How Does Competitive Funding Activity in a Sector Affect Individual Timing?

Competitive funding activity compresses investor bandwidth and creates short timing windows. Learn four scenarios and how each changes your fundraising approach.

When multiple companies in the same sector are actively raising simultaneously, individual fundraising timing shifts from a personal decision into a competitive positioning problem.

Investor attention concentrates, partner bandwidth compresses, and the narrative around which company is winning the category begins forming in real time. Founders who ignore sector funding activity consistently find themselves entering conversations where the frame has already been set by someone else.

What Sector Funding Activity Actually Changes

Sector funding activity introduces an external variable that overrides internal readiness in four specific ways.

Investor bandwidth compression. The first conversation sets the category benchmark. Every subsequent pitch gets measured against it rather than evaluated independently.

Narrative lock-in. When a competitor closes, the investor's mental model crystalizes around that company's framing. Entering two months later requires dislodging a frame that is already familiar.

Valuation anchoring. Announced rounds create reference points that investors apply to your raise whether or not the comparison is valid.

FOMO window creation. Investors who missed the first deal are highly motivated to find the second. Those who wait six months find the window has closed.

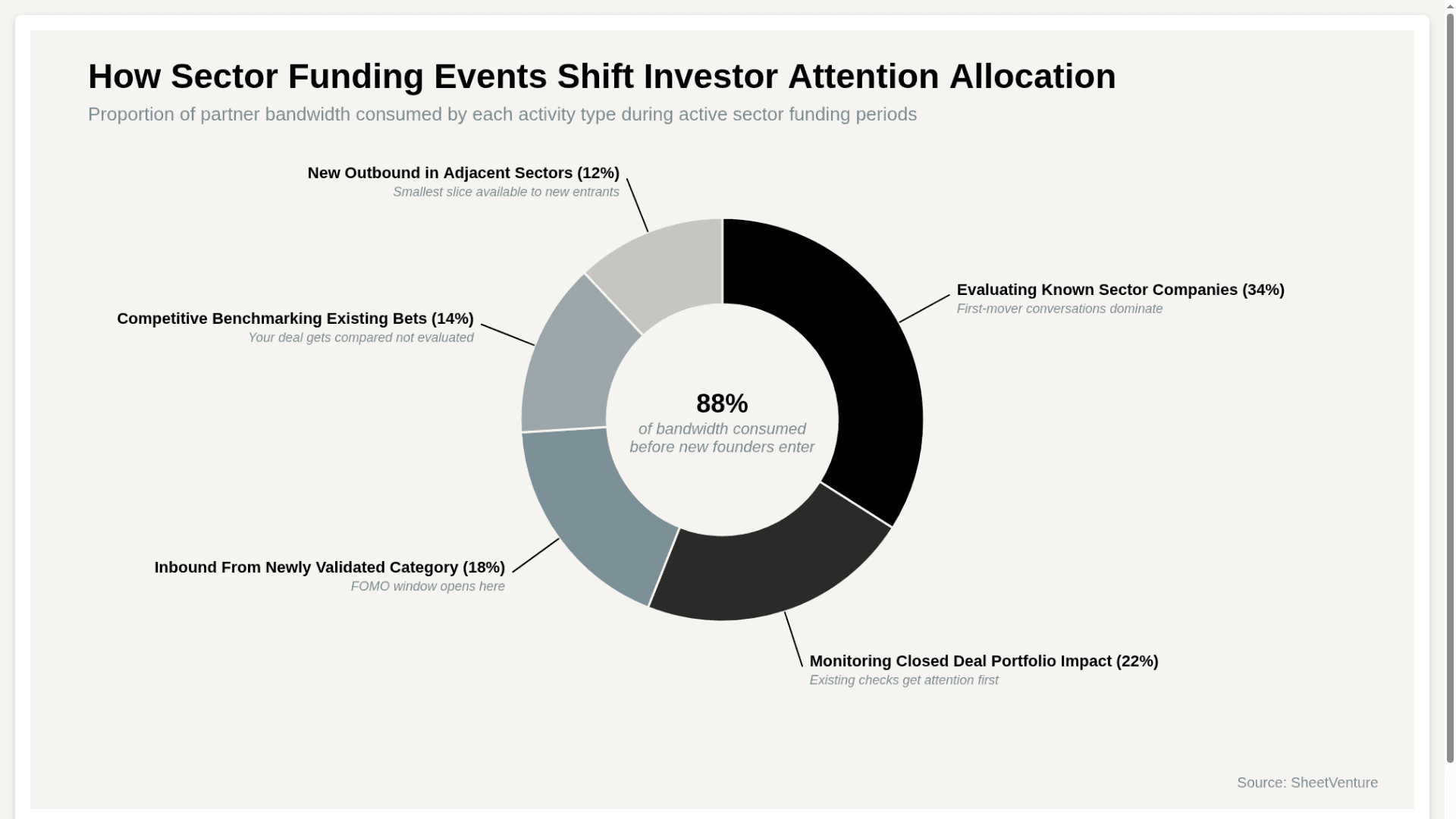

How Sector Funding Events Shift Investor Attention Allocation

The chart shows 88% of investor bandwidth during active sector funding periods is consumed before new founders enter the conversation, making timing precision the single highest-leverage decision in a competitive raise environment.

The Four Timing Scenarios and What Each Demands

Scenario 1: You Are First in the Sector to Raise

What this creates: Validated market interest but compressed narrative space. Investors who passed on the competitor are actively looking for the alternative bet, a window that lasts 60 to 90 days.

What this demands: Stronger market size argumentation because no recent deal validates the space.

Timing risk: First-mover advantage only works when the problem is already real to investors, not when you are also educating them on why the category exists.

Scenario 2: A Competitor Closes Just Before You Start

What this creates: Investors who passed on the competitor are actively looking for the alternative bet, a window that lasts 60 to 90 days.

What this demands: Immediate differentiation from the closed deal as the opening move.

For context, understand how investors think about timing and market cycles and what triggers accelerated conviction in active sectors.

Scenario 3: Multiple Competitors Are Raising Simultaneously

What this creates: A perceived horse race that investors use to defer decisions.

