How Do Investors Verify If Other Term Sheets Actually Exist?

Investors verify competing term sheets through network calls and document requests. Learn five methods and why false claims always get caught.

Investors verify competing term sheets through five methods: direct network calls to the named firm, cap table and document requests, timeline consistency testing, founder behavior pattern reading, and legal counsel confirmation.

Verification happens faster than most founders expect. A partner can confirm or disprove a competing term sheet claim through two network calls within 24 hours. Founders who misrepresent competing interest do not just lose the deal. They lose access to that firm's entire network permanently.

Why Investors Always Verify and Never Assume

What verified competing interest produces:

Genuine acceleration of internal decision timelines

Partner-level attention replacing associate-level screening

Better terms driven by real competitive fear rather than negotiating theater

What failed verification produces:

Immediate removal from consideration regardless of company quality

Network-wide reputation damage through partner communication channels

Permanent credibility loss that survives into future fundraising rounds

For deeper context, understand deal velocity and why the speed of investor verification has increased as VC networks have become tighter.

The Five Verification Methods Investors Use

1. Direct Network Calls to the Named Firm

What this looks like: Within hours of hearing a competing term sheet claim, the investor calls a partner at the named firm directly. The call takes five minutes and produces a definitive answer. The investor does not need to ask directly whether a term sheet exists. They ask broader questions about deal flow and the answer reveals itself naturally.

Red flag: Naming a firm where the investor has no connection does not protect the claim. Investors reach lateral connections through one or two intermediary calls.

2. Timeline Consistency Testing

What this looks like: The investor asks a sequence of questions across separate conversations: when did you first meet that partner, how many meetings have you had, when was the term sheet issued. Fabricated claims produce timeline inconsistencies that surface across two or three conversations. Real term sheets produce consistent answers because they actually happened.

Red flag: Founders who answer timeline questions with vague language rather than specific dates signal the claim is inflated.

Learn how to follow up with VCs after a meeting and how post-meeting communication patterns factor into verification behavior.

3. Document and Term Request

What this looks like: The investor asks specific questions about term sheet contents: what is the valuation cap, who is the lead, what are the pro-rata rights. A founder with a real term sheet answers immediately. A founder without one becomes evasive or produces increasingly vague descriptions of terms they cannot specify.

Red flag: Confidentiality claims that prevent sharing any detail. Real term sheets include details the founder can reference without breaching the document itself.

4. Founder Behavior Pattern Reading

What this looks like: A founder claiming a 48-hour deadline who responds to investor questions immediately and at length is not behaving like someone managing a compressed close. Real competitive pressure gets referenced once and then managed. Manufactured pressure gets repeated because the founder is trying to make it feel real.

Red flag: Founders who mention the competing term sheet repeatedly across multiple touchpoints signal the claim is fabricated.

5. Legal Counsel Confirmation

What this looks like: Investors ask whether counsel has been engaged on the competing term sheet. Law firm involvement is independently verifiable without breaching any confidentiality obligation.

Red flag: Founders who claim a term sheet is fully negotiated but have not yet engaged counsel. The sequencing does not hold.

