How Much Runway Should Founders Have Before Starting Fundraising Process?

Founders should raise with 9 to 18 months of runway. Learn five rules that protect negotiating leverage throughout the fundraising process.

Founders should begin fundraising with 9 to 12 months of runway remaining, never below 6 months, and ideally with 18 months available at the start so the final close lands before the business enters distress territory.

Runway is not just a survival metric. It is a negotiating position. Investors read remaining runway as a signal of how much leverage the founder holds before a word is spoken.

Why Runway Timing Defines the Entire Raise

What sufficient runway enables:

Running a parallel process across 20 or more investors without timeline pressure

Walking away from unfavorable terms without existential consequences

Presenting from a position of choice rather than urgency

What insufficient runway causes:

Investors detecting desperation through compressed timelines and aggressive follow-up

Forced acceptance of unfavorable valuations because alternatives do not exist

Round failures that damage reputation for the next attempt

For deeper context, understand when to start fundraising and how market signals compound the runway calculation in either direction.

The Five Runway Rules That Determine Process Outcomes

1. The 9 to 12 Month Starting Rule

What this looks like: Founders who begin outreach with 9 to 12 months of runway have enough time to run a full parallel process and reach a competitive close before the balance sheet becomes a liability. A founder raising with 5 months of runway answers questions differently than one with 11 months. The follow-up cadence and willingness to negotiate shift in ways experienced investors recognize immediately.

Red flag: Starting at 6 months or below means leverage is already lost before the first meeting.

2. The 18 Month Buffer Calculation

What this looks like: Work backwards from the close date, not the start date. A full process takes 3 to 6 months from first outreach to wire. Starting with 18 months means the business still has 12 to 15 months of runway when the round closes, removing any post-close pressure that compresses deployment.

Red flag: Starting with exactly enough runway to survive the raise signals no plan for process delays, which always happen.

3. The Traction Window Alignment

What this looks like: Runway timing should align with the business's strongest recent performance window. Starting a raise immediately after a record growth month or major customer close creates a momentum narrative that compressed runway timing destroys.

Red flag: Beginning fundraising during a metrics trough because runway forces it. Investors evaluate the data in front of them, not the trajectory being promised.

Learn how to create a fundraising timeline and how runway calculation fits inside a broader process calendar.

4. The Parallel Process Requirement

What this looks like: Running 20 to 25 investor conversations simultaneously requires enough runway to wait without closing prematurely on the first committed check. Sequential processes never generate competitive dynamics, and competitive dynamics are what produce better terms.

Red flag: Accepting the first term sheet without running a competitive process because runway pressure makes waiting feel impossible.

5. The Bridge Trap Awareness

What this looks like: Founders who raise a bridge round before a proper raise often discover it damaged the next round's valuation narrative. Investors ask why the bridge was needed and what changed. A clean raise from a strong runway position avoids this entirely.

Red flag: Treating a bridge as a substitute for runway planning rather than an emergency tool of last resort.

Runway Timing by Funding Stage

Funding Stage | Minimum Runway to Start | Ideal Runway to Start | Expected Process Length | Target Runway at Close |

|---|---|---|---|---|

Pre-Seed | 6 months | 12 months | 2 to 3 months | 9 months minimum |

Seed | 8 months | 15 months | 3 to 4 months | 12 months minimum |

Series A | 9 months | 18 months | 4 to 6 months | 12 to 15 months |

Series B | 10 months | 18 months | 4 to 6 months | 15 to 18 months |

Growth | 12 months | 24 months | 6 to 9 months | 18 months minimum |

The pattern: Minimum runway requirements increase with stage because process length grows and diligence deepens. What constitutes safe runway at pre-seed creates a dangerous position at Series A.

