What Tells You a VC Typically Invests in Competitive Deals Simultaneously?

VCs reveal competitive investing through portfolio overlap and term sheet structure. Learn six signals founders must identify before signing anything.

VCs who invest in competitive deals simultaneously reveal that behavior through six observable signals: portfolio company overlap within the same category, LP reporting language that normalizes competitive exposure, partner public statements defending the practice, fund size that makes concentration risk unacceptable, co-investment patterns with thesis-agnostic firms, and term sheet structures that include limited exclusivity windows.

Knowing which VCs operate this way before signing is not a negotiating tactic. It is a due diligence requirement that most founders skip entirely until the damage is already done.

Why This Matters Before You Take the Money

What knowing this in advance allows:

Structuring exclusivity protections into term sheet negotiations before they become necessary

Making informed decisions about which information to share during diligence

Understanding how much competitive intelligence flows through a shared investor's network

What discovering it afterward causes:

Competitor access to timing, product roadmap signals, and hiring plans through shared board dynamics

Negotiating leverage lost because the information asymmetry already exists

For deeper context, understand VC decision making and how portfolio construction logic drives simultaneous competitive investment decisions.

The Six Signals in Detail

1. Portfolio Overlap Within the Same Category

What this looks like: A firm with two or more portfolio companies solving the same core problem has already demonstrated willingness to hold competitive positions. Sector overlap is common. Customer overlap is the signal that matters.

Where to find it: Crunchbase portfolio pages and LinkedIn pages of portfolio founders who describe their target customer explicitly.

2. Partner Public Statements Defending the Practice

What this looks like: Partners who write publicly about why competitive investing is healthy have self-identified. These statements are pre-emptive defenses of a practice the partner intends to continue.

Where to find it: Partner essays on Substack, podcast appearances discussing portfolio construction, and Twitter threads responding to founders who have raised the issue publicly.

Learn how to research a VC firm before your pitch and where partner-level public statements fit inside a complete pre-meeting research process.

3. Fund Size That Makes Concentration Risk Structurally Unacceptable

What this looks like: A fund with $500M or more cannot build a returnable portfolio without spreading bets across competing companies in the same category. Fund size is not an excuse. It is a structural incentive that produces predictable behavior.

Where to find it: SEC Form D filings and fund announcement press releases.

4. Limited Exclusivity Windows in Term Sheet Structure

What this looks like: A term sheet offering 14 days or shorter exclusivity signals the firm wants to maintain the option to invest in competing companies. Standard exclusivity runs 30 to 60 days. Anything shorter is a documented statement of intent most founders sign without recognizing what it means.

What to do: Request a minimum 45-day exclusivity window and watch the response. Resistance confirms the behavior pattern before any money changes hands.

5. Co-Investment Patterns With Thesis-Agnostic Firms

What this looks like: A firm consistently co-investing with multi-stage funds known for writing checks into any category has built a network optimized for deal flow volume rather than competitive discipline.

Where to find it: Deal announcement histories on Crunchbase filtered by co-investor.

6. LP Reporting Language Normalizing Competitive Exposure

What this looks like: Firms that report competitive portfolio positions as deliberate strategy rather than exception have codified the behavior institutionally. This is the hardest signal to find but the most definitive confirmation available.

Where to find it: Academic research on VC portfolio construction and LP interviews in institutional investor publications.

Signal Strength Table: What Each Indicator Reveals

Observable Signal | What It Confirms | Ease of Discovery | Available Before First Meeting |

|---|---|---|---|

Portfolio overlap in same category | Firm explicitly tolerates competitive exposure | Easy | Yes |

Partner public statements | Personal conviction, likely repeated behavior | Easy | Yes |

Fund size analysis | Structural incentive overrides exclusivity | Easy | Yes |

Co-investment patterns | Network built around volume not conviction | Medium | Yes |

Term sheet exclusivity window | Documented intent to maintain optionality | Very easy | At term sheet only |

LP report language | Institutional policy not individual exception | Hard | Rarely |

The pattern: Four of the six signals are discoverable before the first meeting. Founders who wait until the term sheet stage have already spent weeks in a process they could have pre-qualified in an afternoon.