What this demands: A tighter process with a hard close date. Extending timelines in a crowded raise environment always produces worse outcomes.

Scenario 4: A Competitor Raises a Large Follow-On in Your Sector

What this creates: Two opposing investor reactions. Some read the follow-on as proof the category is real. Others read it as evidence the winner has already emerged.

What this demands: A clear answer to "why does this market support two companies at scale" before the investor asks.

Learn how investors evaluate startups raising in crowded markets and how follow-on activity changes the evaluation framework for earlier-stage companies.

Timing Decision Matrix by Sector Activity Type

Sector Activity | Investor Sentiment Effect | Optimal Founder Response | Window Duration |

|---|---|---|---|

No recent deals in sector | Skeptical, needs education | Build market narrative first, raise second | No urgency |

Peer closes seed round | Validated interest, open frame | Enter immediately, differentiate from day one | 60 to 90 days |

Multiple simultaneous raises | Deferral behavior, wait and see | Compress timeline, hard close date, no extensions | Active now |

Peer closes large Series A | Split reaction, category forming | Answer "why two winners" proactively | 30 to 60 days |

Sector experiences public failure | Risk aversion, category discount | Wait for sentiment reset or reframe entirely | 3 to 6 months |

Major acqui-hire in sector | Short validation spike | Move immediately before narrative resets | 30 days maximum |

The pattern: Every sector funding event creates a window that either opens or closes depending on how quickly founders recognize and respond. Founders who react generically consistently underperform those who tailor timing to the exact activity occurring.

How to Monitor Sector Funding Activity

Set Crunchbase alerts for funding announcements in your category filtered by stage and geography

Monitor SEC Form D filings for unannounced closes that precede press coverage by 30 to 60 days

Track which VCs comment publicly on sector deals as a signal of where attention is concentrating

Use investor intelligence to track which firms are actively closing deals in your sector so timing decisions are based on real deployment data rather than press coverage that lags reality by 60 to 90 days.

The Bottom Line

Competitive funding activity affects individual timing through investor bandwidth compression, narrative lock-in, valuation anchoring, and short FOMO windows that open and close faster than most founders realize.

Founders who plan timing exclusively around internal milestones consistently find themselves entering conversations where the frame has already been set. Watch the sector. Read the signals. Move when the window is open.

SheetVenture helps founders track sector funding activity in real time so raise timing is always based on what the market is actually doing, not what the calendar says.