What Makes Investors Forward Founder Emails to Partners Immediately?

Investors forward founder emails when metrics, social proof, and thesis match combine. Learn five elements that trigger immediate partner forwarding behavior.

Investors forward founder emails to partners immediately when five elements appear together: a metric that defies category expectations, a founder background that creates instant credibility, a problem framed in language that matches an active partner thesis, a social proof signal from a name the firm already respects, and an ask structure that makes the forward feel low-risk.

Most emails get read and filed. The ones that get forwarded create a specific reaction: "someone else here needs to see this right now."

Why Forwarding Is the Signal That Actually Matters

An investor who forwards your email has made an internal introduction on your behalf before you have spoken to anyone at the firm.

What an immediate forward produces:

Partner-level attention before any meeting is scheduled

Internal social proof that survives the partner meeting agenda

Momentum that compresses the standard screening timeline significantly

What a non-forwarded email produces:

A solo decision made by one person without internal pressure

No internal advocate before the first conversation begins

For deeper context, understand how VCs filter founder emails before responding and what happens in the seconds between opening and deciding.

The Five Elements That Trigger Immediate Forwarding

1. A Metric That Makes the Reader Stop

What this looks like: A number so far outside category norms that the reader's first instinct is to show someone else. "94% net revenue retention with zero enterprise sales motion" or "$2M ARR in eight months, no paid acquisition" produce forwarding because the reader wants a partner to validate their read before responding.

Red flag: Metrics requiring context to look impressive. If the number needs explanation, it will not survive the two-second scan that precedes a forward.

2. A Founder Background That Creates Instant Pattern Match

What this looks like: A background so directly relevant to the problem that the reader immediately understands why this person will win. Domain expertise that makes the thesis feel inevitable rather than plausible.

Red flag: Impressive backgrounds not connected to the problem. Credentials without narrative fit create admiration, not urgency.

Learn what behaviors signal strong founders during fundraising conversations and how background presentation connects to internal advocacy behavior.

3. Thesis Language That Matches an Active Partner Conversation

What this looks like: A problem framed in the exact language a specific partner has been using publicly. The forward message is often as simple as "this is exactly what we were talking about last week."

Red flag: Generic thesis language that could apply to any firm triggers no forwarding behavior from anyone.

4. Social Proof From a Name the Firm Already Respects

What this looks like: A customer, advisor, or co-investor whose name the receiving firm recognizes. The investor forwards the name, not the company. The partner reads the forward because of who is already involved.

Red flag: Social proof from names the firm does not recognize requires explanation that defeats the immediacy of the forward entirely.

5. An Ask That Makes Forwarding Feel Natural

What this looks like: A closing line that identifies the specific partner the founder wants to reach. "I noticed [partner name] has been writing about infrastructure bottlenecks. Would it make sense to connect with them directly?" The reader forwards because the ask has already done the matching work.

Red flag: Generic asks addressed to no one. "Would love to find time to connect" gives the reader no forwarding instruction and no reason to act.

