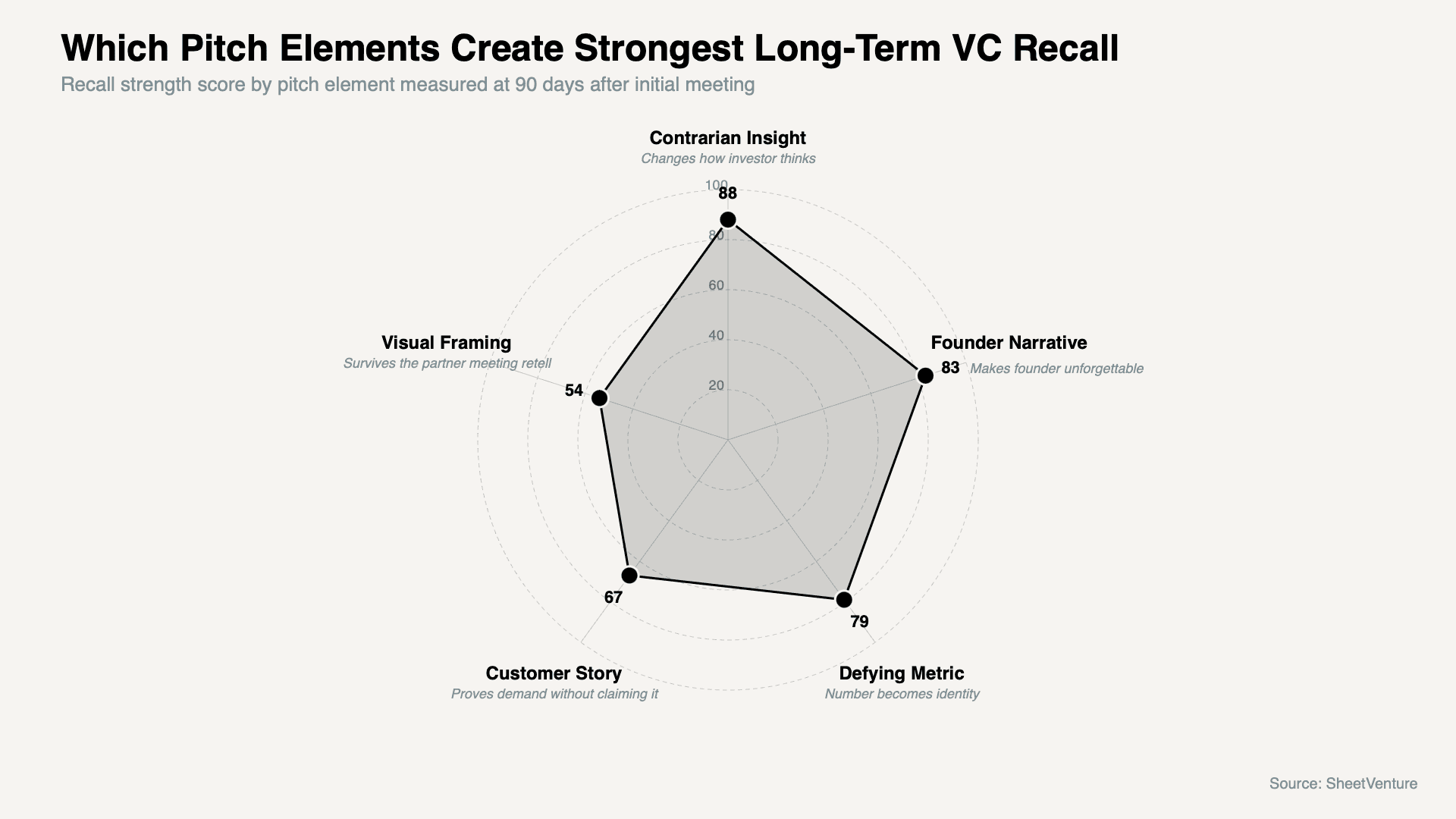

VCs remember pitches months later through five elements: a single contrarian insight that challenges how they think about the market, a founder narrative that connects personal history to the problem in a way that feels inevitable, a metric that defies category expectations, a specific customer story that proves demand without the founder claiming it, and a visual or framing device that attaches the company to a memorable concept.

Most pitches are forgotten within 48 hours. The ones that survive are not necessarily the best businesses in the room. They are the ones that changed something in how the investor thinks.