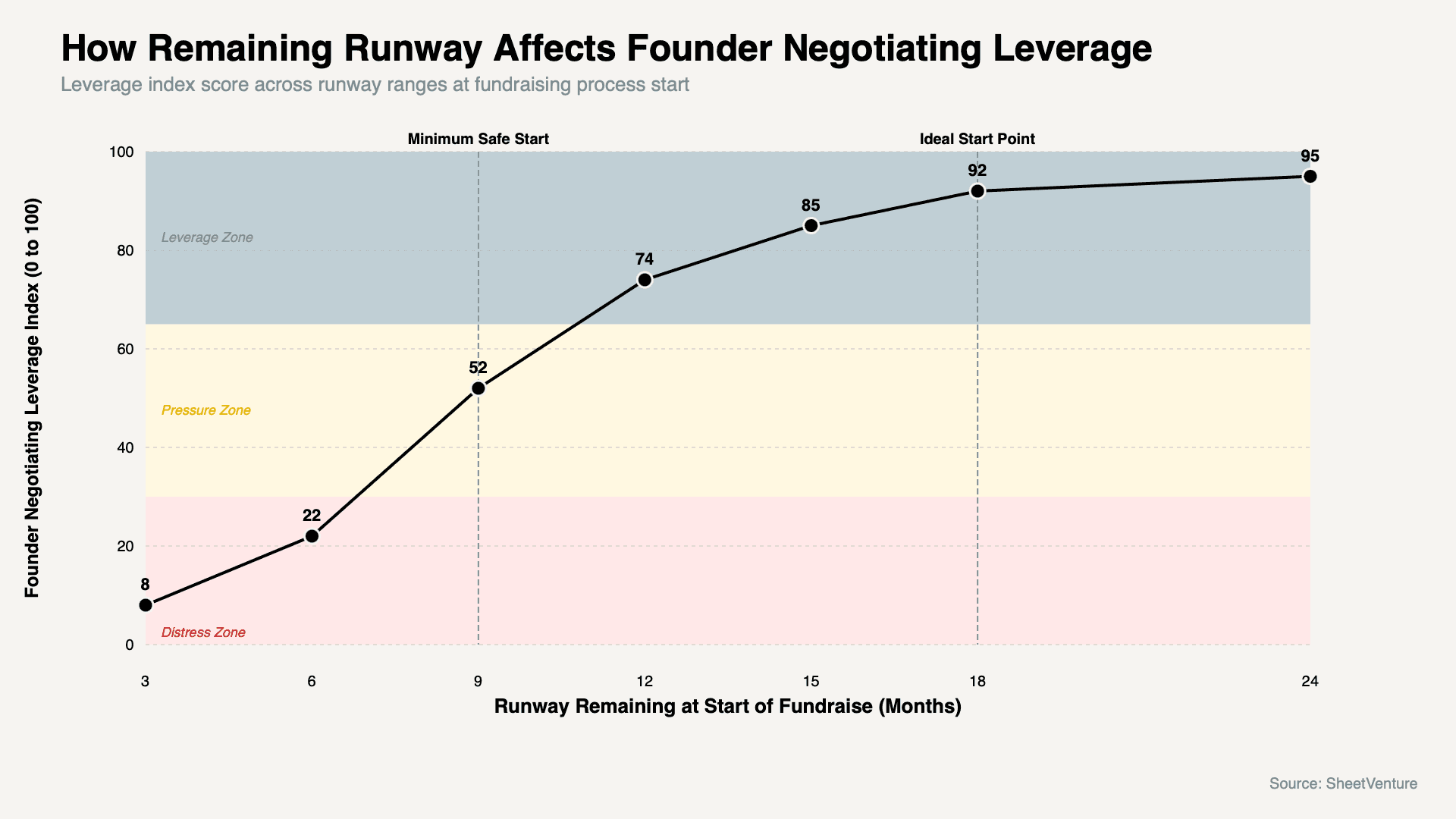

Founder Negotiating Leverage vs Remaining Runway at Fundraising Start

The chart shows leverage rises steeply between 6 and 12 months of runway, confirming that the difference between a distressed raise and a competitive one is often just 90 days of earlier preparation.

How to Extend Runway Before Starting

Cut non-essential burn in the 60 days before fundraising begins to extend the process buffer

Accelerate revenue collection from existing customers to improve the balance sheet at first meetings

Delay discretionary hires until post-close rather than pre-raise to preserve optionality

The principle: Every additional month of runway before the process starts is worth more than any pitch improvement made during it. Investors negotiate against the clock. Founders who remove that clock negotiate against the opportunity instead.

Access SheetVenture's database to build a parallel investor list before runway pressure forces sequential outreach.

The Bottom Line

Founders should begin fundraising with 9 to 12 months of runway at minimum and 18 months at ideal, working backwards from the close date to ensure sufficient leverage throughout the process. Runway is negotiating position.

It determines which investors get pursued, which terms get accepted, and whether the process runs competitively or reactively. The founders who close the best rounds started the process with enough time to wait for the right outcome.

SheetVenture helps founders identify active investors before runway pressure forces the wrong decisions so the process starts from strength, not survival.