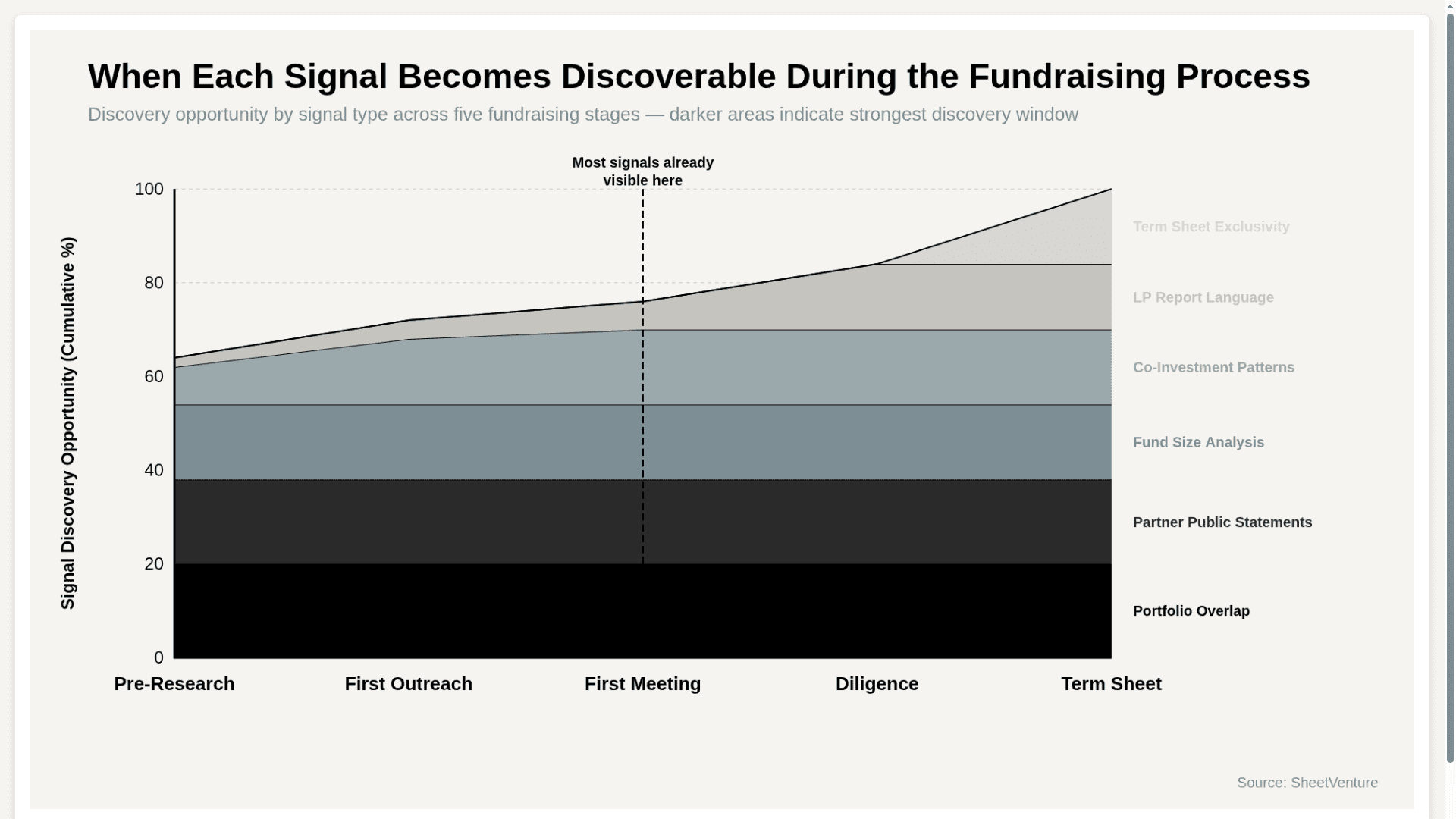

Discovery Opportunity Window by Signal Type

The chart shows that over 70% of total signal discovery opportunity is available before the first meeting, confirming that competitive investing behavior is a research problem, not a negotiation problem.

Questions to Ask That Force Disclosure Before Signing

"Do you currently have any portfolio companies targeting the same buyer profile we serve?"

"What is your firm's policy if a competitor approaches you for investment after our close?"

"What exclusivity window does your standard term sheet include and is that negotiable?"

"Have your LPs set any guidelines around competitive portfolio exposure within a single category?"

Why these work: Partners who deflect the portfolio question or minimize the exclusivity discussion have already answered through the framing they choose.

Use investor intelligence to cross-reference which firms in your target list have existing portfolio companies in your customer category before outreach begins.

The Bottom Line

VCs who invest in competitive deals simultaneously reveal that behavior through portfolio overlap, partner public statements, fund size incentives, co-investment networks, term sheet exclusivity windows, and LP reporting language. Four of the six signals are discoverable before the first meeting through basic research.

Founders who identify competitive investing behavior early negotiate from awareness. Those who discover it after signing negotiate from regret. Research the portfolio before the pitch. Read the term sheet before the excitement. Ask the direct questions before the wire hits.

SheetVenture helps founders identify portfolio overlap and competitive exposure risk before outreach begins so every investor on the list is qualified on fit, not just sector and stage.