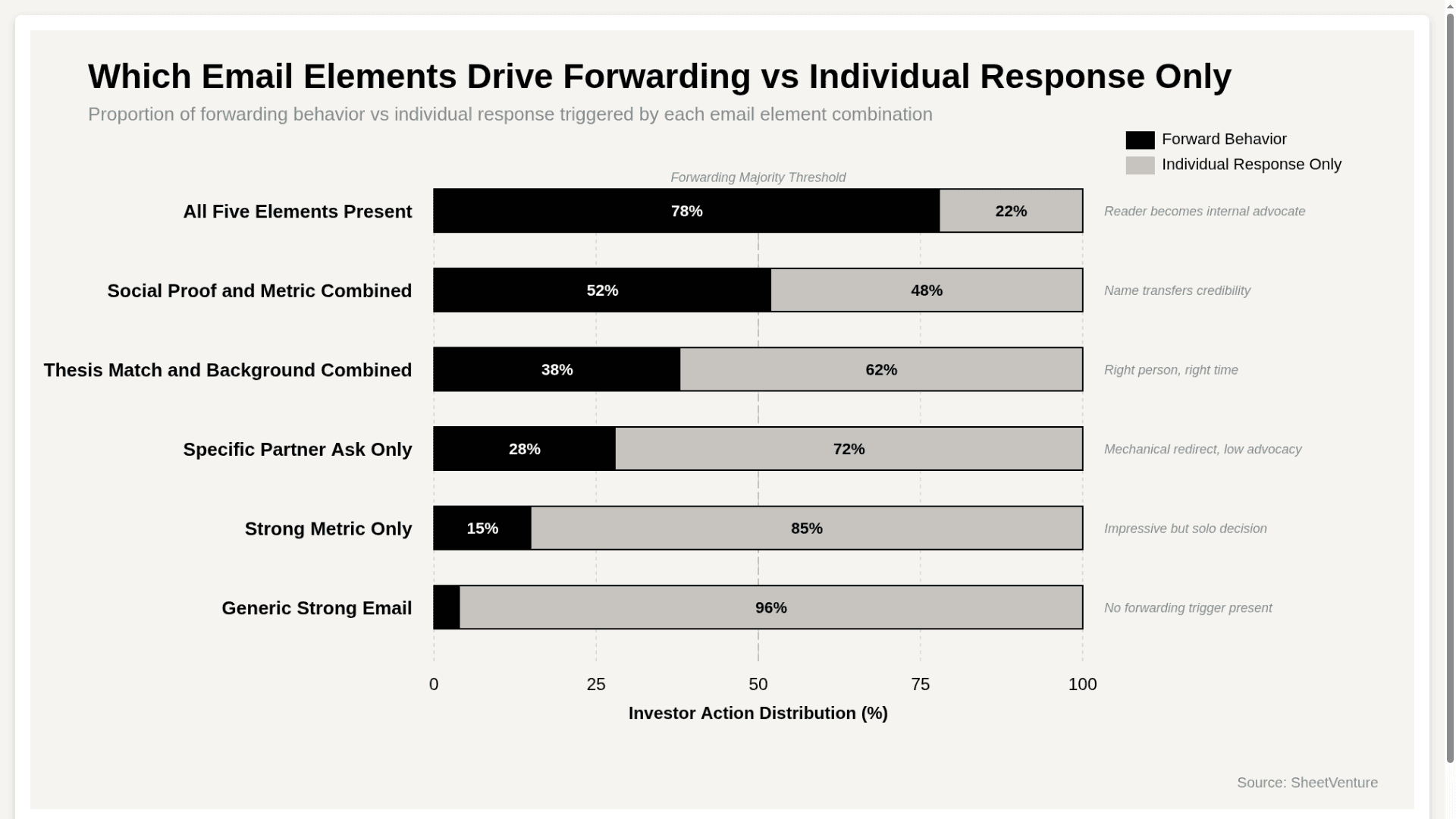

Which Email Elements Drive Forwarding Behavior vs Individual Response Only

The chart shows forwarding behavior crosses the majority threshold only when social proof combines with a strong metric, confirming that no single element alone creates the internal advocacy that makes partner-level attention happen before any meeting is scheduled.

Response Type by Email Element Present

Element Present | Likely Investor Action | Time to Forward | Partner Engagement Level |

|---|---|---|---|

Category-defying metric only | Read and consider responding | Same day if at all | Solo decision, no forward |

Strong background only | Saved for later review | Days to weeks | Low, no urgency created |

Thesis language match only | Polite response, standard pace | No forward | Individual interest only |

Social proof from known name | Faster individual response | Hours if forwarded | Medium, depends on name tier |

Specific partner ask only | Redirect to named partner | Same day | Mechanical forward, low advocacy |

All five elements present | Immediate forward with endorsement | Minutes to hours | High, reader becomes advocate |

The pattern: Each element alone produces a better individual response. All five together produce a forward with internal endorsement, which is a fundamentally different outcome than any single element can create alone.

How to Write for the Forward, Not Just the Response

Open with the metric, not the company description. The number earns the read. The company earns the response.

Name the specific partner in the closing line and explain the thesis connection in one sentence

Include one social proof signal in the first three sentences before the reader decides whether to forward or file

Write so the reader can forward without adding context of their own. If they need to explain your company to make the forward make sense, they will not forward it

The principle: The reader forwarding your email costs them professional credibility. Every element should make that favor feel obvious, low-risk, and immediately valuable to the partner receiving it.

Access SheetVenture's sheet to research partner backgrounds before drafting outreach so every email is written for the person most likely to forward it.

The Bottom Line

Investors forward founder emails immediately when a category-defying metric, a directly relevant background, thesis language matching an active partner conversation, respected social proof, and a specific partner ask all appear in the same message. Each element alone improves individual response rates.

All five together create a reader who becomes an internal advocate before any meeting is scheduled. Write for the forward, not just the reply.

SheetVenture helps founders research the right partner at every firm before outreach begins so every email is written for the person most likely to forward it, not just read it.