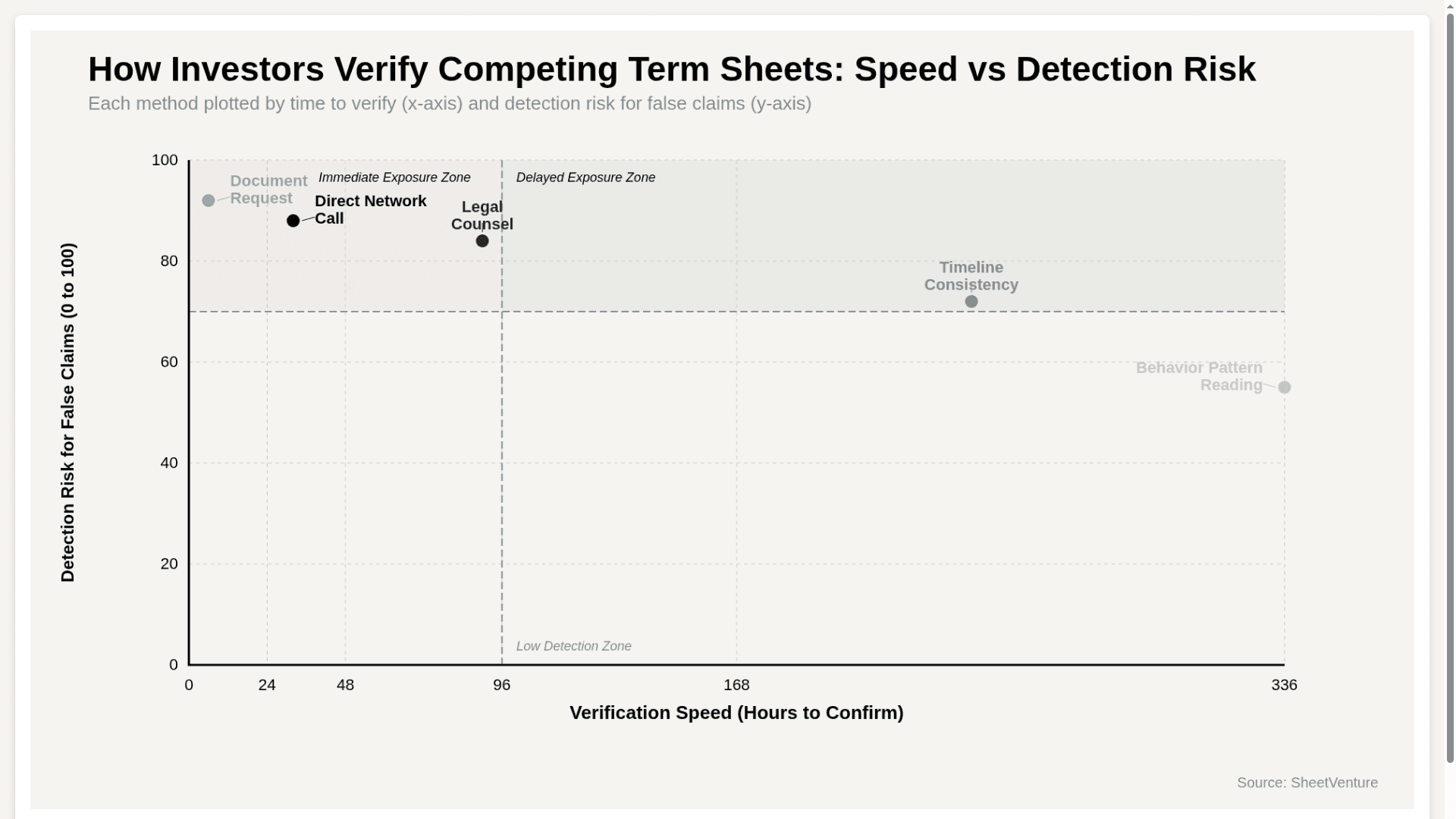

Verification Speed vs Detection Risk for False Claims

The chart shows that the three most frequently used verification methods all land left of the 48-hour mark, meaning most false term sheet claims are exposed before they produce a single day of leverage for the founder who made them.

Verification Speed by Method

Verification Method | Time to Confirm | Accuracy Level | Founder Detection Risk |

|---|---|---|---|

Document Request | Immediate | Very high | Very high if claim is false |

Direct Network Call | 2 to 24 hours | Very high | High if claim is false |

Legal Counsel Confirmation | 24 to 48 hours | Very high | High if claim is false |

Timeline Consistency | 1 to 2 weeks | High | Medium: requires multiple conversations |

Behavior Pattern Reading | Ongoing | Medium-high | Low: passive observation |

The pattern: The fastest verification methods are also the most dangerous for founders making false claims. Document requests and direct network calls produce definitive answers within hours, not weeks.

What Founders Should Do Instead of Fabricating

Build real parallel pipeline across 15 to 25 firms before claiming competitive interest exists

Reference genuine exploratory conversations accurately: "we are in early conversations with two firms" is verifiable and honest

Let actual competitive dynamics develop through parallel process design rather than narrative construction

The principle: The only term sheet claim that survives investor verification is a true one. Founders who engineer real competition through parallel outreach never need to fabricate anything. The process produces genuine urgency that holds up under every verification method simultaneously.

Use investor intelligence to identify which firms are actively deploying in your sector so parallel outreach produces real competing conversations rather than claims that collapse under a single network call.

The Bottom Line

Investors verify competing term sheets through direct network calls, timeline consistency testing, document requests, behavior pattern reading, and legal counsel confirmation. Most false claims are exposed within 24 to 48 hours. The damage extends beyond the current raise into every future interaction with that firm and their network. Build real pipeline, run a real parallel process, and let genuine competition do the work that fabricated urgency cannot survive.

Real term sheets verify themselves. Fake ones verify themselves faster.

SheetVenture helps founders build genuine parallel investor pipelines so competitive signals in every conversation are always true, always verifiable, and always working in their favor.