Why Most Pitches Disappear From Memory

VCs see 1,000 to 2,000 pitches annually and invest in fewer than 10:

What memorable pitches do:

Attach the company to a concept the investor already cares about

Change the investor's mental model about a market they thought they understood

Make the founder feel like someone the investor wants to be right about

What forgettable pitches do:

Confirm what the investor already believes about the space

Leave no single idea the investor can repeat to a partner the next morning

For deeper context, understand what signals tell investors a startup is fundable and how memorability connects to fundability in the same conversation.

The Five Elements That Make Pitches Stick

1. A Contrarian Insight About the Market

What this looks like: A reframe that makes the investor think "I have been looking at this wrong." The insight needs to be defensible with data and counterintuitive enough to be worth repeating.

What investors do months later: Reference the insight in partner meetings as their own evolving thesis, often without remembering exactly where they first heard it.

Red flag: Contrarian framing without evidence reads as naivety rather than insight.

2. A Founder Narrative That Feels Inevitable

What this looks like: A story where the problem and the founder feel like they were always going to find each other. The narrative answers "why you" before the investor asks.

What investors do months later: Describe the company by describing the founder first. The business becomes inseparable from the person in memory.

Red flag: A background that is impressive but disconnected from the problem leaves no emotional anchor.

Learn what investors look for in a founding team and how narrative fit between founder and problem factors into long-term recall.

3. A Metric That Defies Category Expectations

What this looks like: A retention rate or growth figure so far outside normal category ranges that it stops the conversation. Framing matters: "94% net revenue retention" lands harder than "our customers love us."

What investors do months later: Lead with the metric when describing the company. The number becomes the company's identity in partner conversation.

Red flag: Leading with the metric before establishing category context removes all reference weight.

4. A Specific Customer Story That Proves Demand

What this looks like: One customer, named if possible, who found the product independently and expanded without being asked. The story proves pull demand more credibly than any claimed NPS score.

What investors do months later: Retell the customer story as proof of product-market fit when evaluating competing companies.

Red flag: Stories requiring heavy founder involvement prove execution, not demand.

5. A Visual or Framing Device

What this looks like: A market map that redraws category boundaries or an analogy that makes a complex product immediately understandable to someone who was not in the room.

What investors do months later: Use the framing device as shorthand, making the company the default reference point for an entire category.

Red flag: Visual devices that prioritize design over clarity defeat the purpose entirely.

Table: How Each Memory Element Surfaces in Partner Discussions

Memory Element | How It Surfaces Months Later | Partner Discussion Trigger | Competitive Advantage Created |

|---|---|---|---|

Contrarian market insight | Referenced as evolving thesis | New deal in same space | Investor positions company as category definer |

Founder narrative | Company described through founder first | Team evaluation of new pitch | Founder becomes the investment thesis |

Defying metric | Leads all casual descriptions | Portfolio benchmarking discussions | Number becomes company identity shorthand |

Specific customer story | Retold as demand proof | PMF debates about competing companies | Story anchors product-market fit claim |

Visual framing device | Drawn on whiteboards in partner meetings | Category mapping exercises | Company becomes default category reference |

The pattern: Each element creates a different retrieval trigger. Founders who include all five give investors multiple paths back to the pitch across different types of internal conversations.

Which Pitch Elements Create Strongest Long-Term VC Recall

The chart shows recall strength clusters heavily around the top three axes, confirming that pitches which change investor thinking create a fundamentally stronger memory footprint than evidence-based elements alone.

How to Build Each Element Before the Meeting

Write the contrarian insight as one sentence a partner could repeat without the deck

Rehearse the founder narrative until the connection between history and problem takes under 90 seconds

Identify the single metric furthest outside category norms and prove it in the data room

Prepare one customer story with the customer's name and what happened without founder intervention

The principle: Memorability is engineered before the meeting, not performed inside it.

Access SheetVenture's database to find investors whose portfolio patterns signal they are already building conviction in your space.

The Bottom Line

VCs remember pitches months later when a contrarian market insight, an inevitable founder narrative, a category-defying metric, a specific customer story, and a repeatable visual framing device all appear in the same conversation. Forgettable pitches confirm what investors already believe. Memorable pitches change something.

The test is not whether the investor leaves impressed. The test is whether they describe your company accurately to a partner who was not in the room three months later.

SheetVenture helps founders research the investors in the room before they walk in so every element of the pitch lands with the context that makes it stick.